All is well with globalisation – China has benefited economically from the pandemic, Polish exports confirm their resilience

Published: 21/07/2021

Although the volume of world trade in goods dropped by 5.5 per cent in 2020 against 2019, the demand for electronics soared and deliveries of computers went up by 13.1 per cent.

Importantly, China’s share of world exports increased by 1.6 pps over the same period, whereas the respective proportion for Poland rose by 0.14 pp. Simultaneously, a mere 6 per cent of the Polish enterprises surveyed by the PEI declared to already participate in the supply chain shift from China – as follows from the report of the Polish Economic Institute entitled Globalisation during the pandemic.

Thus far, the COVID-19 pandemic has not appeared to be a game changer in the world’s economic order. Global supply chains have been disrupted, but not permanently broken. Due to putting an effective curb on the COVID-19 pandemic, the Chinese economy started to bounce back quickly. In the third quarter of 2020, the rest of the world also began to recover from the recession. At the end of 2020, chip supplies appeared to be insufficient for the automotive industry. According to various estimates, chip shortages might result in car production cuts by as many as 1 to 1.5 million pieces in the first half of 2021 (Święcicki, Ambroziak, 2021). Restrictions aimed at curbing the spread of the pandemic caused problems with unloading container ships, which pushed up sea freight rates by 309 per cent between the beginning of 2020 and the beginning of 2021. Supply chain disruptions due to the COVID-19 pandemic made a number of countries in the world intervene in international trade. The most frequent measures were export subsidies. Much tension concerned trade in medical devices, medicines and vaccines.

‘Our analysis confirms that the directions of developments in the world economy have been determined not only by economic factors related to the pandemic. The increasing system and political rivalry has played a major role as well. Whereas the consequences of the pandemic might affect corporate risk and cost calculations within supply chains, with short-term transport costs still significantly higher and deliveries of certain components insufficient, a more important driver of the long-term situation will be the US and EU measures oriented towards reducing their dependence on China. First and foremost, there will be long-term pressure to relocate production from China and active industrial policies aimed to strengthen the competitiveness of America and Europe’, says Marek Wąsiński, the head of the foreign trade team at the Polish Economic Institute.

In economic terms, China has benefited the most from the pandemic

The greatest beneficiary of the COVID-19 pandemic in merchandise trade is China. In 2020, the country’s share of world exports went up by 1.6 pps to 14.7 per cent. It was possible due to China’s putting an effective curb on the pandemic and adjusting production quickly to the rising global demand for certain articles, especially products related to fighting the pandemic, electronic devices and electrical equipment.

Despite various announcements of shifting production from China made by a number of companies in the spring of 2020, there have been few actual relocations. Global value chains appeared to be inflexible in the face of demand and supply disruptions as well as of growing problems in maritime transport. It was particularly noticeable in the automotive sector, based on just-in-time manufacturing and not prepared for component shortages at the first stage of the pandemic or for delayed chip deliveries in late 2020. Neither are there indications of an initiated process of mass relocation of production to the new EU Member States, e.g. Poland.

Polish exports resilient to the pandemic

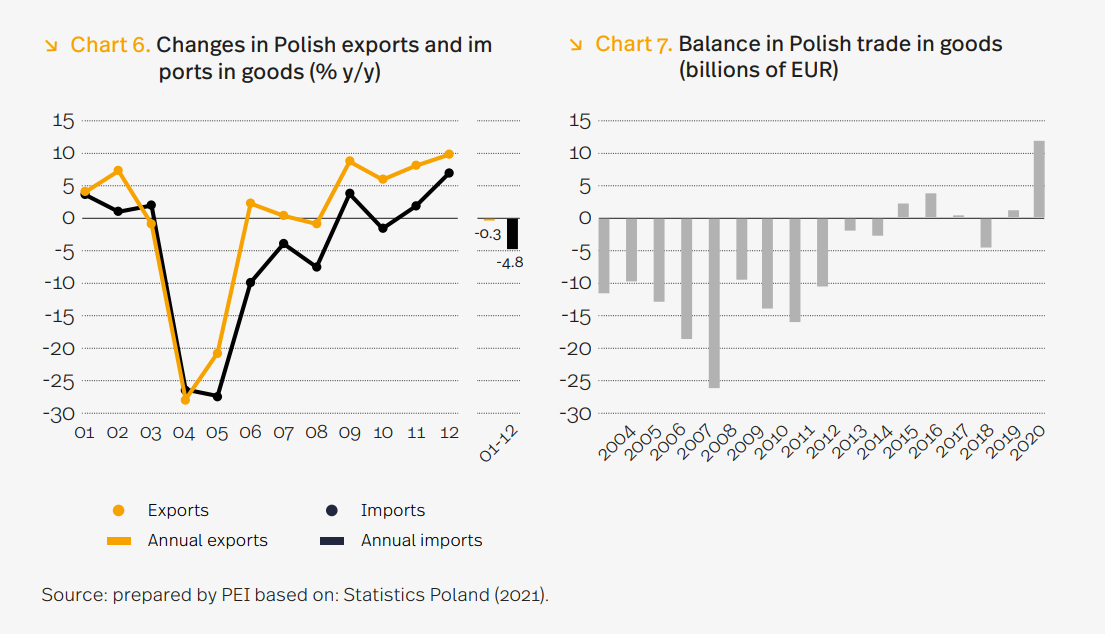

From the outbreak of the COVID-19 pandemic, Poland coped rather well in merchandise exports against the background of other countries. Throughout 2020, the value of Polish exports (expressed in EUR) was lower, but by a mere 0.3 per cent than a year before. It was the third best result in the EU. As imports recovered more slowly than exports, the former dropped by nearly 5 per cent in 2020. Consequently, Poland’s merchandise trade surplus reached a record high of EUR 12 billion.

Slightly more than 6 per cent of the Polish firms surveyed by the PEI in collaboration with GUS admitted to benefiting from the relocation of supply chains from China. Apart from companies already involved in shifting supply chains from China, another 7.7 per cent were positive about the phenomenon; 3.9 per cent of the respondents intended to join in, 2.3 per cent considered participation, whereas a mere 1.5 per cent declared that they would be willing to participate if subsidised from public funds. As demonstrated by the PEI survey results, over 15 per cent of the total number of respondents had no intention to take part in shifting production from China. It is worth noting that nearly 41 per cent of the respondents thought that the relocation of production from China by transnational corporations did not concern them.

‘The relatively good performance of Polish exporters was determined by several factors. Firstly, it was due to greater diversification of Poland’s exports as compared to the majority of the EU Member States. For example, automotive products had a considerably lower share in Polish exports than in those of many EU Member States and the automotive industry was hit the hardest during the spring lock-down. Secondly, in the period of the spring lock-down, a fall in Polish exports was cushioned by a relatively greater role played by articles for which foreign demand dropped to a lesser degree than in the case of cars, or even showed an increase. Between March and May 2020, there was a marked rise in Polish exports of medicines and pharmaceuticals (by 23 per cent), tobacco products (by 14 per cent), wearing apparel, beverages and foodstuffs. Therefore, growth was noted with regard to nearly 18 per cent of Polish deliveries abroad. Thirdly, Polish exporters benefited from increased global demand for durable consumer goods, with a rather high share in Poland’s export sales. Those included household appliances, radio and television equipment, electronics and furniture. Moreover, Poland was actively involved in global supply chains related to electromobility (having gained in importance during the pandemic), thus strengthening its position as a manufacturer and exporter of electric buses and becoming the largest exporter of Li-ion batteries’, says Łukasz Ambroziak, an analyst of the foreign trade team at the Polish Economic Institute.

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research spans foreign trade, macroeconomics, energy and the digital economy, with strategic analyses on key areas of social and public life in Poland. The Institute provides analysis and expertise for the implementation of the Strategy for Responsible Development and helps popularise Polish economic and social research in the country and abroad.

Media contact:

Ewa Balicka-Sawiak

Press Spokesperson

T: 48 727 427 918

Kategoria: Press releases / Report / Reports 2021 / World Economy