Polska może zyskać ponad 8 mld USD rocznie dzięki delokalizacji produkcji z Chin

Opublikowano: 24/06/2020

Jak wynika z raportu Polskiego Instytutu Ekonomicznego “Szlaki handlowe po pandemii COVID-19”, w następstwie przeniesienia części produkcji z Chin do innych krajów PKB Państwa Środka mógłby zmniejszyć się nawet o 1,64 proc.

W 2019 r. Azja odpowiadała za 35,3 proc. światowego eksportu i 33,8 proc. światowego importu, odpowiednio o 8,8 p.p. i 9,4 p.p. więcej niż w 2001 r. Największymi globalnymi eksporterami i importerami pozostają kraje europejskie (z udziałem 36,7 proc. i 35,7 proc.), jednak ponad połowa tego handlu przypada na obroty wewnątrzunijne.

Chińskie półprodukty miały istotne znaczenie dla światowej produkcji. Materiały pochodzące z Chin stanowiły bowiem 3,5 proc. materiałów zużytych na świecie do produkcji wyrobów przemysłowych. Chiński wsad importowy miał największe znaczenie w krajach Azji Południowo-Wschodniej, Azji Wschodniej oraz Ameryki Północnej. W układzie branżowym najbardziej uzależniona od dostaw z Chin była światowa produkcja komputerów, wyrobów elektronicznych i optycznych, wyrobów tekstylnych i odzieży, a także urządzeń elektrycznych i nieelektrycznych oraz sprzętu AGD.

Branże te były najbardziej uzależnione od chińskiego wsadu materiałowego również w Polsce. W 2015 r. z Chin pochodziło 16 proc. zużycia materiałowego w Polsce w dziale produkcji komputerów, wyrobów elektronicznych i optycznych. Przeniesienie z Chin części produkcji półproduktów i wyrobów finalnych oznaczałoby dla tamtejszej gospodarki ubytek wartości dodanej, który mógłby wynieść – w zależności od wariantu – od 22,4 mld USD do 172 mld USD rocznie – tłumaczy Łukasz Ambroziak z zespołu handlu zagranicznego Polskiego Instytutu Ekonomcznego. Oznaczałoby to zmniejszenie PKB Chin w przedziale od 0,21 proc. do 1,64 proc. w porównaniu z sytuacją wyjściową.

Scenariusze nowego ładu w światowych szlakach handlowych

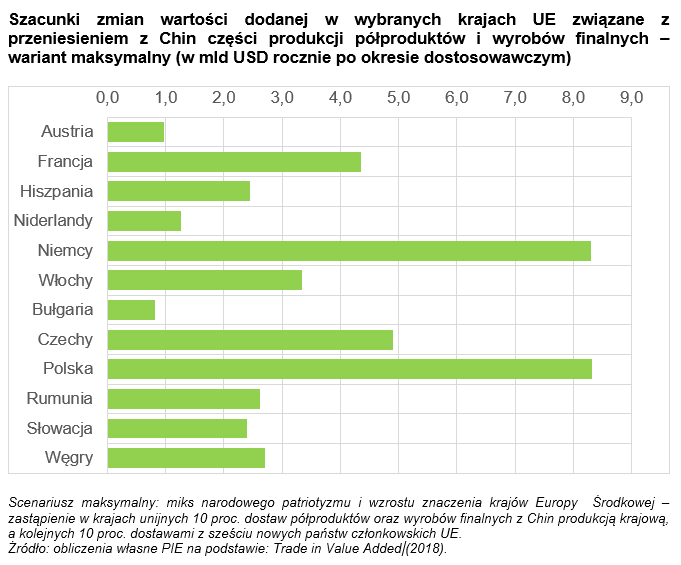

Układ beneficjentów delokalizacji produkcji z Chin zależy od założeń przyjmowanych w poszczególnych scenariuszach. Dla państw unijnych najkorzystniejsze byłoby połączenie narodowego patriotyzmu oraz umocnienia się nowych państw członkowskich z Europy Środkowej (Czech, Polski, Słowacji, Węgier, Rumunii i Bułgarii) w roli fabryki dla krajów UE. Poza Polską (8,3 mld USD) sporo zyskałyby w naszym regionie także Czechy (4,9 mld USD), Węgry (2,7 mld USD) i Rumunia (2,6 mld USD).

W scenariuszu zakładającym zmniejszenie dostaw półproduktów i wyrobów gotowych z Chin o 10 proc. i zastąpienie ich produkcją krajową, największe korzyści w ujęciu absolutnym odniosłyby kraje Ameryki Północnej, a następnie UE-14 (kraje starej UE bez Wielkiej Brytanii) oraz Azji Wschodniej i Południowo-Wschodniej. W zależności od regionu oznaczałoby to wzrost wytworzonej wartości dodanej w granicach od 0,2 proc. do 0,48 proc. rocznie. Wśród krajów europejskich efekt byłby wyraźnie silniejszy w krajach nowej (UE-13) niż starej Unii (UE-14), kształtując się na poziomie odpowiednio 0,31 proc. i 0,20 proc.