Economic Weekly 44/2025, November 7, 2025

Published: 07/11/2025

Table of contents

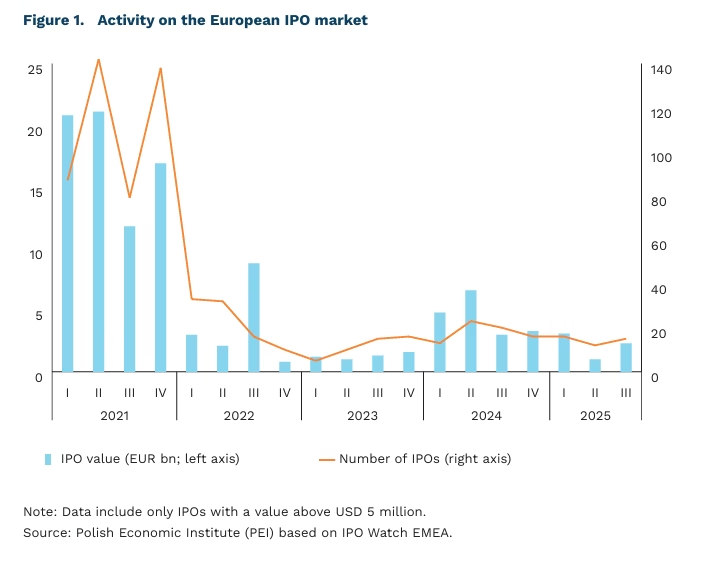

Revival on the European IPO market in Q3 2025

EUR 2.3 bn total IPO value in Europe in Q3 2025

15 number of IPOs on European markets in Q3 2025

The European IPO (Initial Public Offering) market showed signs of recovery in the third quarter of 2025. The number of listings increased to 15, with a total value of EUR 2.3 billion – a clear improvement compared to the previous quarter, which saw 12 IPOs worth EUR 1 billion in total. The largest offering was that of Swiss Marketplace Group AG on the Zurich Stock Exchange, valued at EUR 967 million, supported by several large transactions in Sweden, Spain and Germany. The increase in IPO value signals a return of investor confidence to European markets, currently undergoing a sectoral rotation – the largest number of new listings came from the real estate, hospitality and construction sectors. The financial sector is also gaining momentum, while the technology sector continues to dominate in terms of funds raised. Nevertheless, despite signs of revival, the European IPO market still faces major headwinds, particularly those stemming from geopolitical tensions and economic uncertainty.

In 2025, the IPO markets in the United Kingdom and Ireland remain largely in a waiting phase. Since the beginning of the year, activity has risen modestly, and sentiment has started to improve: some companies are planning to list in London before the end of the year, while others have withdrawn their offerings citing weak demand and increased investor caution. Moreover, in Q3 2025, the London Stock Exchange (LSE) fell out of the world’s top 20 IPO markets by value, ranking 23rd. The total value of IPOs on the LSE declined by 69% to USD 248 million – the lowest level in over 35 years. Poland ranked higher, with IPOs worth around USD 490 million, ahead of countries such as Italy and Germany.

Europe’s average IPO performance still lags behind the United States, limiting its potential to close the economic and technological gap. A strong capital market should remain the foundation for further economic development and enhanced competitiveness across Europe, including the European Union. Companies that go public typically experience a marked increase in productivity and a greater propensity to invest in innovation. The European Central Bank (EBC) also highlights that boosting IPO activity requires simplifying listing rules, reducing entry costs for small and medium-sized enterprises, and engaging retail investors through savings products that channel capital into equity markets.

Piotr Kamiński

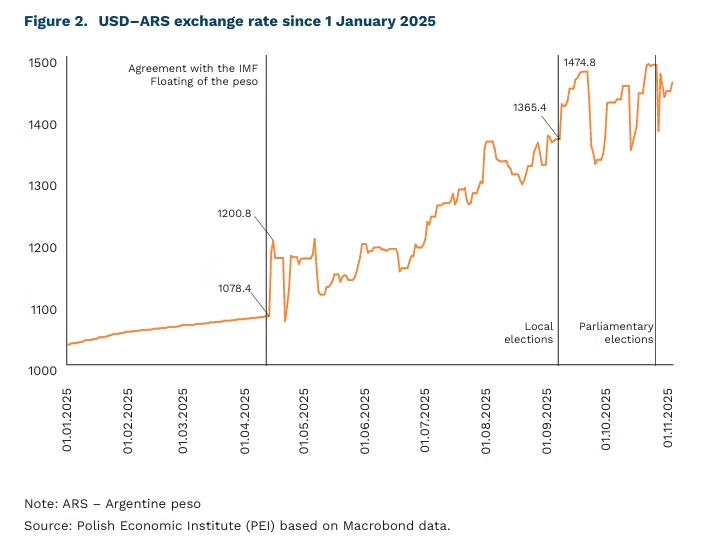

Argentina Launches the Second Phase of Liberal Reforms

40% share of votes won by Javier Milei’s party in the latest parliamentary elections

USD 40 billion total value of financial support pledged to Argentina by the United States

48% share of Trump voters in 2024 who disapproved of U.S. support for Argentina

Full implementation of Argentina’s liberal economic reform programme became possible following the victory of Javier Milei’s party in the parliamentary elections of 26 October 2025, where it secured over 40% of the vote. Until now, lacking a majority in Congress, many of the president’s initiatives had been blocked. Following the latest elections, his party won 13 of 24 seats in the upper house and 64 of 127 in the lower house, with the potential to form a coalition. The next congressional session is scheduled for 10 December 2025, when the long-prepared first budget bill under Milei – envisaging, among other measures, a zero budget deficit – may be adopted.

Reform of the labour market, the tax system and the pension scheme are the next key objectives in Argentina’s economic transformation under Milei. The labour-market reform aims to boost workforce productivity by promoting formal employment (currently, around 40% of Argentine workers are informally employed) while simultaneously strengthening employers’ flexibility. Measures include direct negotiations between workers and companies when signing employment contracts and the possibility of extending working hours to 12 per day. The tax system is to be simplified to make doing business easier, including through the abolition of around 20 taxes, a reduction in income tax, and changes to the distribution of VAT and other levies between provinces and the federal government. Argentina has the second-highest tax-to-GDP ratio in Latin America after Brazil, standing at 27.8% of GDP in 2023. A pension-system reform is also planned, though no details have yet been announced.

Milei’s strengthened political position was made possible in part by U.S. support. A sharp depreciation of the Argentine peso (ARS) in September – a 4% decline against the USD within a week following unfavourable local election results – threatened to trigger a currency crisis. The Argentine central bank intervened, selling over USD 1 billion in two days to stabilise the ARS. The United States stepped in by offering a USD 40 billion(1) swap line(2) and announcing plans to purchase Argentine beef. These measures halted the peso’s further decline and temporarily stabilised the Buenos Aires stock exchange.

Trump’s support, however, has been widely criticised in the United States — including among some members of the Republican Party — as a departure from the ’America First’ policy. According to a survey by The Economist and YouGov, 48% of Trump voters in 2024 disapproved of the support for Argentina. The decision has been explained partly by fears of regional destabilisation and growing Chinese influence in resource-rich Argentina, which holds large deposits of critical raw materials. In 2023, Milei’s Peronist predecessor obtained a USD 6.5 billion swap line from China under similar circumstances.

- Of the total USD 40 billion in support pledged to Argentina, USD 20 billion originates from the U.S. Treasury’s Exchange Stabilization Fund, while the remaining USD 20 billion comes from banks and sovereign wealth funds.

- A swap line is an agreement between two central banks that allows them to exchange a specified amount of their currencies for a set period and at an agreed exchange rate.

Katarzyna Sierocińska

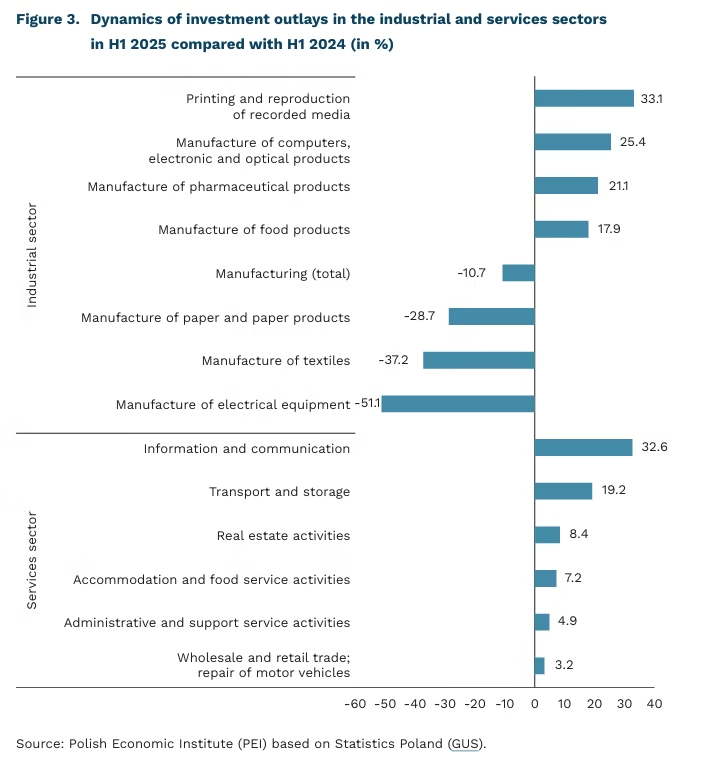

Investment Activity of Service Firms on the Rise

51.8% share of investment outlays by medium-sized and large industrial firms in total investment outlays in the Polish economy in H1 2025

32.6% year-on-year increase in investment outlays in the ‘Information and communication’ sector

45.7% share of expenditure on machinery, equipment and tools in total investment outlays on fixed assets

In H1 2025, investment outlays by enterprises amounted to PLN 87.1 billion and, in constant prices, were 1.2% lower than in the same period of 2024, according to Statistics Poland (GUS)(3). More than half (51.8%) of total investment came from enterprises in the industrial sector. Data from the National Bank of Poland’s (NBP) Quick Monitoring survey confirm that overall investment levels remain relatively stable. Investment activity has revived in public enterprises, while private-sector investment remains below last year’s levels.

The structure of investment outlays in the Polish economy is shifting, according to GUS data. In H1 2025, compared with H1 2024, non-financial enterprises increased spending on machinery, equipment and tools by 1.4%, while reducing building and structuresn investment by 4.8% and spending on means of transport by 0.8%. As a result, machinery and equipment accounted for the largest share of investment in fixed assets (45.7%). The share of investment in buildings and structures fell slightly – from 35.5% in H1 2024 to 35.2% in H1 2025.

Enterprises also sharply increased investment in intangible assets, such as copyrights, licences and industrial, commercial, scientific or organisational know-how, which rose by 175% year-on-year in Q1 2025. Consequently, the share of investment in intangible assets in total investment outlays rose above the long-term average (13.1% compared with 8.2%), according to the NBP Quick Monitoring survey.

H1 2025 saw a revival of investment in the services sector. In most sections, investment outlays rose year-on-year, with the strongest growth recorded in Information and communication (up 32.6%) and Transport and storage (up 19.2%).

In the industrial sector, investment activity varied significantly across branches. The steepest declines in investment were recorded in industries sensitive to the German business cycle and among producers of intermediate goods. Conversely, the strongest increases were observed in printing and reproduction of recorded media (up 33.1%) and in the manufacture of computers, electronic and optical products (up 25.4%).

Investment growth forecasts among large enterprises, which play a key role in shaping overall investment trends, remain positive for both annual and quarterly horizons. This outlook is supported by the high level of capacity utilisation and expected demand growth over the next year. The strongest optimism prevails in the services sector, where firms are benefiting from a favourable financial situation and satisfactory profitability, according to the NBP Quick Monitoring survey.

3. The data refer to non-financial enterprises employing 50 persons or more. The figures exclude agriculture, forestry, hunting and fishing; financial and insurance activities; higher education institutions; independent public healthcare establishments; and cultural institutions with legal personality.

Urszula Kłosiewicz-Górecka

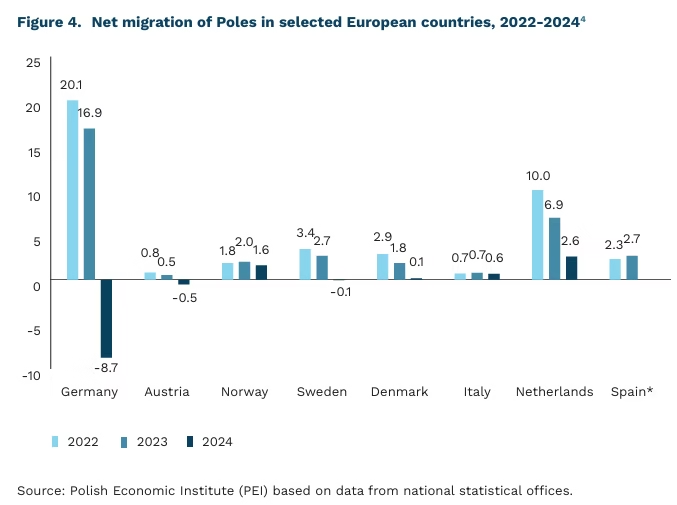

Declining Migration of Poles to Western Europe

-4.3 thousand year-on-year decline in the net migration of Poles to the Netherlands

28% share of Poles in Iceland’s foreign-born population

-529 net number of Poles who left Austria in 2024

In 2024, Germany, Austria and Sweden all recorded a negative net migration balance with Poland. The largest gap between inflows and outflows of Polish citizens occurred in Germany (-8.7 thousand), as reported earlier in PEI Economic Weekly, issue no. 28/2025. In Austria, the net balance stood at -529 (compared with +705 in 2023), while in Sweden it was -54 (against +2.7 thousand in 2023). In each of these countries, this was the first time in the 21st century that more Poles left than arrived.

In other European countries, the net migration of Poles remained positive but declined. In the Netherlands, the indicator fell to 2.6 thousand in 2024 from 6.9 thousand a year earlier, and in Norway to 1.6 thousand from 2 thousand in 2023. A pronounced drop was also observed in Denmark, where the net balance declined to just 130 persons in 2024 from 1.8 thousand in 2023.

The declining net migration levels coincide with lower employment of Poles abroad through temporary work agencies. In 2024, the number of Poles employed abroad via recruitment agencies amounted to 137.4 thousand – the second-lowest level since 2018 (after 136.6 thousand in 2020). Year-on-year, this represents a 5% decrease.

Despite the decline in the net migration balance of Poles across various countries in 2024, Polish citizens continue to account for a significant share of the foreign-born population in seven OECD countries. The highest share of Poles born abroad was recorded in Iceland – 28% in 2024. In Norway, Germany and Ireland, the figure ranged between 10% and 11%, while in Denmark, the Netherlands and the United Kingdom, Poles accounted for between 6% and 7% of the foreign-born population.

4. Data for Spain for 2024 are not yet available. In the United Kingdom, Ireland, France and Switzerland, national statistical offices do not provide migration data disaggregated by country of origin.

Jędrzej Lubasiński

Solid-fuel boilers in Poland are not being replaced fast enough

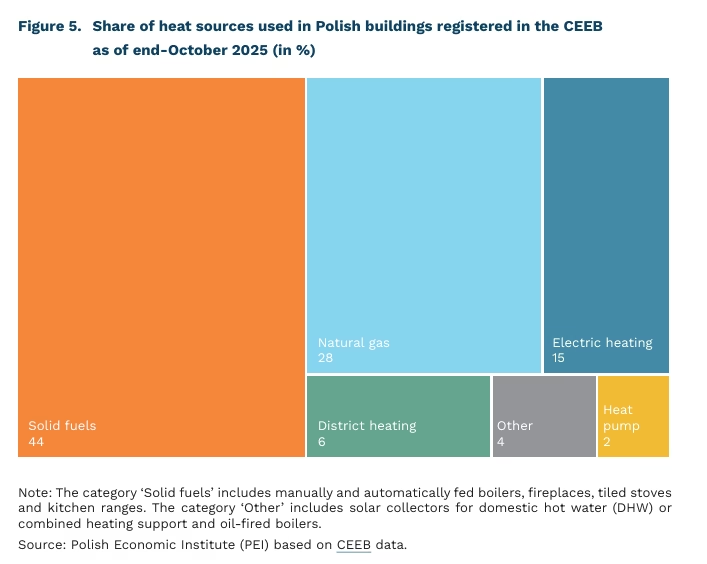

44% share of solid-fuel heating appliances in buildings registered in the CEEB database

31% share of single-family houses using only non-compliant solidfuel devices that do not meet emission standards

35,000 estimated number of premature deaths annually in Poland caused by poor air quality

Poland’s actions to combat smog remain insufficiently effective. This is one of the conclusions of a report published by the Supreme Audit Office (NIK) at the end of October 2025, which highlights the slow pace of replacing so-called kopciuchy – obsolete solid-fuel boilers(5) that do not meet air pollution standards – with clean heat sources. According to NIK, in some of the 18 municipalities examined, the complete elimination of such devices could take from several to even 24 years. This stands in contrast to the objectives of the Polish Energy Policy until 2040 (PEP2040), which foresees the phase-out of coal heating in households by 2030 in cities and by 2040 in rural areas.

The elimination of high-emission heat sources remains a major challenge due to their sheer number. Data from the Central Emission Register of Buildings (Centralna Ewidencja Emisyjności Budynków, CEEB(6)) show that, of nearly 17.5 million heating appliances registered in Poland, as many as 44% run on solid fuels such as coal or biomass. By contrast, non-emitting sources such as electric heating and heat pumps account for only 15% and 2% respectively. Among single-family houses, over 31% rely exclusively on non-certified, non-compliant solid-fuel devices.

For Poland to fight smog more effectively, several barriers must be overcome. The NIK report points to key obstacles, including irregularities in the implementation of anti-smog resolutions by local governments, low public awareness of the benefits of switching to low- or zero-emission systems, and high replacement costs. The latter is particularly significant, not only due to the purchase cost of new systems, but also their higher operating costs. NIK stresses that only four of the 18 municipalities surveyed provide financial support for households affected by energy poverty, for whom the higher running costs of new systems can be a serious burden.

Obsolete solid-fuel boilers remain the main cause of poor air quality in Poland, making their phase-out critical from a public health perspective. Poland continues to rank among the EU’s worst performers in terms of air pollution, which contributes to around 35,000 premature deaths annually. Moreover, the replacement of heat sources (alongside building thermal modernisation) will be key in the context of the introduction of the EU ETS 2 system, scheduled to take effect in 2027.

5. Solid fuels in this context include hard coal and biomass in the form of wood, pellets, or other types.

6. The CEEB database collects data on devices used for heat generation for central heating and/or domestic hot water installed in residential buildings, both single- and multi-family, as well as in non-residential buildings.

Wojciech Żelisko

Growing wealth gap between single women and men in the EU

Among the many categories of economic inequality between women and men highlighted by researchers, recent findings on wealth disparities in the EU, published by analysts from Bruegel, deserve particular attention. The study examined single, childless men and women aged 25-65 from 22 EU countries. No systematic gender differences were found in average wealth levels, either within individual countries or across the EU as a whole. However, differences emerged when analysing wealth distribution using quantile regression. While the gap was statistically insignificant among the least wealthy, from the 30th percentile upwards single women consistently possessed less wealth than single men, and this gap remained relatively stable in higher quantiles of the distribution.

These disparities widened between 2010 and 2021, showing that women’s increasing participation in education and the labour market has not translated into reduced wealth inequality between genders.

According to the authors, the pattern of growing gender wealth inequality across the distribution reflects both structural and behavioural differences between women and men, such as investment decisions and entrepreneurial activity. Men are, on average, more likely to own property, run businesses, and invest in riskier assets. Women, by contrast, tend to accumulate wealth in traditional bank deposits and lower-risk assets. Despite women’s better educational outcomes compared to men, this advantage does not translate into greater financial assets, even though education positively affects employment, earnings, and financial literacy. The limited impact of education on women’s wealth can be explained by gender differences in employment opportunities and career interruptions.

Wealth disparities between women and men are not uniform across EU countries, indicating cultural and institutional determinants such as labour market regulation and inheritance laws. The largest gender gaps were recorded in Austria and Latvia, where the average wealth of single women represented only 41% and 71%, respectively, of that held by single men.

Poland was not included in the detailed cross-country comparison of 22 EU member states due to missing data (the analysis was based on four waves of the ECB’s Household Finance and Consumption Survey). However, internal national analyses placed Poland among the countries where the gender wealth gap has been narrowing, alongside Croatia, Hungary, Ireland, Luxembourg, Lithuania, and the Netherlands.

The specific focus on single, childless individuals reflects methodological challenges in analysing wealth differences within shared households, particularly those with children, divorced, or widowed persons. Numerous studies indicate that married couples tend to accumulate greater wealth than single individuals. Yet, as social norms surrounding marriage and cohabitation evolve, the population of single men and women continues to grow. Consequently, the issue of rising gender wealth inequality is becoming an increasingly important public policy challenge, especially considering the lower financial resilience of single women in retirement and their reduced capacity to finance healthcare needs.

Agnieszka Wincewicz-Price