A threefold increase in the role of state aid to companies threatens the cohesion of the single market

Published: 26/01/2024

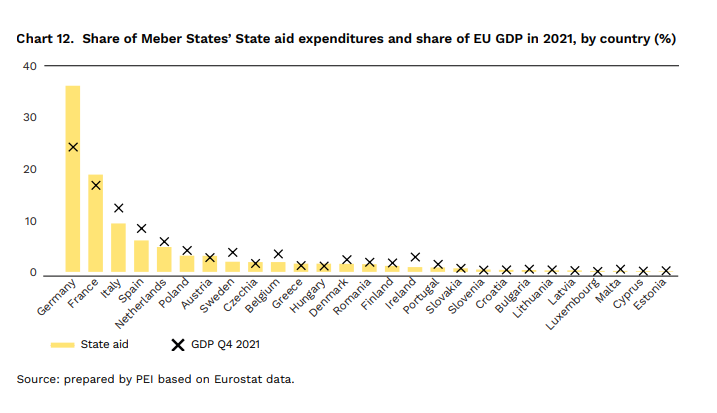

Global trade shifts triggered by the pandemic, the Russian invasion of Ukraine and the trade rivalry with China have prompted the EU to take its own measures to support domestic industry. Annual spending on state aid to companies increased by 188 % between 2020 and 2021. Aid from Germany and France alone accounted for as much as 77 % of all notified state aid to companies in the EU between March 2022 and January 2023. However, new measures are limited at EU level, with more transfers between existing funds and plans to mobilise private funds. Efforts to maintain the EU's global competitiveness threaten cohesion and competitiveness within the EU. For example, Central and Eastern Europe did not receive any funding under the third round of allocating funds for low-carbon industry from the Innovation Fund. Support for green industry and the cohesion of the single market is analysed by the Polish Economic Institute in its report 'The Single Market in a Time of Storm: The struggle to maintain competitiveness and cohesion in an era of growing protectionism.'

EU public aid for development projects is on the rise

Confronted with examples of subsidising industrial companies, especially in the area of green technologies, in other countries such as China and the USA, among others, the European Union has relaxed the rules on the use of state aid. From March 2022 to January 2023, its total value amounted to EUR 672 billion. Of this, more than three quarters was accounted for by two countries alone, i.e. Germany and France. These are the same two countries that had already committed the highest funds in absolute terms in earlier years, but the gap between them and the other countries has widened. At the same time, the German-French share of EU GDP is 41 %.

Looking at expenditure in absolute terms, Germany spent EUR 10.3 billion on R&D&I (‘research, development and innovation’) in 2021, which accounted for 55 % of EU-27 expenditure. Between 2020 and 2021, German expenditure increased by 442 %. These figures show the growing disparity in R&D&I expenditure between Germany and France and the rest of the EU.

“The relaxation of the rules on state aid is a particularly significant threat to cohesion in the single market. In just a few years, there has been a reversal of thinking: from reducing the scale of distortions to competitiveness in the single market by limiting the intervention of Member States, to significantly relaxing the rules and allowing inequalities to emerge. State aid is dominated by the strongest countries – France and Germany – and its scale exceeds their economic weight or demographic potential. Measures taken at EU level, such as the Sovereignty Fund, could mitigate this risk for Central and Eastern Europe, as well as Southern Europe,” emphasises Marek Wąsiński, Head of PEI’s Global Economy team.

New funds more likely for Western Europe

The STEP (Strategic Technologies for Europe Platform) initiative has the potential, according to EC estimates, to mobilise a total investment of €160 billion in projects in the areas of digital technologies, green technologies and biotechnology. This is expected to be the result of, on the one hand, the business incentives already in place under the Cohesion Policy and the Reconstruction and Resilience Instruments, and on the other, the additional EUR 10 billion allocated to InvestEU, Horizon Europe, the Innovation Fund and the European Defence Fund.

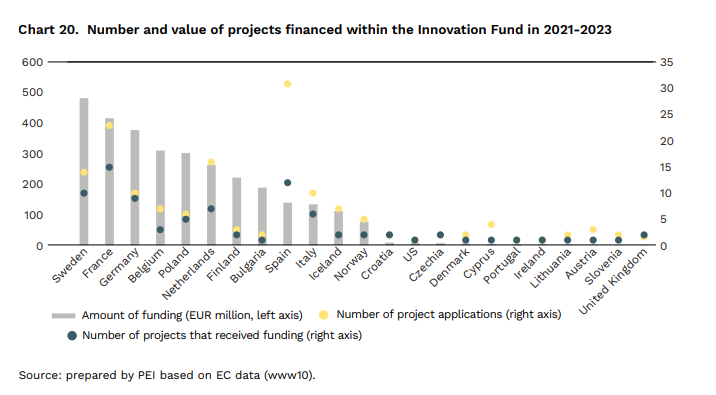

The aforementioned programmes seem to be more favourable to those with the right economic potential and level of human capital rather than to levelling economic potentials between CEE countries and the rest of the EU27. Of the 88 projects worth more than EUR 3.0 billion that received funding from the Innovation Fund between 2021 and 2023, only 13 projects worth a total of EUR 517.3 million were implemented with their participation. In the third round in 2023, Central and Eastern Europe fared worst in the distribution of funds for large-scale low-carbon projects under the Innovation Fund. Only two projects out of 41 were from CEE, i.e. one from Croatia and one from the Czech Republic. Not a single project in the area of low-carbon industry funded in the third round was located in Central and Eastern Europe.

“There is large geographical imbalance within the EU in the existing solutions, whose funding capacity will be increased under STEP. It is apparent that the concentration of resources provided by InvestEU, Horizon Europe and the Innovation Fund excludes the Central and Eastern European region. Strengthening these mechanisms will not help to reduce this disparity, which was supposed to be the aim of the Sovereignty Fund. At the same time, redirecting some of the cohesion policy funds to support low-carbon industries will result in funds being spent contrary to their intended purpose, which is to reduce development disparities,” points out Filip Leśniewicz, Senior Analyst from the Digital Economy team.

There is a need to ensure geographical balance within the EU

A crucial problem of the proposed acts and strategies is the tension between maintaining the EU’s economic position in the world and its competitiveness and preserving the operations of the single market. The European energy crisis caused by the Russian invasion of Ukraine is not insignificant in this context. Companies in the US had 83 % cheaper gas, 77 % cheaper electricity and 6 % cheaper oil than companies operating in the EU in H1 2023. Subsidies of China, USA are in turn a challenge for the European development of the RES industry. On the one hand, the protectionist actions of third countries demand a response from the EU, or even should be anticipated and create their own dependencies and technological advantages. On the other hand, the lack of fiscal capacity of the EU and the small EU budget mean that the main tools to be used are in the hands of individual Member States.

“Increasing the budgetary capacity of the European Commission would be the most desirable solution from the perspective of preserving the cohesion of the single market. Relaxing state aid rules distorts it. The EC should have tools at its disposal to support and maintain the competitiveness of European actors on an EU-wide level. The Sovereignty Fund, for example, could be such a solution. A common response at EU level will also require a growing competitive advantage from third countries, including the US, over gas, electricity and oil prices. Current solutions, as proposed in the REPowerEU plan, should take greater account of differences in regional development in order to strengthen EU cohesion. In order to implement such proposals, an ambitious approach to the EU budget is required, which should not be reduced, but actually increased and targeted at measures to ensure the development of the internal market and innovation of EU actors. Among the possible changes in the planned funding mechanisms, the creation of a certain pool of minimum funding for individual Member States also seems worth considering. The idea is to create equal access to innovative industry in every corner of the EU through such measures, and not to create enclaves of modernity surrounded by poorer regions left to themselves,” notes Kamil Lipinski, Head of the Energy and Climate team.

***

The Polish Economic Institute is a public economic think tank dating back to 1928. Its research primarily spans macroeconomics, energy and climate, foreign trade, economic foresight, the digital economy and behavioural economics. The Institute provides reports, analyses, and recommendations for key areas of the economy and social life in Poland, taking into account the international situation.

Media contact:

Ewa Balicka-Sawiak

Press Officer

M: +48 727 427 918

E: ewa.balicka@pie.net.pl

Category: Press releases / Report / Reports 2023 / World Economy