Economic Weekly 35/2025, September 5, 2025

Published: 05/09/2025

Table of contents

Protective Tariffs Have Curbed but Not Halted Imports of Electric Cars from China

62.2% year-on-year increase in newly registered electric passenger cars in Poland in H1 2025

EUR 570 million value of electric passenger car imports to Poland in H1 2025

27.3% decline in the value of electric car imports from China to the EU in H1 2025

In the first half of 2025, 14,400 new electric passenger cars were registered in Poland, a 62.2% increase compared with the same period in 2024. Registrations of all new cars, regardless of technology, rose by only 3%, reaching 285,000 in total. Electric vehicles therefore accounted for just 5% of all new car registrations in Poland. Registrations of plug-in hybrid passenger cars also increased sharply, i.e. by 80.3%, to 13,500 units. This growth reflects the expansion of both established and new market players, as well as the subsidy programme for electric car purchases introduced in February 2025. In addition, the EU’s new regulatory incentive mechanism for zero- and low-emission vehicles (ZLEV) entered into force in 2025. Meeting the threshold of a 25% share of ZLEVs in a manufacturer’s total sales entitles producers to more lenient CO₂ reduction targets.

In the same period, the value of imported electric passenger cars to Poland reached EUR 570 million, up 17% year on year, and accounted for 6.4% of the total value of passenger car imports. The vast majority of these were new vehicles (91%), although this share declined by 2 percentage points compared with the previous year. At the same time, the volume of imported electric cars rose by 40% year on year.

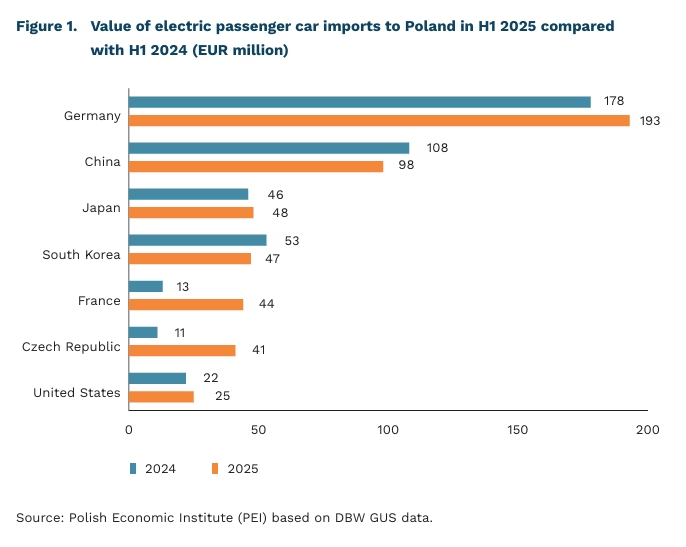

Half of the value of Poland’s electric passenger car imports in H1 2025 came from Germany and China. Germany accounted for just under 34% of imports – EUR 193 million – increasing its share by more than 8 percentage points year on year. At the same time, the value of electric car imports from Germany represented less than 10% of the total value of passenger cars imported from that country. From China, Poland imported electric passenger cars worth EUR 98 million, corresponding to a 17% share of all passenger cars imported from China. Imports from Japan and South Korea each reached almost EUR 50 million, while France and the Czech Republic both exceeded EUR 40 million on the back of around 250% year-on-year growth. In terms of brands, the market in the first half of 2025 was led by Tesla (15% share, a 24% year-on-year decline), followed by KIA (8%), and Hyundai and BMW (7% each). Chinese brands are expanding rapidly, led by BYD, which reached a 4% share, marking a 2,800% increase year on year.

EU tariffs on Chinese electric vehicles have curbed imports but have not stopped them altogether. The value of imports from China to Poland fell by only 10% year on year, while imports to the EU as a whole dropped by 27%. Despite the tariffs, China’s share of EU electric car imports stood at 41%. Beijing remains the EU’s largest external supplier of electric cars, followed by South Korea (27%, +44% year on year), Japan (11%, +15%), the United States (8%), and the United Kingdom (7%). In total, the EU imported electric cars worth EUR 7.5 billion in H1 2025, a 5.6% year-on-year decline.

Piotr Palac

Employment and Investment in Services Rose in the First Quarter, but Firms Report Weaker Financial Results

6.7% year-on-year increase in gross value added in Professional, scientific and technical activities and Administrative and support service activities in Q1 2025

3.7% year-on-year increase in employment in Real estate activities in Q1 2025

20.7% year-on-year decline in financial results from sales of goods and services in Accommodation and catering in Q1 2025

Gross value added in the Polish economy (seasonally adjusted) rose by 2.6% in the first quarter of 2025 compared with the same period in 2024, driven primarily by the services sector. While industry recorded a slight decline in gross value added (-0.2%), the majority of service sections posted growth, according to Statistics Poland (GUS). The strongest increases were recorded in Professional, scientific and technical activities (+6.7%), Transport and storage (+5.4%), and Accommodation and food service activities (+4.2%).

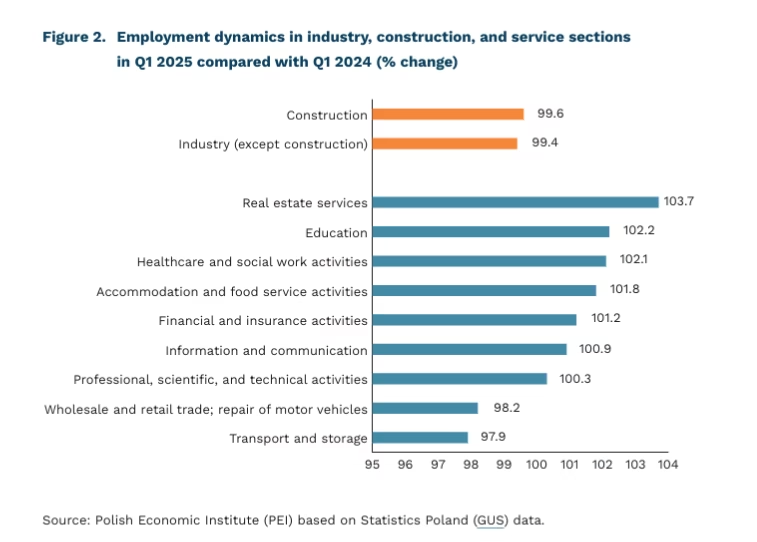

Employment in the Polish economy remained stable, rising by just 0.03% in the first quarter of 2025 compared with a year earlier. Increases were noted in most service sections, while industry and construction reported declines respectively 0.6% and 0.4%. The largest employment gains were observed in Real estate activities (+3.1%), Education (+2.2%), and Human health and social work activities (+2.1%).

The decline in investment outlays in the Polish economy in the first quarter of 2025 compared with the same period in 2024 was driven primarily by a fall in industrial investment (-8.8%). Increases were recorded in construction (+40.6%) and across several service sections. The strongest growth in investment within services was observed in Real estate activities (+93.5%), Accommodation and catering (+13.6%), and Information and communication (+12.0%). Only Administrative and support service activities recorded a decline (-1.3%). The surge in Real estate activities investment reflects heightened demand for property purchases, as investors seek a safe and stable store of value that offers resilience against economic fluctuations and a secure refuge for savings.

Over the same period, financial results from sales of products, goods, and materials improved in industry and construction (+10.6% and +10.9%, respectively). By contrast, in most service sections companies’ financial results deteriorated. The weakest outcomes were recorded in Accommodation and catering (-20.7%), Administrative and support service activities (-14.5%), and Wholesale and retail trade; repair of motor vehicles (-7.6%), where the growth in costs of goods sold outpaced the growth in revenues. A notable exception was Information and communication, which saw a marked improvement (+21.1%).

Developments in Poland’s service sector in the first quarter of 2025 reflect a broader global trend: the growing importance of services. Services are driving economic growth, generating the majority of jobs, contributing to technological development and innovation through investment, and enhancing the quality of social life.

Urszula Kłosiewicz-Górecka

University Graduates in Poland Have No Difficulty Finding Jobs, but More Often Work Below Their Qualifications Than the EU Average

92% share of recent university graduates in Poland who found employment in 2024

24.8% share of tertiary graduates aged 25-34 in Poland working below their qualifications in 2023

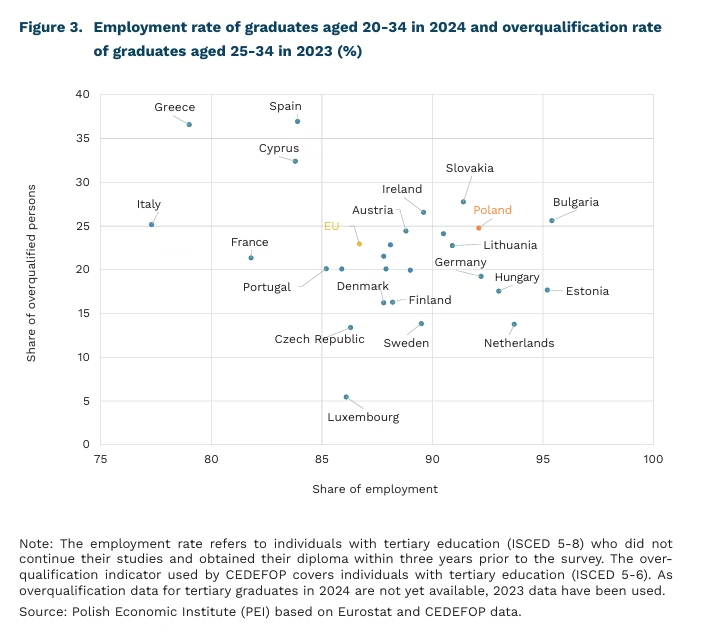

In 2024, the employment rate among recent university graduates in Poland stood at 92%, the 6th highest in the European Union. Only Germany, Hungary, the Netherlands, Estonia, and Bulgaria ranked higher. Across the EU as a whole, just under 87% of graduates found employment after completing their studies. ‘Recent graduates’ are defined as individuals who received their diploma no more than three years before the survey.

Graduate employment outcomes in Poland have consistently improved over the past decade. In 2013, the employment rate in this group was 81.3% (the 17th highest in the EU), compared with an EU average of 79.7%. The most notable improvement has been among women: in 2013, 76.7% of Polish female graduates were employed, rising to 91.5% in 2024, an increase of nearly 15 percentage points. Among men, the employment rate rose by 4.4 percentage points over the same period, reaching 92.8% in 2024.

Despite the high employment rate, university graduates also face negative trends in the labour market. In 2023, 24.8% of tertiary graduates aged 25-34 in Poland were overqualified for their jobs, placing the country 8th highest in the EU. Higher levels of overqualification were observed in Spain, Italy, Greece, Cyprus, Slovakia, Ireland, and Bulgaria. The overqualification indicator covers graduates not employed as managers (ISCO 1), professionals (ISCO 2), or technicians and associate professionals (ISCO 3). A relatively high incidence of overqualification may suggest that qualifications gained in education are less well matched to labour market demand in Poland than in many other EU countries.

Over the past decade, Poland’s overqualification rate has improved. Between 2013 and 2023, it fell by 4 percentage points, from 28.7%. At that time, in 2013, Poland ranked 6th highest in the EU; since then, its position has improved by two places. The declining share of graduates working in jobs below their qualifications is partly the result of structural changes in the Polish economy. In 2013, only 36% of all employed persons(1) in Poland worked in ISCO 1-3 occupations (see above) – 3 percentage points lower than the EU average. By 2024, this figure had risen to 44%, both in Poland and across the EU.

- Employed persons aged 15-64

Jędrzej Lubasiński

Fed Close to a Rate Cut, ECB on Hold – Monetary Policy Divergence Widens

4.25-4.50% current target range for the federal funds rate in the US (Fed)

2.00% ECB deposit facility rate (MRO 2.15%, MLF 2.40%)

The Fed is preparing for rate cuts. At the September FOMC meeting, a decision to lower interest rates appears almost certain. Market pricing currently assigns an ~87-92% probability to a 25 basis point cut, making this the consensus scenario. The move is driven by a cooling labour market and PCE inflation holding at 2.6% year on year, which is still above target, but increasingly under control. An increasing number of policymakers signal that the conditions for policy easing are in place; the key question now is the scale and pace of further actions.

The ECB, by contrast, is set to hold steady. In Europe, the September meeting is widely expected to deliver no change in rates. Following two cuts earlier this year, the deposit facility rate stands at 2.0%, while the flash estimate of August HICP shows inflation rising to 2.1% year on year (core inflation at 2.3%). In this context, even typically hawkish Isabel Schnabel is signalling ‘stay the course’, along with resilient economic activity and pro-inflationary external risks (e.g. tariffs). President Lagarde’s communication stresses independence and a meeting-by-meeting approach, without pre-committing to a path. Market expectations for September remain muted, with only limited repricing of easing by year-end.

Institutional tension in the United States is an additional but secondary factor. President Donald Trump attempted to dismiss Lisa Cook, a member of the Fed’s Board of Governors, sparking concerns about the central bank’s independence. Financial markets reacted moderately, i.e. the USD weakened slightly, while long-term bond yields rose temporarily. Investors judge that the institutional dispute will not affect the September rate cut decision, but concerns have emerged about the Fed’s long-term credibility if political pressure intensifies. President Lagarde publicly warned that interference in the Fed poses a risk to the global economy – a signal that reinforces Europe’s narrative of “stability and predictability.”

The divergence in central bank stances is spilling over into markets. The expected Fed cut is weighing on the USD against the euro and fuelling demand for ‘safe-haven’ assets: the price of gold has surpassed USD 3,500/oz, reaching a new record alongside rising volatility in US Treasuries. In Europe, conditions remain more stable – the ECB pause and a modest uptick in inflation are limiting pressure on the yield curve. Investors should therefore expect US monetary policy to remain the main source of global market volatility in the coming months.

Sebastian Sajnóg

Modest Workforce Renewal Fails to Resolve the Age Structure Challenges in Poland’s Rail Sector

90,500 number of people employed in Poland’s rail sector in 2024

42.7% share of rail sector employees aged over 50 in Poland in 2024

12.6% share of rail sector employees under the age of 30 in Poland in 2024

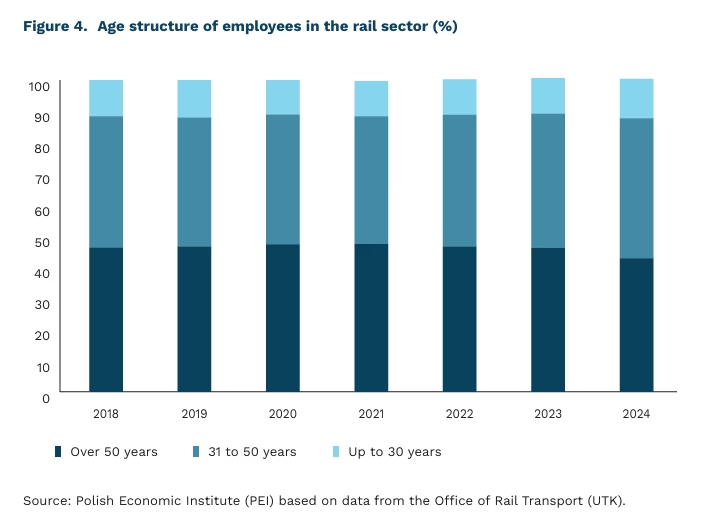

In 2024, 42.7% of the equivalent of 91,900 full-time employees (across all forms of employment, including permanent contracts, service contracts, and traineeships) in the rail sector were aged over 50. By contrast, only 12.6% were under 30. The share of employees over 50 was highest among infrastructure managers (46%) and in freight transport (44%), and lowest in passenger transport (37%). The age structure of railway employees has shown some modest improvement in recent years, particularly in passenger transport. Nevertheless, the current structure continues to pose a serious challenge and risks future shortages of skilled workers, especially in light of projected growth in rail transport.

According to the European Commission’s Rail Market Monitoring Raport, the challenge of a high share of near-retirement-age workers is present across the EU. In 2022, 41.9% of railway employees were aged over 50, though shares varied considerably across Member States. The highest proportions of infrastructure managers aged over 50 were recorded in Greece, Estonia, and Romania, where the share exceeded 60%. By contrast, in France, Luxembourg, Belgium, and Sweden, the share did not exceed 30% (in Poland, it stood at 48.3% in 2022). Among major passenger rail operators, the share of employees aged over 50 exceeded 60% in Bulgaria and Romania, while it remained below 30% in Luxembourg, France, Finland, Belgium, and Italy (in Poland, it was 51.2%).

Forecasts based on the Passenger Transport Model project an increase in passenger numbers of 11% to 37% by 2030, depending on the market development scenario, compared with 407 million passengers carried in 2024. If these forecasts materialise and the current age structure of the workforce remains unchanged, thousands of new employees will need to be recruited in the coming years. The greatest challenge is likely to be the recruitment of train drivers, given the length of training (12-18 months to obtain a driver’s licence) and the high entry requirements for candidates. Additional staff will also be needed in other railway operations positions (train managers, conductors, traffic controllers, dispatchers) as well as in rolling stock maintenance (mechanics, electronics specialists, electrical fitters, inspectors). In occupations related to railway operations, proficiency in Polish is essential, which limits the ability to address generational gaps with foreign workers. Beyond employer-led training, part of the solution lies in expanding the number of students trained in vocational, technical, and higher education programmes, including technicians (e.g. railway automation specialists, electrical fitters, mechanics), engineers, and railway traffic safety specialists.

Krzysztof Krawiec

Party Size and Dining Duration Shape Tipping Behaviour

USD 61 billion estimated value of tips in the US restaurant sector in 2023

30% share of respondents in Poland (2018 survey) who declared they always left a tip when visiting a restaurant

Tips are an expense that consumers could easily avoid, yet they often choose to make this additional payment for service. In the US restaurant sector, the estimated value of tips in 2023 exceeded USD 61 billion. From the perspective of classical economic theory, such behaviour may appear irrational – in principle, consumers should seek to minimise expenditure, maximise savings, and allocate funds to other purposes.

In practice, however, tipping goes beyond a simple economic transaction: it is a complex social phenomenon shaped by cultural norms and psychological mechanisms. One important factor driving the propensity to tip is the desire to conform to social expectations – the wish to gain acceptance and avoid disapproval from others. Tipping may also be motivated by internalised personal norms, whether to avoid guilt or to derive satisfaction from acting in line with one’s principles. Altruism also plays a role, as a tip can be perceived as a form of support for service workers, who often occupy less advantaged economic positions. At the same time, a tip may serve as a reward for high-quality service. In some cases, it is seen as an investment in future preferential treatment or as a way to maintain a current satisfactory level of service.

Context also matters – tip size depends on party size and dining duration, as shown in a study conducted in Norway and published this year. The impact of these factors on the likelihood of leaving a tip, however, varies depending on the bill amount, customer ratings, and alcohol consumption. The researchers analysed data from a large transaction database of a Norwegian restaurant chain – more than 800,000 observations across 60 outlets. The study is particularly valuable academically because it is based on actual consumer behaviour rather than self-reported declarations. Since 2019, employers in Norway have been required to record tips received by employees. Tips are treated as income and subject to both taxation and social security contributions.

In Poland, the frequency and size of tips in restaurants are strongly correlated with income levels and the frequency of dining out, according to a survey conducted in 2018. 29.8% of respondents reported that they left a tip on every restaurant visit, while only 13.2% said they never tipped. Among those who had tipped at least once, the largest group (50.7%) stated that they typically tipped 5-10% of the bill. A smaller share (28.2%) reported leaving less, 13.5% left 11-15%, and the remaining 7.6% declared higher amounts.

Iga Rozbicka