98% of EU demand for rare-earth elements is met by China

Opublikowano: 06/09/2023

By 2040, global demand for rare-earth elements is expected to increase seven-fold and demand for lithium 42-fold. China is the main producer in many categories of critical raw materials. Russia also remains a raw material powerhouse. 19% of the world's reserves of the metals needed to produce a standard lithium-ion battery are in Africa and the Democratic Republic of the Congo’s share in global cobalt production amounted to 71.2% in 2022. In its new report entitled “African critical raw materials and the EU's economic security”, the Polish Economic Institute analyses the demand for critical raw materials in the EU (and Poland) and its compatibility with the raw material reserves on the African continent.

Critical raw materials for the EU are mainly produced by China and, to some extent, Russia

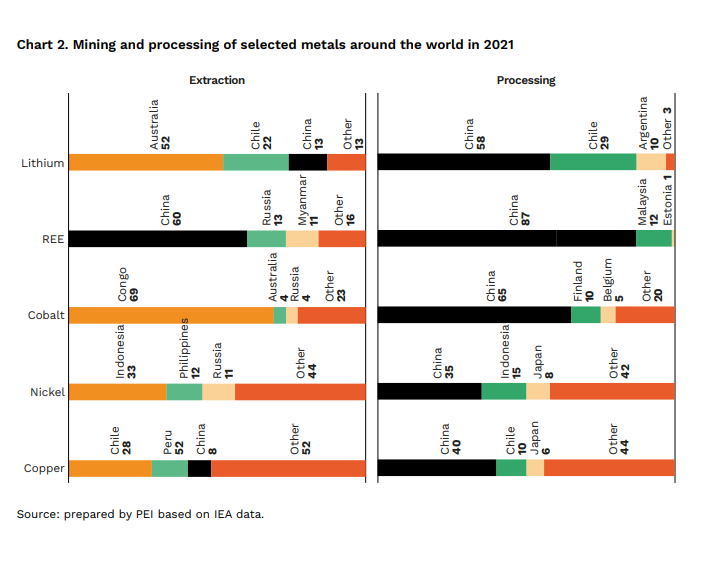

Countries that are not allied with the West occupy a dominant position in the production of many categories of critical raw materials. Russia has traditionally been a significant supplier of many industrial metals. 43% of palladium and 15% of global nickel production comes from Russian mines. China plays a key role in the production of magnesium and rare-earth elements. It also holds a quasi-monopolistic position in the processing of a whole range of metals, such as lithium (59%) and cobalt (73%). As much as 98% of the rare-earth elements imported by the EU come from China. Extraction is also highly concentrated in other categories of raw materials: the EU imports 99% of the borate it consumes from Turkish mines, 71% of the platinum it consumes from South Africa, and 85% of the niobium it consumes from Brazil.

“The current structure of critical raw material supplies to the EU points to the need to diversify them. It results from the need to meet the demand linked to the growing electric car market and the EU’s adoption of extremely ambitious twin transition — green and digital — goals. An additional challenge is the intensifying geopolitical rivalry, not only with China, but also with countries that share similar norms and values in international relations. The EU’s dependence on a single source of raw materials is dangerous. Unless the EU launches a political offensive to diversify raw material supplies, it could prove costly for it in the future, but also constitute a systemic threat analogous to its dependence on hydrocarbons, revealed by Russia’s invasion of Ukraine,” says Dominik Kopiński, a senior advisor on the PEI’s world economy team.

Africa is rich in the critical raw materials needed by the EU

Africa has 30% of the world’s mineral reserves and almost half the world’s gold deposits. It has 59% of the world’s reserves of platinum group metals, 48% of the diamonds, 75% of the cobalt, 68% of the manganese and 59% of the graphite, among other things, as well as large, undetermined deposits of lithium. Africa also has 67% of the world’s phosphate reserves, with production dominated by Morocco, and 59% of the bauxite, with Guinea the leading country in this case. It also has as well as uranium (33%). The continent has at least 20% of the reserves in the 12 categories of minerals key to the green transition.

“Africa’s raw material potential is highly compatible with the EU demand for critical raw materials. Of the 34 critical raw materials listed by the European Commission, 24 categories of raw materials are sourced from different countries in Africa. However, EU diplomatic efforts, financial assistance and support for new mining and infrastructure projects in Africa could extend the list of raw materials obtained from African partners significantly and lead to new discoveries,” adds Dominik Kopiński, a senior advisor on the PEI’s world economy team.

The EU must transform its relationship with Africa

The EU’s energy and digital transition means that it must redefine its relations with Africa. European countries will be able to make up for years of lagging behind China in designing comprehensive supply chains in the extraction, refining and use of critical raw materials. At the same time, it will be a unique opportunity for Africa to carry out its own transition and industrialisation based on raw materials. The bottlenecks are: the short time left for the EU to achieve carbon neutrality, the lack of appropriate transport infrastructure in Africa, and the unfavourable institutional and regulatory conditions on the continent. Solving these problems and redefining relations with Africa should be based on real partnership and building local value added.

“The key condition for turning towards Africa and increasing its share in the raw materials supply chain to the EU is financing. This problem should be analysed at three levels: the EU level, the national level, and the private sector. Regardless of EU institutions’ actions, Poland should actively strive for rapprochement with Africa and provide financial (and insurance) vehicles to secure the supply of raw materials, especially those listed in its National Raw Materials Policy,” says Dominik Kopiński, a senior advisor on the PEI’s world economy team

***

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research primarily spans macroeconomics, energy and climate, the world economy, economic foresight, the digital economy and behavioural economics. The Institute provides reports, analyses and recommendations for key areas of the economy and social life in Poland, taking into account the international situation.

Media contact:

Ewa Balicka-Sawiak

Press spokesperson

T: +48 727 427 918

E: ewa.balicka@pie.net.pl

Kategoria: Report / Reports 2023 / World Economy