Economic Weekly 5/2026, February 6, 2026

Published: 06/02/2026

Table of contents

Polish households are increasingly choosing low-emission energy sources and energy-efficient household appliances

94% of hard coal consumed by households in the EU is used in Poland

18% of district heat consumed by households in the EU is used in Poland (the highest amount among EU countries)

by 23.6% increased the average annual electricity consumption per household in Poland (compared to 2002)

Polish households consume 9% of the energy used by all households in EU countries. Data from Statistics Poland (GUS) shows that among the various energy sources, they use the most district heat (18%) and hard coal (94%). They are also among the leaders in the energy consumption from renewable sources1 (9%). These values are higher than the share of the Polish population in the total EU population, which is 8%.

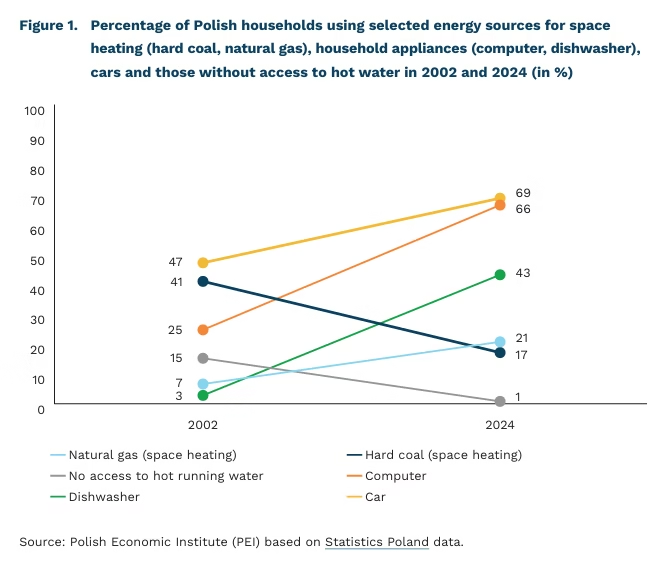

The way energy is used in households in Poland has changed significantly over the last 23 years (compared to 2002). They are heating their homes to a much greater extent with natural gas (an increase of 14.1 percentage points) at the expense of solid fuels, i.e. hard coal (a decrease of 23.8 percentage points) and firewood (a decrease of 21.1 percentage points). The share of households using electrical appliances, including air conditioners (up 7.2 percentage points), dishwashers (up 40.3 percentage points) and laptops (up 41.7 percentage points), has increased. More people also have at least one car (up 21.6 percentage points). Indicators related to energy availability also improved – the percentage of households assessing their thermal comfort as insufficient decreased (by 8.4 percentage points) as did the percentage of those without access to hot water (by 14.4 percentage points).

The average building used by household in Poland is most often heated with district heat. It is the primary heating method for 44.3% of Polish households. The share of other energy sources is significantly lower – 20% for natural gas and around 30% for solid fuels: hard coal (14.2%) and firewood (17.2%). Only 2% of households use heat pumps for this purpose, although their share is gradually increasing. The share of households with access to air conditioning is also increasing, reaching 7.3%2. The condition of buildings certainly needs improvement, as the survey respondents’ answers indicate that more than 2 in 5 households are uninsulated (7.5%) or only partially insulated (13.8%).

Most Polish households are equipped with energy-efficient household appliances and audio/video equipment3. Among the most frequently used appliances are automatic washing machines (86.3%), TV sets (82.9%), fridge-freezers (81.1%), mobile phones (78.8%) and laptops (61.4%). Most of them have an energy efficiency rating of A or better. Home lighting is also relatively efficient, with as many as 95.4% using energy-saving light bulbs – by comparison, incandescent light bulbs are used by 25.1% of households (compared to 86.2% in 2009).

The average household in Poland uses one petrol car that is approximately 12 years old. Members of households in our country most often use one car (47.3%) or use none (31.3%). Among households that have at least one car, 63.2% use petrol-powered vehicles (including those with and without LPG systems), and 35.1% use diesel-powered vehicles. The use of hybrid and electric cars is growing, but remains marginal – they are utilised by 1.5% and 0.2% of households that have a car, respectively.

- In this case, renewable energy includes biomass, solar energy, geothermal energy and ambient heat.

- Statistics Poland notes that the data was compiled based on a small number of observations (up to 100), so this share may not accurately reflect the actual situation in the wider population.

- The data comes from Statistics Poland (GUS) publication Energy consumption in households in 2024 and differs from the data in the GUS publication Concise Statistical Yearbook of Poland 2025.

Wojciech Żelisko

More than USD 1 billion worth of acquisitions was completed abroad by Polish firms in 2025.

USD 1 billion was exceeded in 2025 by the value of Polish foreign acquisitions for which public data are available

USD 4 billion was the value of the largest greenfield project announced in 2025 by a Polish company abroad

90% is the share of renewable energy projects in the total value of Poland’s outward greenfield foreign direct investment

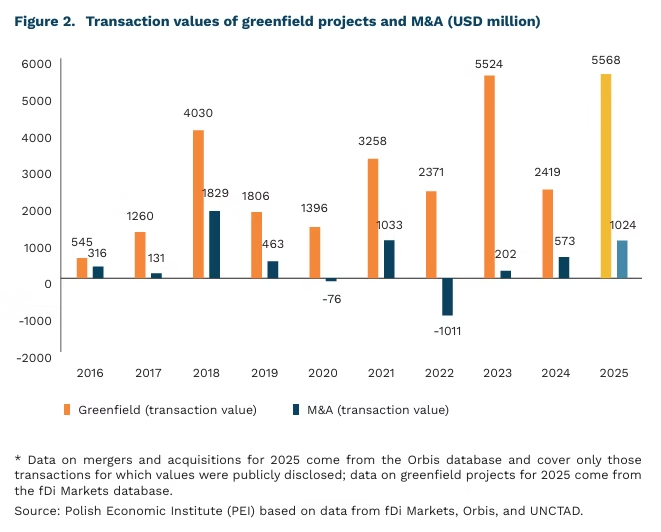

The year 2025 was markedly strong compared to previous years in terms of the activity of Polish enterprises in the area of foreign M&A (mergers and acquisitions). Although the available data are fragmentary, the total of publicly known amounts has already exceeded USD 1 billion. Due to the fact that 30 out of 45 projects did not have disclosed transaction values, the actual scale of investment was certainly higher. At the same time, it can be assumed that data availability favors larger transactions. High-profile, multi-million acquisitions carried out, for example, by Benefit Systems (the acquisition of Turkey’s Mars Spor Kulübü), Wirtualna Polska (the purchase of the European group Invia Group SE), Trans Polonia (the acquisition of the Dutch logistics group Nijman/Zeetank), and Enea Nowa Energia (the purchase of wind farms from Denmark’s European Energy) show that Polish companies entered foreign markets more boldly in the past year. For comparison, according to UNCTAD data, in 2024 the total confirmed value of foreign acquisitions completed by Polish firms amounted to USD 573 million.

In 2025, Polish enterprises completed 45 foreign acquisitions, of which 34 concerned European markets – according to Orbis data. The highest number of takeovers was recorded in Germany (9 transactions), followed by the United States (6 acquisitions), and third by the Czech Republic and Romania (3 transactions each). Such a geographic structure confirms the strong concentration of the capital expansion of Polish firms in Europe. In mature European markets, acquisitions are a way to obtain immediate access to key resources – a customer base, sales channels, know-how, as well as organizational capabilities and infrastructure. Acquisitions, therefore make it possible to compress the learning curve and mitigate the risk and costs of expansion compared with greenfield projects, that is, investments carried out from scratch.

However, Poland is also likely to record a very strong performance in the greenfield project category in 2025. Last year, 48 such projects were announced with a combined value of USD 5.56 billion, which – if implemented – would mark the highest result on record. This outcome was driven primarily by Hynfra’s mega-project, valued at USD 4 billion, involving the construction of a green hydrogen and ammonia hub in Andhra Pradesh, India. Including this project means that roughly 90% of the total value of all Polish greenfield investments abroad is concentrated in the renewable energy sector. Once excluded, the share of renewable energy projects falls to about 50%, while close to 90% of investments remain located in Europe. Greenfield projects typically involve longer ramp-up periods, delayed revenue generation, and elevated operational risk, making them harder to finance and generally less appealing than acquisitions for many Polish firms.

Dominik Kopiński

Retail companies declare stable employment and wage levels in Q1 2026

51% of retail entrepreneurs expect no changes in their company’s situation

87% of retail companies predict that their company’s employment level will be maintained in Q1 2026

48% of retail companies consider payment backlogs to be an important or very important barrier to business operation

Trading companies are more optimistic about the future situation of their companies in the first quarter of 2026 than about the country’s economic situation, according to the January Monthly Business Climate Index (MIK) survey. Half (51%) of the surveyed companies believe their company’s situation will remain unchanged, while 24% anticipate it will improve. Regarding the assessment of the economic situation in the country, fewer trading companies (38%) believe the situation will remain unchanged and fewer (21%) anticipate it will improve in the first quarter of 2026.

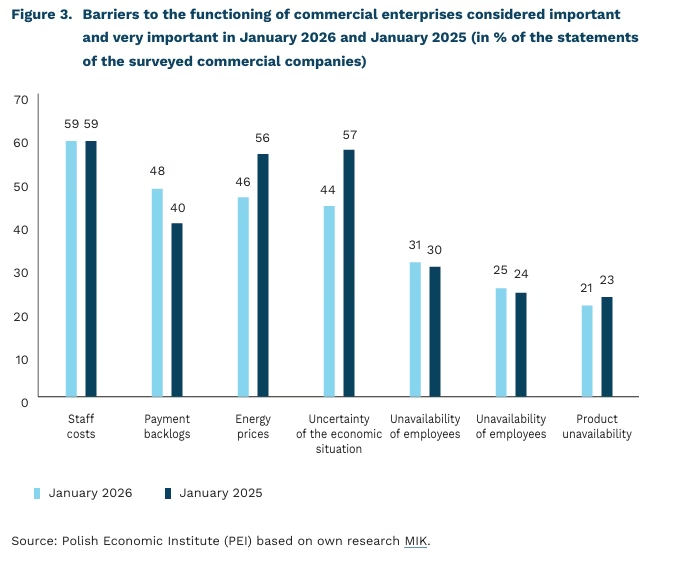

According to entrepreneurs, the situation of retail companies will be primarily affected by employee costs (59% of responses), payment backlogs (48%), and energy prices (46%). These were identified as the most burdensome barriers to the functioning of retail companies in January 2026. The decline in the importance of economic uncertainty as a barrier to functioning in 2026 results from entrepreneurs recognizing it as a common condition for doing business. Retail companies are more likely to be concerned about payment backlogs in 2026 than in 2025.

In the January MIK reading, entrepreneurs’ opinions regarding the value of sales and new orders improved compared to the same period in 2025. 25% of trading companies indicated an increase in new orders (17% in January 2025). In terms of sales value, the percentage of trading companies indicating a decline in sales value decreased (from 35% to 31%). These results correspond to the month-on-month improvement in consumer sentiment recorded in January 2026, regarding both the current and future situation, according to the Central Statistical Office.

Retail companies report stable employment and wage levels during the first quarter of this year, according to a January MIK survey. As many as 87% of companies anticipate maintaining current employment levels (78% in the same period in 2025), and 4% anticipate employment growth (10% in 2025). This is the result of employment optimization efforts (introducing self-service checkouts, automating wholesale trade processes).

Urszula Kłosiewicz-Górecka

Large companies benefit more than smaller ones from the use of artificial intelligence

4% increase in productivity increases in companies implementing AI

26% of companies in Poland declare that they use AI solutions, which is 11 percentage points less than the EU average, according to EIB research

In-depth research shows that the use of artificial intelligence (AI) has a positive impact on the productivity growth of companies implementing such solutions (by 4%). Furthermore, the increase is due to an increase in total factor productivity (TFP) rather than a reduction in employment. What is more, the findings of researchers from the European Investment Bank (EIB) indicate that employees in companies using AI also benefit from higher wages. However, the results also suggest that the current trend of AI implementation may contribute to market polarisation – large, innovative companies will grow faster and the gap between them and smaller or less digitally open entities will widen.

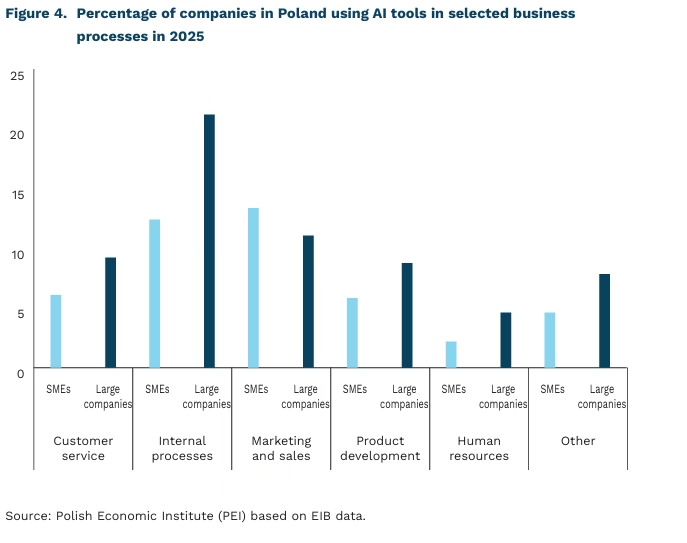

Differences in the processes in which AI is implemented may be related to the benefits that companies achieve – companies that change their production processes may gain more than those that limit themselves to marketing or HR. The results obtained by the EIB indicate that AI is most often used in internal business processes and in marketing and sales – this is the case both in Poland and in most EU countries. In the latter category, small and medium-sized enterprises are ahead of large ones. This may indicate that communication tools using AI are relatively easier to adapt in smaller organisations and that they are more ‘agile’. Large companies, on the other hand, show a relatively greater willingness to use AI in internal processes and for product development.

When analysing the differences between smaller and larger companies, it is also important to note Eurostat data, according to which large companies lead the way in Poland in all categories of AI use. Here, too, AI is most commonly used in marketing, although in the case of large companies, it should also be noted that it is used to ensure ICT security (26% of companies) and in production processes (22%). For comparison, such tools are most commonly used by companies in Scandinavian countries – Finland and Denmark (65% and 55% respectively), while Greece and Italy are at the bottom of the list (around 20% each).

According to Eurostat data, the difference in the percentage of companies using AI between large and smaller companies is much greater than in EIB data, which is probably due in large part to the specific nature of the research sample (much smaller in EIB studies). Given the above-mentioned research results on the impact on productivity, the risk of widening differences in the market may be even more real in Poland, especially between large companies and small or micro-enterprises. While the EIB’s research results fall within the middle range of forecasts for the impact of SI on productivity, the long-term impact of this type of factor differentiating companies should not be ignored. The EIB’s data and research are another signal providing arguments for supporting the widespread adoption of new technologies by Polish companies.

Ignacy Święcicki

In 2025 we protected our online privacy more

77% the share of EU citizens who take at least one action to protect their private data online

68.8% the share of Poles who take at least one action to protect their private data online

According to Eurostat data for 2025, the share of EU citizens who protect their private information online has increased. Nearly 77% of Europeans now take such actions, which represents an increase of 3.7 percentage points compared to the previous survey from 2023.

Eurostat identified several possible actions serving this purpose that respondents could indicate. The largest share of Europeans refused to allow their personal data to be used for advertising purposes by online platforms. A similarly large share refused to provide platforms with information about their location. The least popular action was reading the privacy policies of platforms, although more than 35% of respondents surveyed by Eurostat still confirmed taking this step.

Citizens of Finland, the Netherlands, and Sweden take the greatest care to protect their online privacy – 92.6%, 91.2%, and 90.7% of respondents in these countries, respectively, protected their personal information. Poland is below the EU average: 68.8% of Poles surveyed by Eurostat reported taking actions to protect their privacy, which is 8 percentage points less than the EU average.

What might explain the lack of attention to online privacy among nearly one in four EU citizens? In a recently published article, Hernández et al. (2026) present the results of an experiment in which participants shopped online in a specially designed environment, while an AI-based system collected information about their behavior and influenced the products offered to them and their prices. Participants made purchasing decisions dozens of times, and each time they wanted to make a purchase, they had to accept or refuse the collection of cookies in order to tailor the store’s offers to their preferences.

The researchers examined whether informing participants about how much their behavior as online shoppers reveals about them affects their willingness to refuse the collection of cookies. It turned out that such information had little impact. However, informing participants about how exactly the data-collection system worked – and thus how they could try to change their online shopping behavior so that the system would learn less about them – did lead to meaningful behavioral changes. A strong effect in increasing personal data protection was also observed among participants who were offered a free mobile app designed to support the protection of personal information by advising them on how to conceal private data in the experimental online store.

These results suggest that, as internet users, we want to protect our privacy, but there is a motivational barrier. On the one hand, this barrier stems from a lack of full awareness of how our online behavior reveals information about us; on the other hand, it reflects insufficient knowledge of how, in specific situations, one can avoid the unnecessary disclosure of personal data.

Łukasz Baszczak

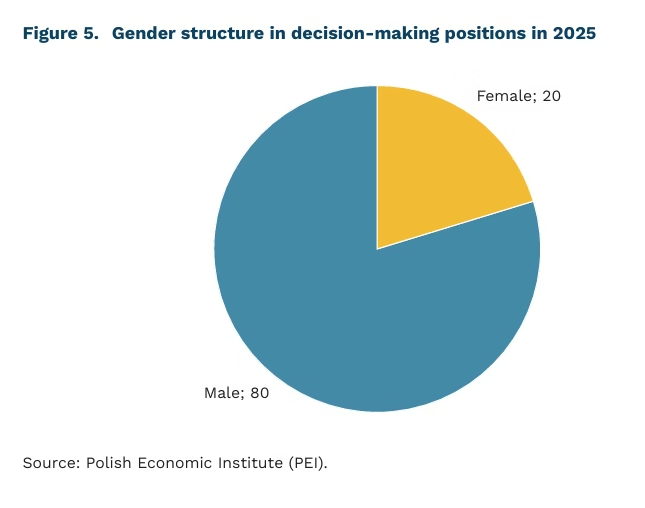

Women are increasingly taking up managerial roles, but are less likely to reach the ranks of top decision-makers

50.9% women’s employment rate in Q3 2025 (Statistics Poland)

42.6% share of women among people in managerial positions (Q3 2025; Eurostat)

20.4% share of women among people managing companies (PIE survey)

Women’s growing labour-market participation does not fully translate into filling the most important decision-making roles in companies. Despite an overall improvement in women’s situation on the labour market, a gap persists between this trend and women’s participation in the actual management of businesses.

The employment rate of women in Poland is rising and has reached its highest levels in several years, although it still remains clearly lower than that of men. According to Statistics Poland data, in Q3 2025 the employment rate of women was 50.9%, the highest Q3 reading since 2021. By comparison, in Q3 2025 the employment rate of men was 64% and has remained relatively stable over the years.

Poland stands out in the EU for its high share of women in managerial positions. Eurostat data show that in Q3 2025 women accounted for 42.6% of people in managerial roles in Poland. This is one of the highest results in the European Union – higher figures were recorded only in Estonia (46.1%) and Sweden (45.6%). By comparison, the EU average in the same period was 36.44%. Over a multi-year horizon, changes in Poland have been moderate: in the past five years the highest value was recorded in 2021 (43.9%) and the lowest in 2023 (40.2%), indicating stabilisation in the range of roughly 40-44%, with yearto-year fluctuations.

At the highest level of management and in real decision-making processes, women’s participation remains low. A PIE survey from December 2025 shows that women account for only 2 out of 10 people who actually make decisions in companies. The result is based on a quota sample of 1,000 firms, which makes it a meaningful signal about power structures in business: despite rising labour-market participation and a relatively high share of managerial positions, women are less likely to reach roles that directly shape strategy and key operational decisions.

Jakub Kubiczek, Karolina Rutkowska