Economic Weekly 51/2025, December 23, 2025

Published: 31/12/2025

Table of contents

Sharing Meals Boost Happiness

10.7 average weekly number of shared meals (lunches and dinners) with people one knows in Poland (World Happiness Report)

69% share of respondents who maintain regular contact with all or most members of their immediate family (PEI survey)

More frequent shared lunches and dinners with people we know may enhance subjective well-being, according to this year’s World Happiness Report. Across cultures worldwide, eating together plays a central role in building and celebrating community. As a result, the number of meals shared with family and friends can be treated as an indicator of the strength and quality of social ties.

In developed economies, social relationships have been weakening over time. An analysis of 30 European countries shows that participation in groups and associations declined between 1990 and 2012, despite an increase in generalised trust in some areas. Moreover, this year’s World Happiness Report indicates that Americans are increasingly eating alone, which may reflect weakening social bonds in the United States. In 2023, around one in four Americans reported eating all meals alone the previous day – an increase of 53% compared with 2003.

In terms of the average number of shared meals, Poland stands out positively among 146 countries surveyed. This may suggest stronger opportunities and motivations to build and celebrate community, which is encouraging given broader international trends. According to Gallup data for 2022-2023, respondents in Poland reported eating an average of 10.7 lunches and dinners per week with people they know. Only Senegal (11.7), Gambia (11.2), Malaysia (11.0) and Paraguay (10.8) ranked higher. Among European countries, Iceland ranked in the top ten (10.1), while Slovakia, Portugal and Sweden (each 9.5) placed in the top twenty. The United States ranked 69th (7.9). The lowest figures were recorded in Bangladesh (2.7), Estonia (2.7) and Lithuania (2.9).

Most people in Poland report maintaining regular and close relationships with their immediate family and friends. In the PEI survey, 69% of respondents stated that they maintain regular contact with all or most members of their immediate family. At the same time, 30% reported contact with only a small share of family members, and 2% reported no contact at all. Around 25-30% of respondents maintain close relations with only a small part of their immediate family, can turn to only a few relatives for help, and trust only a limited number of them. A similar pattern applies to friendships: while the majority reported regular contact (65%), trust (67%) and the ability to ask for help (62%) from most friends, nearly one in three respondents reported close and sincere relationships with only a small share of them.

Relationships with more distant relatives, acquaintances and neighbours are characterised not only by less frequent contact, but also by lower levels of trust and a weaker willingness to seek help. These results are consistent with Poland’s relatively low level of generalised trust compared with other countries. As noted in PEI’s 2024 report, more than half of Poles (53%) disagree with the statement that most people can be trusted. At the same time, close ties with family and friends remain strong, and sharing meals around the same table remains one of the most effective ways to reinforce these relationships.

Iga Rozbicka

The Average European Discards Nearly 0.5 kg of Packaging Waste Per Day

177.8 kg packaging waste generated per capita in the EU in 2023

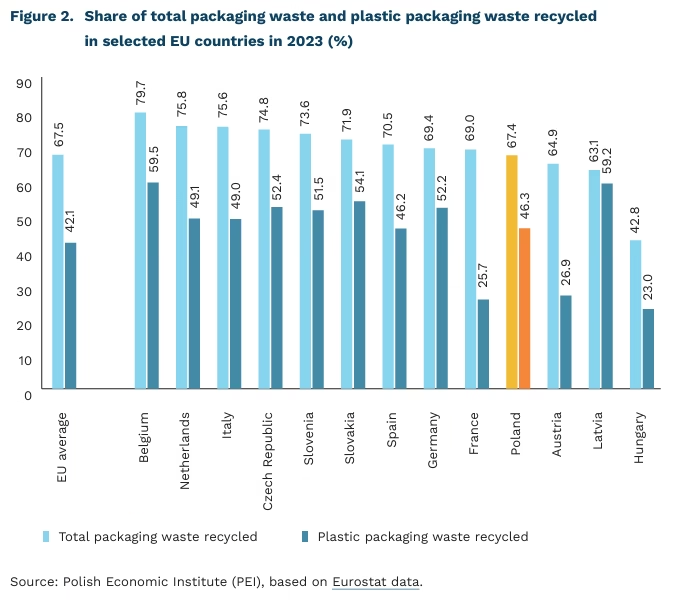

42.1% average recycling rate of plastic packaging waste in the EU in 2023

42.1% average recycling rate of plastic packaging waste in the EU in 2023

46.3% recycling rate of plastic packaging waste in Poland in 2023

The average European discards almost 0.5 kg of packaging waste per day. In 2023, EU residents generated a total of 79.7 million tonnes of packaging waste, equivalent to 177.8 kg per person, or nearly 0.5 kg per day, according to Eurostat data. Rising consumption, the growing popularity of e-commerce, and associated delivery services continue to drive an increase in packaging waste volumes.

The structure of packaging waste remains unfavourable. Eurostat data show that in 2023 paper and cardboard accounted for 40.4% of the total mass of packaging waste, plastics for 19.8%, glass for 18.8%, wood for 15.8%, and other materials for around 5%. While paper and cardboard dominate by weight, plastic packaging poses the greatest challenge for EU waste management systems. Although plastics are lightweight, they occupy a large volume in municipal waste streams and are difficult to recycle.

Plastic packaging waste in the EU is growing faster than recycling capacity. Between 2013 and 2023, the amount of plastic packaging waste generated increased by 6.4 kg per capita, while the amount recycled rose by only 3.8 kg per capita.

Under Directive 94/62/EC of the European Parliament and the Council of 20 December 1994 on packaging and packaging waste, at least 55% (by weight) of plastic packaging waste should be recycled by 2030. In 2023, the average recycling rate of plastic packaging waste in the EU stood at 42.1%. According to Eurostat estimates, Belgium (59.5%) and Latvia (59.2%) had already met the Directive’s target in 2023, while Slovakia (54.1%), the Czech Republic (52.4%), Germany (52.2%) and Slovenia (51.5%) were close to reaching it. The lowest recycling rates were recorded in Hungary (23.0%), France (25.7%) and Austria (26.9%). Poland’s estimated recycling rate of plastic packaging waste amounted to 46.3%. Differences across countries reflect variations in the organisation of packaging collection systems, national regulations and available infrastructure.

Increasing recycling alone is not sufficient. Action is also needed at earlier stages of the packaging life cycle, including design for reuse and the elimination of unnecessary elements (e.g. oversized or double packaging). This approach underpins EU regulations such as the Packaging and Packaging Waste Regulation (PPWR), which introduces harmonised rules and stringent eco-design requirements for all packaging placed on the EU market, including mandatory shares of reusable packaging and uniform consumer labelling.

Urszula Kłosiewicz-Górecka

New Challenges Facing the Polish E-Commerce Market

78% share of respondents who shop online

56% share of respondents who prefer BLIK payments online

46% share of respondents who made a purchase on the Temu platform within the past year

The share of online shoppers in Poland has remained stable in recent years, according to the latest edition of the E-Commerce in Poland 2025 report. The authors indicate that 78% of internet users have made online purchases at least once. These findings are consistent with Eurostat data, which show that 77% of internet users in Poland made e-commerce purchases over the course of a year. The report’s data should be treated as an imperfect approximation; nevertheless, they provide a valuable source of insight into internet users’ preferences.(1)

BLIK was the most widely used payment method for online purchases. As many as 72% of respondents reported having used BLIK payments online at least once, while for 56% the Polish system was the most frequently used method for paying for orders. According to the operator, the number of active BLIK users in 2025 (as of the end of September) reached 19.9 million. Despite the growing popularity of deferred payment systems (according to the Credit Information Bureau, more than 2.8 million customers in Poland have already used them), no clear increase in their use in e-commerce compared with previous years has been observed. The use of deferred payment systems for online shopping was declared by 17% of respondents, with only 3% indicating that this was their most frequently chosen payment method.

For 83% of online shoppers, parcel lockers are among the preferred delivery options and outperform the second-most popular option – direct courier delivery – by as much as 30 percentage points. The most commonly preferred operator among parcel-locker users remains the Polish market leader InPost, whose network includes more than 27,000 parcel lockers in Poland. At the same time, it is worth noting the strengthening customer attachment to ORLEN Paczka, which was indicated by one-third of parcel-locker users. Annual editions of the e-commerce report also show the growing importance of deliveries to partner pick-up points, where consumers collect orders themselves.

The leader in brand recognition in online retail remains Allegro, whose established position translates into a stable level of spontaneous brand awareness(2) at 86% of surveyed internet users in recent years. Nevertheless, the recognition and importance of Chinese platforms in Polish e-commerce are growing rapidly. As many as 46% of surveyed internet users declare that they made a purchase on the fast-growing Temu platform in the past year. In addition, 25% report purchases on AliExpress, and 18% on the ultra fast fashion(3) clothing platform Shein.

According to the report’s authors, the Polish e-commerce market has reached maturity, with competition shifting from acquiring new customers to retaining their loyalty. This situation requires retailers to compete primarily on the quality of services provided. However, normal competitive conditions are disrupted by the expansion of Chinese platforms, which are aggressively gaining market share, supported by public backing in China and by exploiting existing gaps in the customs and tax system. The European Commission has planned changes to protect the European e-commerce market from unfair competition from outside the EU. These will begin in 2026 with the introduction of a EUR 3 fee on each good imported from outside the EU that has not been customs-cleared based on its value, with the longer-term objective of tightening the functioning of the EU customs system.

- The data used in the analysis were weighted to reflect the structure of Polish internet users aged 15 and over (based on gender, age, size of place of residence, and variables related to broadly defined lifestyle); nevertheless, the authors do not declare the data to be representative.

- 2 Spontaneous brand awareness means that a given brand appears among the three examples of e-commerce stores mentioned spontaneously by the respondent.

- Ultra fast fashion refers to an “ultra-fast” fashion model, in which clothing is designed, produced, and sold within just a few days, and which is characterised by a significant environmental footprint.

Jakub Witczak

Disappointing Data from the Chinese Economy Despite Stable GDP Growth

1.3% y/y growth in retail sales in China in November 2025

15.9% y/y decline in investment growth in the real estate sector over the first eleven months of 2025

4.2% China’s GDP growth forecast for 2026, according to the IMF

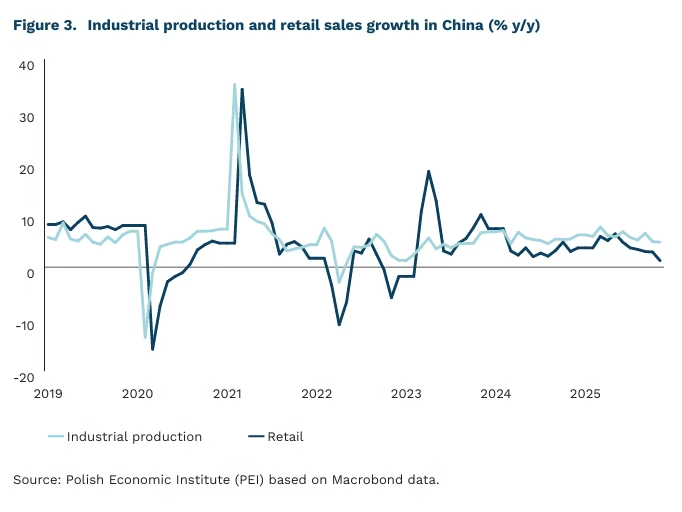

The latest macroeconomic data from China came in weaker than expected. In November, retail sales increased by 1,3% y/y, well below the market consensus of 2.9%. This was also the lowest growth rate since February 2023. Industrial production rose by 4,8% y/y, slightly below expectations of 4.9%. November data point to a relatively strong industrial component, particularly in modern segments such as high-tech industries, where value added increased by 8,4% y/y. Over the first eleven months of 2025, fixed-asset investment declined by 2.6% y/y, with the real estate sector remaining the main drag (-15.9% y/y). Excluding real estate, investment increased by 0.8% y/y. China is therefore currently facing a situation in which the state and the industrial sector are compensating for the weakness of residential construction.

The housing market thus remains in a crisis that has lasted for four years. The downturn was triggered by the bursting of a property bubble in China. Excessive growth in housing prices weakened demand, forcing developers to cut prices. Falling revenues translated into deteriorating liquidity across the sector, with some entities, such as Evergrande, losing the ability to service their liabilities on time. The Chinese authorities responded with active intervention, which helped spread the adjustment over time. As a result, prices of new homes continue to decline – by 0.4% m/m and 2.4% y/y in November, further eroding household wealth and dampening consumption. Home sales were also around 50% lower compared with the same period (January-November) in 2021.

Despite persistent difficulties in the housing market, the Chinese economy continues to show relatively strong growth momentum. According to IMF forecasts, GDP growth is expected to remain at 4.2% in 2026, with strengthening domestic demand remaining one of the key policy priorities. The negative impact of the housing market crisis is only weakly visible in GDP data, reflecting the relatively small share of the sector – around 6% – in total value added. At the same time, under current conditions, economic growth is increasingly supported by exports, which compensate for weak domestic demand. In an economy of China’s global scale, however, such an export-led strategy carries significant geopolitical implications, including rising trade tensions with the United States.

Piotr Kamiński

Four in Ten Working Immigrants from Ukraine Changed Industry after Arriving in Poland

10× increase in the share of working immigrants from Ukraine in Poland between 2015 and 2025

34% wage gap at labour-market entry between immigrants and native workers of the same age and gender in OECD countries

40% share of working immigrants from Ukraine employed in a different industry than in the month prior to arriving in Poland

Between 2015 and 2025, the share of immigrants from Ukraine working in Poland increased tenfold. By the end of 2025, they accounted for 5% of all workers insured with the Social Insurance Institution (ZUS),(4) compared with 0.5% a decade earlier. This unprecedented migration wave has posed significant challenges for the Polish labour market but has also created new opportunities.

Eight in ten immigrants from Ukraine are employed in labour-intensive sectors with low entry barriers, where jobs can be found relatively quickly. These include administrative and support service activities (19.8%), manufacturing (19.1%), construction (13.5%), transport and storage (12.1%), wholesale and retail trade, including vehicle repair (9.2%), and accommodation and food service activities (6.6%). These are also sectors in which labour shortages have been identified in recent years.

Migration is almost always associated with occupational change, and the data confirm that immigrants often work in jobs below their qualifications. Between 2014 and 2024, third-country nationals (non-EU citizens) living in the EU consistently recorded the highest overqualification rate, although it declined from 45.9% to 39.6%. Among people born in another EU country, the rate fell from 34% to 30.3%, while it remained lowest among those born in their country of residence.

Research shows that at the point of entry into an OECD labour market, immigrants earn 34% less than native workers of the same age and gender. Around two-thirds of this gap is explained by immigrants’ concentration in lower-paying sectors and firms. Importantly, the earnings gap narrows by around one-third within the first five years in the host country and by about one-half within the first ten years.

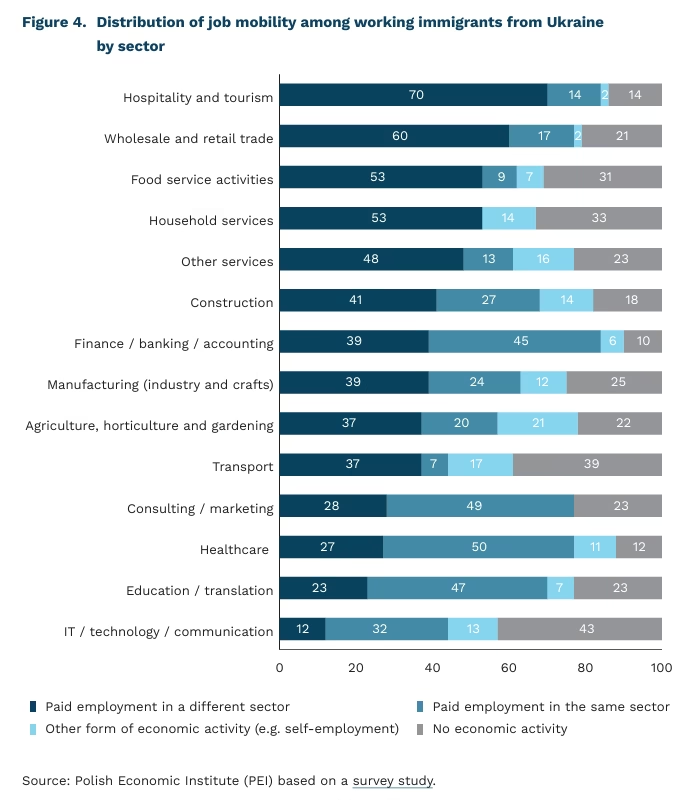

The largest group of immigrants from Ukraine (40%) works in a different industry than in the last month before arriving in Poland. Those employed in the same industry account for 25%. A similarly large group consists of people who were not economically active prior to arrival (24%). The smallest group (11%) comprises workers who were economically active before arriving in Poland but were not in wage employment, instead running their own business or working in another non-standard form of employment.

In some sectors, such as hospitality and tourism, trade, gastronomy, and household services, more than 50% of immigrants worked in a different industry before arriving in Poland. These are sectors where jobs are relatively easy and quick to obtain. In sectors requiring higher levels of specialisation (healthcare, IT, education, and finance) industry switching is less common, with around 50% of immigrants from Ukraine working in the same industry as before migration. Notably, in some sectors (e.g. IT/technology/communications and transport), a relatively large share of workers were not employed prior to arrival, reflecting the age structure of migration, which is dominated by younger cohorts.

Research confirms that immigrants experience a decline in occupational status upon entering the labour market of the host country, but their position improves as they accumulate country-specific human, cultural, and professional capital. Removing systemic barriers, such as difficulties in recognising foreign qualifications and accessing upskilling opportunities, is also crucial. As the OECD emphasises, integration policies should focus on providing information about job search and labour-market conditions in the host country, career guidance, and support for building professional networks.

4. Data on persons insured with ZUS cover both employees and non-agricultural self-employed persons (including cooperating family members).

Cezary Przybył

Bilateral Contracts for Difference for Further Offshore Wind Farms in Poland

3.4 GW total installed capacity of offshore wind farms awarded support in the first offshore auction in 2025

2.7% average difference between the auction maximum prices and the prices offered by the winning bidders

16-20% potential share of offshore wind in Poland’s electricity generation in 2035

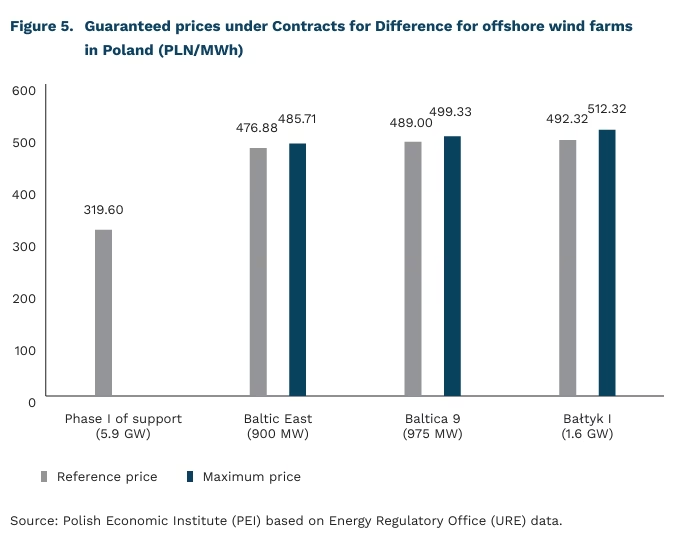

On 17 December 2025, the Energy Regulatory Office (URE) conducted Poland’s first auction for offshore wind farms. URE awarded support to three projects with a total planned installed capacity of 3.4 GW: Baltic East (ORLEN), Baltica 9 (PGE), and Bałtyk I offshore wind farm (Polenergia and Equinor). As part of Phase II, four auctions are scheduled for 2025, 2027, 2029, and 2031, under which the right to cover the negative balance may be granted to installations with a total capacity not exceeding 12 GW. The Regulation of the Minister of Climate and Environment of 9 January 2025 sets three ceiling price levels for Phase II auctions, depending on the location of the offshore wind farm: PLN 485.71/MWh, PLN 499.33/MWh, or PLN 512.32/MWh.

Support in both phases is based on bilateral Contracts for Difference (CfDs). In Phase I, which covers 5.9 GW of offshore capacity, the guaranteed price (strike price) was set in 2021 at PLN 319.6/MWh and is subject to indexation. Indexation is carried out based on the medium-term inflation target set by the Monetary Policy Council, which stands at 2.5%. Competitive auctions apply to Phase II, and participation is limited to developers whose projects have previously obtained, among other things, location permits.

CfDs for electricity generation from offshore wind farms are one of the horizontal measures aimed at reducing emissions, as set out in Poland’s National Energy and Climate Plan (NECP). CfDs provide protection for both the energy system and consumers during periods of energy crises and high wholesale prices, as they allow the state to finance consumer support schemes using surplus revenues (difference payments) paid by electricity producers. In periods of lower market prices, CfDs may result in regular top-up payments to operators. At the same time, integrating offshore wind farms into the system – projects that would not be viable at scale without such revenue stabilisation – will reduce wholesale electricity prices, particularly during night-time hours and in winter.

According to the updated NECP presented on 17 December 2025, installed offshore wind capacity in Poland could reach 11.8 GW by 2040 under the WEM (with existing measures) scenario, or 16 GW under the WAM (with additional measures) scenario. These projections represent a significant downward revision compared to the 18 GW assumed in the draft NECP presented in July 2025. By 2030, offshore wind farms with a total capacity of 5.9 GW are expected to be commissioned, and offshore wind could account for 10.7-11.2% of Poland’s electricity generation in that year. The 2040 projections of 11.8-16 GW of installed capacity would translate into an offshore wind share of 18-21% of electricity generation.

Marianna Sobkiewicz

Italy’s Economic Interventionism Under Brussels’ Scrutiny

from 83 to 835 number of notifications under Italy’s golden power procedure between 2019 and 2024

92% share of cases notified in 2024 that were approved by the government

almost 80% share of 2024 notifications concerning sectors classified in EU regulations as critical infrastructure, technologies, and access to personal data

Italy’s government interventionism has raised concerns in Brussels. On 21 November 2025, the European Commission launched an infringement procedure against the Italian government over its interference in the takeover of Banco BPM by UniCredit. The transaction involved two banks operating on the Italian market and would have made UniCredit the largest bank in Italy. The deal was effectively blocked by the government through the use of Italy’s legal mechanism known as golden power.(5)

The mechanism grants the government veto rights over investments in strategic assets. Each such transaction must be notified to the Council of Ministers, which may approve it, object to it, or – most often – approve it subject to conditions. In the case of the UniCredit–Banco BPM merger, the government imposed prohibitive conditions that in practice rendered the transaction unfeasible.

Italy has been steadily expanding the list of sectors protected under this mechanism. In 2012, the rules covered only critical infrastructure, defence, and energy. Today, they also extend to technologies (including 5G, AI, and semiconductors) as well as the financial sector. The instrument was originally designed to protect against hostile capital from outside the EU, primarily from China and Russia. According to Italian government reports, around 80% of notifications in recent years concerned transactions involving non-EU companies.

In 2024, only 12% of notifications related to transactions between Italian firms, while around 10% involved transactions between Italian companies and entities from other EU Member States. Blocking the UniCredit–Banco BPM transaction nevertheless marks the f irst case of its kind. The precise reasons for the intervention remain unclear and may stem either from concerns about UniCredit’s excessive influence on the Italian economy following the acquisition or from a lack of trust on the part of the government towards the company.

The abuse of golden power runs counter to the foundations of the EU single market, including the free movement of capital. Similar instruments designed to protect key assets from foreign takeovers exist in other EU Member States. However, nowhere else have they been used in a comparable manner to control the internal market. Continued use of this tool without consequences to block mergers and acquisitions not directly related to security could set a dangerous precedent for other Member States.

5. In the original, the mechanism is referred to as “Golden Power”. It was established by a decree-law in 2012.

Michał Kowalski