Economic Weekly 1/2026, January 9, 2026

Published: 09/01/2026

Table of contents

Companies enter 2026 with cautious optimism

43% of companies expect their f inancial situation in 2026 to be good or very good

51% of companies assess their f inancial situation in 2025 as having been good or very good

33 percentage points more companies in the finance and insurance sector assessed their financial situation in 2025 as good or very good than had been forecast

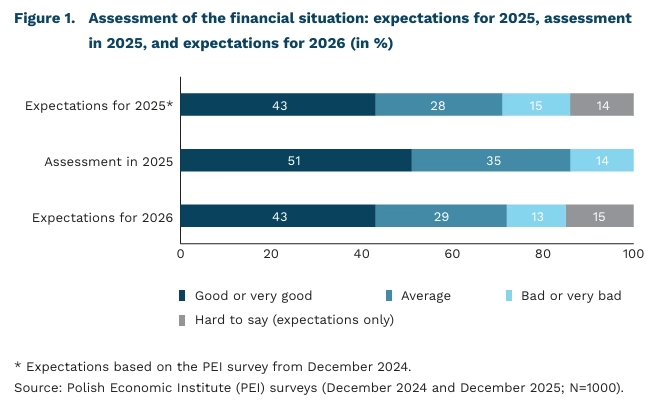

In 2025, more than half of enterprises assessed their financial situation as good or very good, according to a survey conducted by the Polish Economic Institute (PEI) in December 2025 on a sample of 1,000 companies. This outcome proved better than earlier expectations. In December 2024, 43% of surveyed enterprises expected their financial situation in 2025 to be good or very good, while 15% anticipated a bad or very bad financial situation. Expectations for 2026 are broadly in line with those formulated for 2025. 43% of respondents believe their financial condition will be good or very good. At the same time, 13% of companies expect a bad or very bad financial situation, while 15% are unable to assess how their situation may evolve.

Medium-sized enterprises are the most optimistic about the future. 45% of them expect their financial situation in 2026 to be good or very good. Large enterprises experienced the greatest difficulty in assessing their future financial situation (27%). More than half of medium-sized, micro-, and small enterprises assessed their financial situation in 2025 as good or very good, compared with 46% among large companies. Large enterprises recorded the lowest share of negative assessments (1%), while the highest share was observed among micro companies (17%).

The highest share of optimistic expectations was reported among companies operating in finance and insurance, where 60% expect a good or very good financial situation. More than half of respondents from real estate activities, other service activities, and information and communication also expect their financial condition to be good or very good (59%, 57%, and 52%, respectively). The largest proportion of companies unable to assess their future financial situation was recorded in manufacturing (22%), transport and warehousing (18%), and administrative and support service activities (17%). In the finance and insurance sector, 73% of companies assessed their financial situation in 2025 as good or very good, compared with markedly lower expectations expressed at the end of 2024 (by 33 percentage points). Fewer than one in ten companies in real estate activities, finance and insurance, and accommodation and food service activities reported a bad or very bad financial situation (3%, 7%, and 9%, respectively).

2025 proved to be a relatively good year for many companies, supported by improved macroeconomic conditions, including declining inflation and interest rate cuts by the NBP. At the same time, according to a survey conducted by the Polish Economic Institute (PEI) as part of the MIK (Monthly Business Climate Index), more than half of companies did not increase their use of external financing, while 9% reported an increase. External financing was used most intensively by large enterprises (22%) and companies operating in the TSL sector (11%). A positive assessment of companies situation is also confirmed by BIG InfoMonitor data, which indicate that for more than half of entrepreneurs the past year was a good one. Caution in formulating expectations for 2026 is justified by companies reports of growing payment backlogs, cost pressures, and rising debt levels in selected sectors.

Aleksandra Wejt-Knyżewska

Resilient and innovative economies will attract the largest amount of foreign direct investment in 2026

USD 11.2 billion was the value of greenfield projects announced in Poland in 2025

USD 1.3 billion was the value of the largest greenfield investment announced in Poland in 2025

1.7 percent was Poland’s share in global greenfield investments in 2025

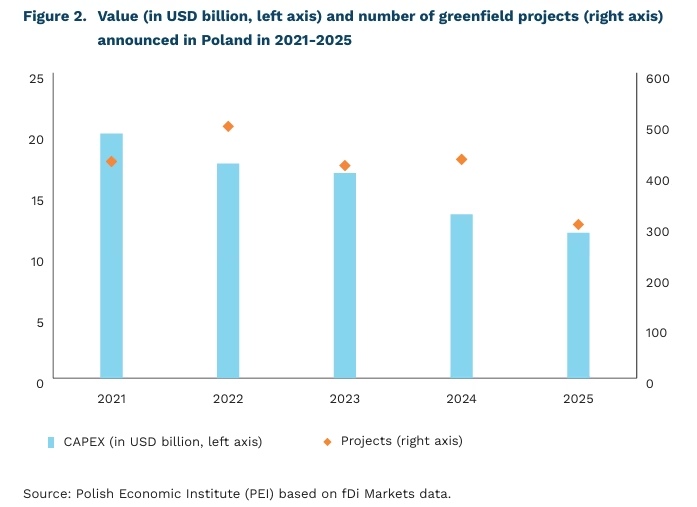

2026 is expected to be a “transitional year” for foreign direct investment (FDI) – between the existing model of globalisation and a new configuration of competitiveness and risk factors – according to a survey by FDI Intelligence conducted among 101 experts and industry leaders. Moderate optimism and awareness of new risks prevail among respondents. The most important of these are geopolitical tensions, which are leading to reshuff ling in global supply chains and reinforcing the trend of friendshoring. Another group of risks consists of economic and financial factors related to U.S. tariff policy and potential disruptions in financial markets, especially in the context of the AI revolution.

A further increase in the importance of investors from the Asia-Pacific region and the Persian Gulf is anticipated. This represents a continuation of the trend observed in the past year, when investments from these areas accounted for 36.4 percent and 12.1 percent of global FDI inflows, respectively. At the same time, a decline in the activity of investors from Europe and North America is expected. Among the regions that may gain in attractiveness are Eastern Europe, Sub-Saharan Africa, and the Middle East.

The key determinant of FDI inflows is expected to be the resilience of economies to political and geopolitical shocks. Competitiveness will be based to an ever smaller extent on protectionism, tax incentives, or low costs, and increasingly on innovativeness, especially in the area of AI technologies. Respondents anticipate a growing importance of strategic investments related to digital transformation, critical raw materials, and semiconductors, as well as a major return of investments in the defence sector and the aerospace industry in connection with ongoing armed conflicts.

In 2026, Poland will most likely maintain its position as a leader in Central Europe, although inflows of greenfield investment are gradually slowing, in line with broader global trends. In the past year, 302 projects were announced with a total value of USD 11.9 billion, under which the creation of 42.5 thousand jobs was declared. The largest projects were implemented by two U.S. companies – Ascend Elements, Battery Resources (USD 1.3 billion) and Microsoft (USD 704 million), as well as by the German company Mercedes-Benz (USD 424 million). In terms of the number of projects, one-sixth of investments were in the IT sector, while the largest amount of capital flowed into the renewable energy industry (USD 2.8 billion).

Dominik Kopiński

European companies’ R&D spending continues to lag behind other regions

only 4.4% of R&D spending in the software domain comes from EU-based companies

EUR 233.7bn was spent on R&D by the largest EU companies in 2024

one Polish company made it into the top 2,000 global corporate R&D spenders

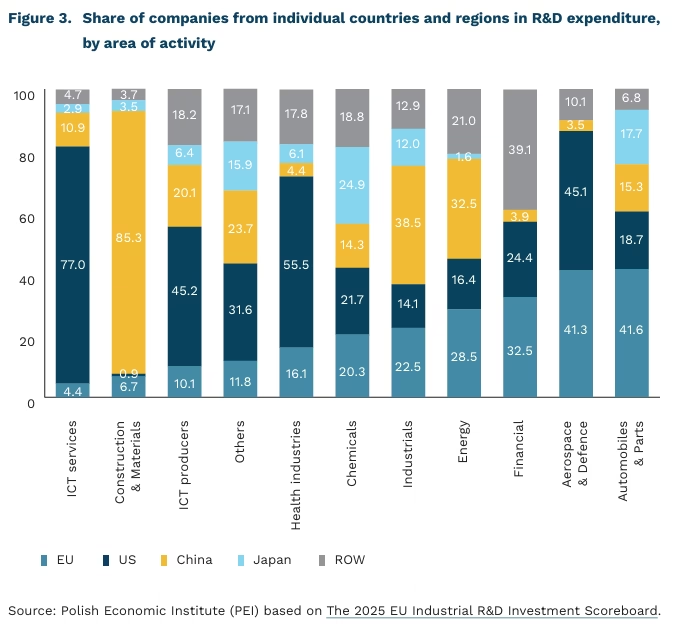

According to the latest JRC study, 318 of the 2,000 global companies that spend the most on research and development are based in the EU. In this respect, the EU trails China (525 companies) and the United States (674 companies). However, when spending amounts are taken into account, the EU still has a slight edge over China (EUR 233.7bn compared to EUR 233.2bn). The United States remain the undisputed leader, where the largest companies spent EUR 680.8bn on R&D, i.e. 47.1% of all spending by the 2,000 companies recorded in 2024. The list includes one company from Poland – InPost – ranked 825th.

Beyond total spending, countries and regions also differ in the sectoral composition of their surveyed firms. EU companies dominate by number in energy (36.2% of firms in that sector) and in financial services (35.4%). In terms of spending levels, EU-headquartered firms lead in automotive (41.6% of total spending) and in financial services (32.5%). EU firms also have a strong presence in aerospace and defence (29.7% of firms; 41.3% of spending) and in industrials (25.8% of firms; 22.5% of spending). However, companies in these five sectors jointly account for only 23.1% of global R&D spending.

The largest R&D expenditures are generated in the ICT sector – both in software and in hardware manufacturing (24.9% and 22.0% of total spending, respectively). In these categories, U.S. companies dominate decisively (77% of R&D spending in ICT services and 45.2% in ICT production). The EU accounts for only about 4.4% of ICT services R&D spending and 10.1% of IT production R&D spending, and the decline in these expenditures relative to 2023 (in real terms) is a cause for concern. China, in turn, clearly dominates spending in construction and materials category.

The latest compilation of corporate R&D spending confirms the trends observed for some time and the EU’s weakening position in innovation activity. Among the sectors in which Europe specialises or holds a strong position, positive changes can be seen in energy (a 16.7% increase in spending) as well as in health and the aerospace & defence industries (increases of 10.1% and 2.5%, respectively). In automotive, real spending fell by 2.1%, and four companies dropped out of the ranking. Meanwhile, Chinese competitors increased their share: three new companies entered the ranking and spending rose by 12.7%.

EU strategies developed over the years to promote innovation have not delivered results – or at least this is not reflected in data on firms’ R&D spending. The position of EU companies has been steadily declining, and their presence in digital sectors remains marginal. Private R&D outlays are also not used as indicators to measure the effectiveness of development strategies (if anything, total R&D expenditure as a share of GDP is used as an indicator). We propose introducing such an indicator as part of the Digital Decade review – it may not quickly reverse the unfavourable trend, but it could serve as a directional building block for public administration activity, in line with the principle that “what gets measured gets done.”

Ignacy Święcicki

Snowstorm and blizzards improved renewable energy share during the holiday season

25 cm the snow cover in Warsaw on 5 January 2026. The last time such a value was recorded was in 2013

23 per cent share of wind energy in net electricity production in Poland between 24 December 2025 and 6 January 2026 (on 30 December 2025, it was 35%)

for 42 per cent of the time between 26 December 2025 and 4 January 2026, generation from lignite-fired power plants did not exceed 2 GW (from 5 January 2026, the level increased due to weaker winds)

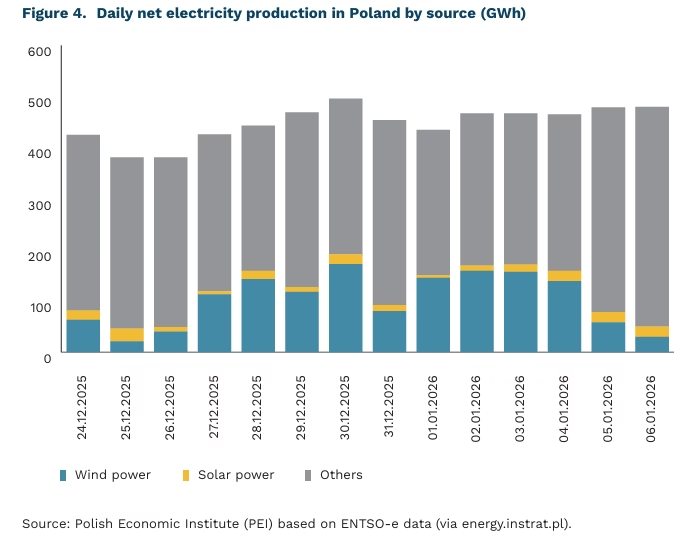

The winter weather in Poland highlights the challenges that the Polish power system will have to face in the future. Although over the decades we have seen a steady increase in winter temperatures and a decrease in snowfall in our country, we must also be prepared for episodes of more difficult weather.

Snowstorms and cold weather are not a problem for wind energy, thanks to which the daily share of renewable energy sources in net electricity production in Poland approached as much as 40 per cent during the Christmas break (the highest since October 2025). Modern turbines installed in Poland are equipped with solutions that prevent ice from forming or enable them to be defrosted, allowing them to withstand temperatures as low as -20 or -30 degrees Celsius.

Snow cover is not a main problem for solar energy, which reached a generation of 4.6 GW around noon on 4 and 6 January this year. The panels are mounted at an angle and the snow melts in the sun. From November to January, however, cloud cover and short days are a key limitation, even in warmer weather. The situation is better in the second part of the heating season (February-April).

Snowfall is good news for hydropower. Although its role in Poland is limited, snow cover in Nordic and Alpine countries is a valuable water reservoir that can support continental power systems in spring and summer.

The key challenge in the face of snowstorms is electricity distribution. The main problems occurred in Warmia and Mazury, affected by power failures in the first days of January. Heavy snowfall and strong winds threaten local distribution networks, which are damaged also by fallen snow-laden trees or branches.

A more difficult test for the system began on 5 January this year: falling temperatures were accompanied by weaker winds. On 6 January, the share of renewable energy sources in daily generation fell to 14 per cent. During a deep dark lull, this ratio may fall to a few percentage points. Even in the 2030s and 2040s, the burden of supplying the system in such times will be borne mainly by carbon-emitting conventional power plants, and later also by nuclear power plants.

A stable supply of electricity to households will become even more important with the electrification of heating and transport. Heat pumps are the most efficient and environmentally friendly source of heat, but their widespread use requires adequate preparation on the part of the system (peaking power plants, secure grid). The dependence of homes on the grid can be reduced by good thermal insulation of the building, heat storage, PV panels and battery energy storage (with off-grid functionality). In isolated homes, a backup wood-burning fireplace or small power generator may be useful.

In the future, the gas system must also prepare for peak demand that is up to twice as high as previous records. It is gas sources that will ultimately secure both the power system and municipal heating systems, as well as part of the domestic heating.

The energy transition also affects the winter operating profile of large dispatchable power plants. Due to high wind speeds, intensive operation of combined heat and power plants, and lower demand, between 28 December 2025 and 4 January 2026, net generation from lignite-fired power plants rarely exceeded 3 GW. Due to its more stable production profile, supplementing wind power is less burdensome for JWCD than in the case of solar.

Michał Smoleń

Responding to job advertisements and direct contact with employers are the most popular ways of looking for work in Poland

34% of working Poles found their current job through direct contact with the employer

31% of working Poles found their current job by responding to a job advertisement

2% of working Poles found their current job through a public employment service (PUP)

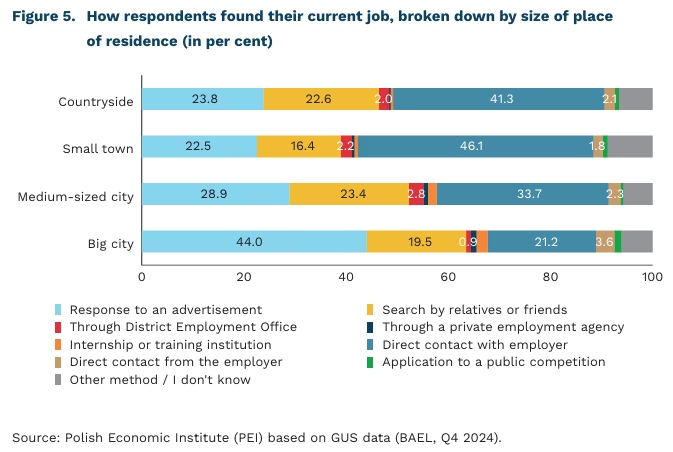

Responding to a job advertisement (e.g. posted electronically on the internet), direct contact with an employer or searching for a job through relatives and friends are among the most commonly used and most effective ways of finding a job in Poland. In the fourth quarter of 2024, a total of 86% of working Poles surveyed by the Central Statistical Office (GUS) indicated that they found their current job by using one of these three channels. Almost 34% of respondents indicated that they found their current job through direct contact with the employer, and 31% responded to a recruitment advertisement. A relatively large percentage of respondents (21%) also indicated that the most effective channel for them was job searches by family and friends. This result does not mean that these contacts were decisive in obtaining the job and that this took place without an independent recruitment competition, but rather that family and friends acted as intermediaries in obtaining information about the job advertisement.

Finding a job through the services provided by District Labour Offices (PUP, Powiatowy Urząd Pracy) is one of the least frequently used methods of job search. Less than 2% of working Poles surveyed by the Central Statistical Office (GUS) in the fourth quarter of 2024 found their current job in this way. Other rarely used methods include: private employment agencies (less than 1% of respondents), public competitions (1% of respondents) and direct contact initiated by the employer (2.6% of respondents).

The effectiveness of various forms of job search varies greatly depending on the size of the respondent’s place of residence. Applying for positions advertised in recruitment advertisements (mainly appearing on the internet) is the most popular method of job search in cities with a population of over 100,000, while it is less popular in medium-sized and small towns and in rural areas. On the other hand, direct contact with employers is a method much more commonly used in rural areas, where 41% of respondents found their current job in this way, and much less popular (though still significant) in large cities, where almost twice as few respondents found work in this way (21%). Direct contact with employers is a very broad category, which most likely also includes contacts via social media and mobile applications.

Although the GUS data discussed here refer to the end of 2024, we can conclude that the trends observed at that time also apply to 2025. This is because changes in preferred job search methods are slow, and social preferences are stable over time and depend, among other things, on the prevalence of internet use and the territorial mobility of Poles.

Paula Kukołowicz, Michał Smoleń

Record Growth for Polish Investment Funds in 2025

+11.9% year-over-year growth in total assets held by Polish Investment Fund Companies (TFI) up to November 2025

+1.1 percentage points increase in the market share of Polish equity ETFs (rising from 2.3% at the end of 2024 to 3.4% in November 2025)

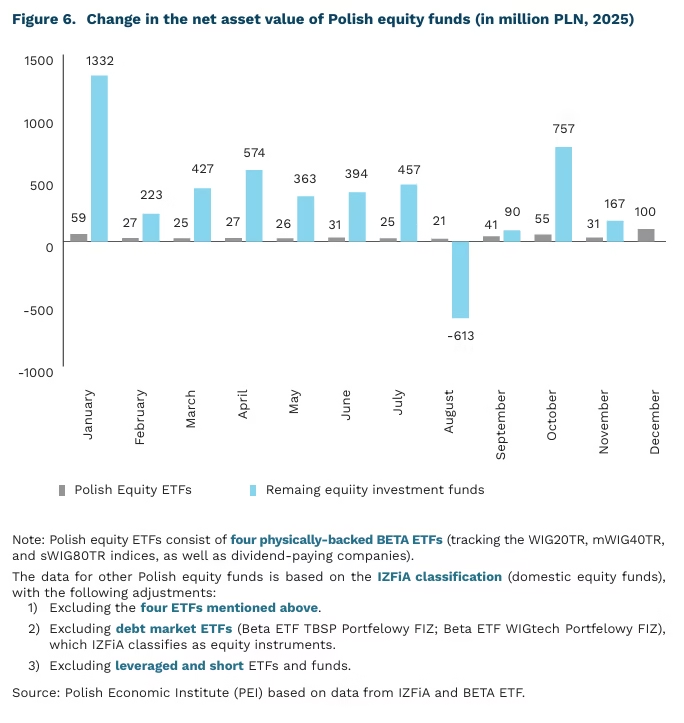

2025 set a new record for the investment fund market, though its fundamental structure remained unchanged. The growth was primarily driven by bond funds and Employee Capital Plans (PPK) – stable products favored by investors seeking safety. At the same time, despite a strong bull market on the stock exchange, ETFs (Exchange-Traded Funds) listed in Warsaw gained more attention, even though they still represent a small part of the overall market.

Record-Breaking Assets. The total value of net assets in investment funds grew from 379.4 billion PLN in late December 2024 to 424.4 billion PLN by the end of November 2025. This is the highest result in history, marking an increase of 45 billion PLN in just 11 months – even without the final data for December. Crucially, this growth was mostly the result of new money flowing into the funds (net inflows) rather than just an increase in the value of existing investments. Between January and November, retail fund sales reached 46.7 billion PLN. November alone saw a surplus of 5.3 billion PLN, almost entirely from individual (retail) clients. It is clear that 2025 was an exceptionally strong year for the industry in terms of attracting new capital.

▶ Bonds and Retirement Plans Lead the Way. The past year was a record-breaker mainly for bond funds and the PPK system.

- Debt (Bond) Funds: These attracted 37.8 billion PLN, the largest share of all new capital. Short-term bond funds were the most popular, taking in 25.4 billion PLN.

- PPK (Employee Capital Plans): These saw steady inflows of 6.3 billion PLN, further increasing their importance in the market.

- Note: While PPK is growing, it is largely filling the gap left by money flowing out of the older pension system (OFE) due to automatic transfer mechanisms.

Investors Remained Cautious of Stocks. Interestingly, despite a booming stock market, Polish investors did not rush into equity (stock) funds. Last year saw massive returns on the Warsaw Stock Exchange – the WIG20 index rose by 51% (including dividends). Despite these gains, more money was withdrawn from stock funds than invested in them (a net loss of 434 million PLN). Specifically:

- Polish stock funds saw 641 million PLN in withdrawals.

- Foreign stock funds (mostly focused on the US market) saw 208 million PLN in new investments. However, the trend began to shift in October and November 2025, as investors started putting money back into stock funds.

The Rise of ETFs. ETFs are slowly becoming more popular in Poland. There are currently 17 ETFs and ETCs listed on the main Warsaw Stock Exchange. Last year, the value of assets in Polish equity ETFs doubled. While they still only hold about 0.8 billion PLN (compared to 23.5 billion PLN in traditional stock funds), their market share is growing steadily.

Marcin Klucznik, Sebastian Sajnóg

Only the largest cities will avoid a decline in population

2.2% the approximate share of Poland’s residents who were born abroad

15% the average share of residents born abroad in OECD countries

over 20% the potential decline in population by 2060 in the most rapidly depopulating OECD countries: Latvia, Japan, and Lithuania

Researchers from the OECD, in a new report, have summarized past trends and future demographic projections for all OECD countries at the regional level (units of analysis corresponding to Polish municipalities).

Poland will be one of fourteen OECD countries expected to experience a population decline by 2060. The most unfavorable demographic trends are projected for Latvia, Japan, and Lithuania, where the population could fall by more than 20%. However, fertility rates have dropped sharply in every OECD country. The largest declines relative to the reference year used in the report (1970) have occurred in South American countries and in Turkey.

Compared to other developed countries, Poland stands out for the relatively small role of immigration in cushioning population decline. In 2023, the share of people born abroad in Poland was around 2%, one of the lowest levels in the OECD (the OECD average is about 15%). In most OECD countries for which population growth is projected in the coming decades, immigration will be the main driver of this trend (this applies, for example, to Australia, the United States, the United Kingdom, and the Nordic countries).

One of the main conclusions of the demographic projections is that population decline will affect both less and more densely populated areas, apart from metropolitan areas. Medium-sized and smaller towns, as well as rural areas, will experience depopulation. This trend is present across Europe – only large cities in European OECD countries are projected to see population growth, as only metropolitan areas combine both positive natural increase and positive net migration.

These phenomena create an unfavorable combination of challenges for local policy: declining local government revenues (due to a smaller number of working taxpayers) and an aging population, which requires adjustments through investments and various public programs, while simultaneously increasing the costs of public services, for example in healthcare.

The authors of the report emphasize that this situation already necessitates appropriate socio-economic adjustments. According to the OECD, the worst approach is to conduct regional public policy based on the assumption that negative demographic trends can be reversed – that is, as if the loss of a significant share of the population were temporary rather than permanent. Policies aimed at reversing depopulation everywhere and at any cost have a low chance of success. Preparing regions to function under conditions of population decline represents a fundamentally different direction of public policy than attempting to counter depopulation.

In the Polish context, this translates into very concrete dilemmas, for example regarding the maintenance of networks of schools, hospitals, public transport, and infrastructure in sparsely built-up municipalities outside large cities. In the area of public services, the authors recommend, among other things, greater flexibility and mobility on the part of service providers (e.g. in healthcare and education) – such as mobile facilities, better transport connections to large cities, and, more broadly, a more comprehensive approach to service accessibility than one based solely on geographic distance. They also call for a more realistic approach to housing policy. In large cities, despite an overall decline in the country’s population, housing prices may continue to rise, while at the same time dispersed development and deteriorating public services could result in as much as 40% of the housing stock in depopulating municipalities becoming unoccupied.

Łukasz Baszczak