Economic Weekly 3/2026, January 23, 2026

Published: 23/01/2026

Table of contents

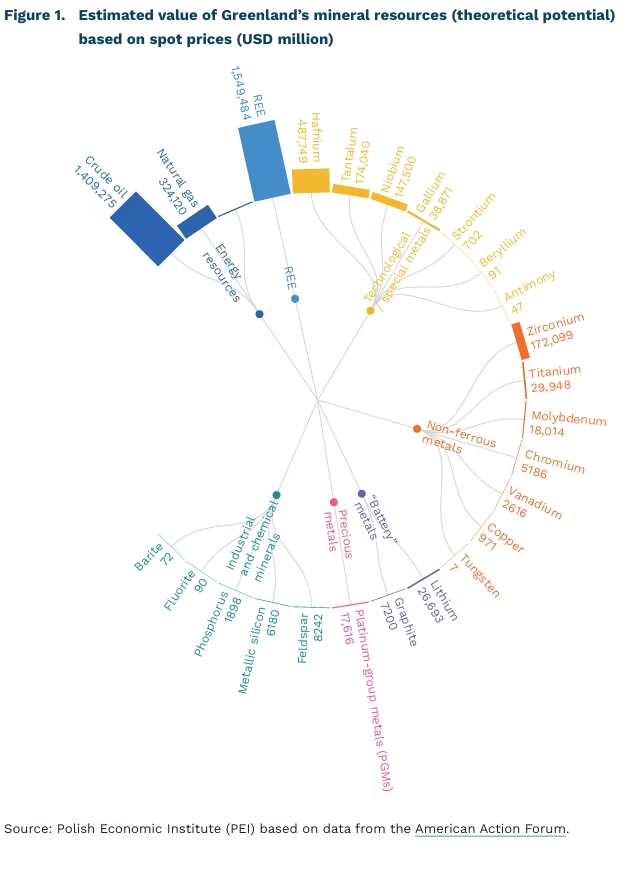

Greenland’s resource wealth exists today largely on paper

USD 4.4 trillion is the theoretical value of Greenland’s mineral resources, according to the American Action Forum

1.5 million tonnes are the documented reserves of rare earth elements in Greenland

2 is the number of active mines on the island

The issue of Greenland’s natural resources appears as one of the arguments in the U.S. narrative concerning control over the island and may partly explain the resort to 10-percent tariffs. At the centre of attention are rare earth elements (REE), occurring in three major deposits, two of which – Kvanefjeld and Tanbreez – are considered among the largest in the world. According to U.S. geological authorities, Greenland holds approximately 1.5 million tonnes of REE reserves, placing it eighth globally. Other estimates, referring to as much as 36 million tonnes, relate to the category of resources which – unlike reserves – do not have to be economically viable or technically recoverable. Greenland also possesses, inter alia, lithium, graphite, zinc, tungsten, titanium, copper, as well as oil and natural gas. A very simplified attempt to value Greenland’s potential mineral resources was presented by analysts at the American Action Forum, who estimated them at USD 4.4 trillion, while the value of reserves alone – that is, resources that could be developed under current conditions – was assessed at approximately USD 186 billion.

Despite the issuance of 147 exploration licences, Greenland’s mining sector remains at an embryonic stage. Since the Second World War, only nine mines have operated on the island, of which just two are currently active: Lumina (anorthosite) and Nalunaq (gold). In the coming years, the launch of the Amitsoq (graphite, 2028), Malmbjerg (molybdenum, 2029) and Tanbreez (heavy REE, 2027) projects is planned.

The development of mining is constrained by climate conditions, high costs and restrictive environmental regulations. Around 80 proc. of the island – almost seven times the size of Poland – is covered by an ice sheet, with winter temperatures dropping to -60°C, which significantly shortens the operating season and disrupts transport as well as the functioning of equipment. Logistical barriers are further exacerbated by rudimentary infrastructure – fewer than 100 miles of roads and ports with limited capacity (the largest, in Nuuk, handles around 2 million tonnes). Labour, transport and energy costs are high, while the local workforce is limited (29,000 economically active people). Moreover, following the 2021 elections, the REE project in Kvanefjeld was blocked due to the co-occurrence of uranium, whose concentration in the deposit exceeds 300 ppm (parts per million). In addition, bringing a mine into operation is a lengthy process – according to S&P Global, it takes on average 15.5 years.

Greenland also lies within Beijing’s sphere of interest, for which the Polar Silk Road initiative constitutes part of its long-term engagement in the Arctic. However, China’s actual presence is – and is likely to remain – marginal, due to security considerations and the growing activity of the United States in the Western Hemisphere. In the past, Beijing sought to participate, inter alia, in infrastructure projects (e.g. the tender for the construction of airports in Nuuk and Ilulissat), but these initiatives were blocked by the Danish authorities. Similarly, Washington successfully lobbied against the takeover of the Tanbreez (REE) project by a Chinese entity. The only significant Chinese asset is a 12% stake in the Kvanefjeld (REE) project, held since 2018 by Shenghe Resources Holding Co. The project, however, is currently frozen.

Dominik Kopiński

The share of electric cars in Poland is considerably lower than in the EU

from 3.7% to 4.4% was the total share of battery electric and plug-in hybrid cars among all cars registered in the EU in 2024

from 0.7% to 1.1% was the total share of battery electric and plug-in hybrid cars among all cars registered in Poland in 2024

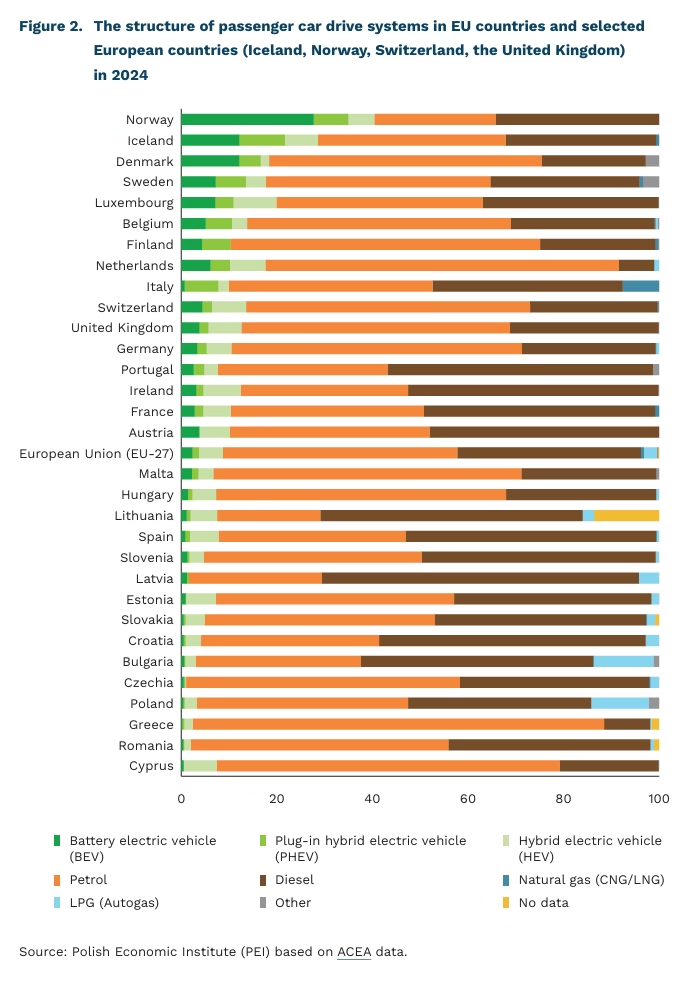

According to the latest report from the European Automobile Manufacturers’ Association (Association des Constructeurs Européens d’Automobiles – ACEA) , externally chargeable passenger cars (battery electric and plug-in hybrid vehicles combined) accounted for 3.7% of all cars in the European Union in 2024. Data from the International Energy Agency (IEA), paint a slightly more optimistic picture, showing that the total share of electric vehicles (BEVs and PHEVs) among all registered vehicles in the EU-27 was 4.4% in 2024.

The ACEA reports that battery electric vehicles (BEVs) accounted for 2.3% of the market, while plug-in hybrids (PHEVs) accounted for 1.4%. Four EU Member States recorded a BEV share exceeding 5% of all registered cars: Belgium (5.1%), Luxembourg (7.1%), Sweden (7.2%), and Denmark (12.1%). Higher shares of this type of vehicle were recorded in non-EU countries, with Iceland (12.1%) and Norway (27.7%) being the countries with the highest shares. The relatively low share of electric vehicles among the total number of registered cars is a structural issue resulting from long life cycle of vehicles and the slow replacement of the fleet. Even in Norway, where 92% of new vehicles sold in 2024 were electric, around two-thirds of all cars registered are still conventional (with combustion engines or hybrids).

In Poland, the share of electric cars among all registered vehicles was lower than the EU average in the same year. According to ACEA data, the share of battery electric cars among all registered vehicles in Poland was 0.3%, while plug-in hybrids accounted for 0.4% in 2024. These figures were slightly lower than those indicated by the IEA, which stated that the combined market share of BEVs and PHEVs in the same year was 1.1% (0.6 percentage points higher than the previous year). Meanwhile, the latest data from the Electromobility Meter of the Polish New Mobility Association and the Polish Automotive Industry Association, show that 212,700 electric vehicles were registered in Poland in October 2025, 107,900 of which were BEVs and 104,800 of which were plug-in hybrids.

In 2024, combustion engines continued to dominate the structure of passenger car engines in Poland, including a relatively high share of LPG-powered vehicles. According to ACEA data, 82.6% of passenger cars in Poland were petrol- or diesel-powered in 2024, with a further 12% running on LPG. Alongside Bulgaria, Poland was the only EU country where the share of LPG-powered vehicles exceeded 5%.

One of the factors limiting the uptake of electric vehicles in Poland is the slow development of charging infrastructure. As indicated by the IEA, the number of publicly available charging points in Poland was 9,200 (of which 3,000 were fast charging points) compared to 130,000 fast charging points and 690,000 slow charging points across the EU-27 in 2024. Per capita, there are on average more than seven times as many electric vehicle charging points in the EU-27 as in Poland.

In the coming years, the pace of electrification of road transport in Poland will largely be determined by the development of charging infrastructure, in accordance with the provisions of the Regulation of the European Parliament and of the Council on the deployment of alternative fuels infrastructure (AFIR), and the effectiveness of public policy instruments, including support programs for electric vehicle buyers, including support programmes for buyers of electric vehicles (e.g., NaszEauto).

Krzysztof Krawiec

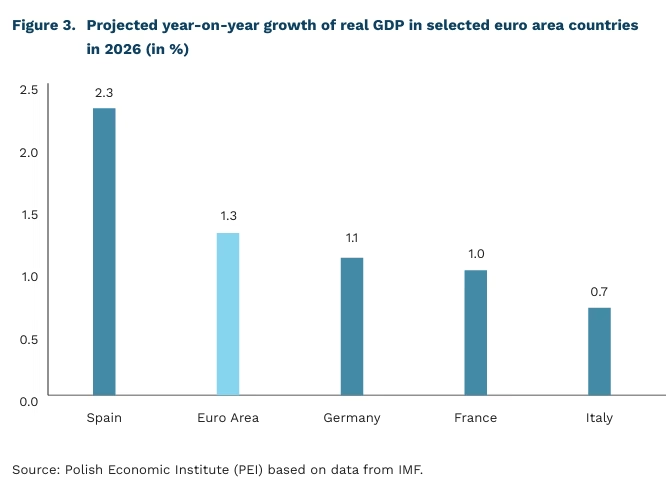

IMF forecasts a gradual improvement in the macroeconomic outlook for the euro area

1.3% is the projected GDP growth of the euro area in 2026 – according to the IMF

1.1% is the projected GDP growth of Germany in 2026 – according to the IMF

After a period of high inflation and energy shocks, the euro area enters 2026 with a visible improvement in macroeconomic stability, but without a strong growth impulse. The narrative prevailing in international institutions’ forecasts is consistent: the euro area economy will remain resilient, inflation will continue to fall toward the target, and growth will be driven primarily by domestic demand. However, all forecasts are subject to significant risk due to the unpredictable nature of U.S. trade policy.

Forecasts for euro area economic growth in 2026 are becoming gradually more optimistic. According to IMF projections, euro area GDP growth is expected to reach 1.3% in 2026 and accelerate to 1.4% in 2027. Growth is expected to be supported by relatively strong domestic demand, strengthened by rising real wages and employment, alongside resilient labour markets and record-low unemployment. Additional support for the euro area economy will come from announced public spending on infrastructure and defence, as well as improved financing conditions resulting from interest rate cuts. GDP growth in the euro area will remain uneven across countries, with improvement expected to be particularly visible in the German economy, which is projected to accelerate to 1.1% in 2026. High uncertainty in trade policy and U.S. tariffs, however, will limit investment in Germany’s export-oriented industrial sector.

Another key element of the euro area’s macroeconomic outlook will be declining inflation. According to ECB projections, HICP inflation is expected to amount to 1.9% in 2026 (after 2.1% in 2025) and fall to 1.8% in 2027, suggesting that price dynamics will be close to the target, and even temporarily below it. At the same time, core inflation (HICP excluding energy and food) is expected to gradually ease to 2.2% in 2026, indicating a continuation of disinflation also in the more “persistent” components of the basket. In this environment, the narrative is shifting toward keeping monetary policy restrictive long enough to entrench inflation’s return to target. In its baseline scenario, the IMF assumes that interest rates in the euro area will remain unchanged, which contrasts with projected rate cuts in the U.S. and the United Kingdom and may matter, among other things, for the euro exchange rate and financing conditions in the economy.

Institutions also point to structural barriers faced by euro area countries. A key challenge remains the competitiveness of the economy, especially important in a region that has historically relied on exports for growth. The IMF further notes that the boom in technological investment (AI) is stronger in North America and Asia than in other regions. In the EU, growth in the production of computers and electronics also remains relatively weak, while the U.S. and parts of Asia show a more pronounced technological impulse. In practice, this means that in 2026 the euro area may struggle to join the global trend of investment in general-purpose technologies, which in the medium term translates into productivity.

Piotr Kamiński

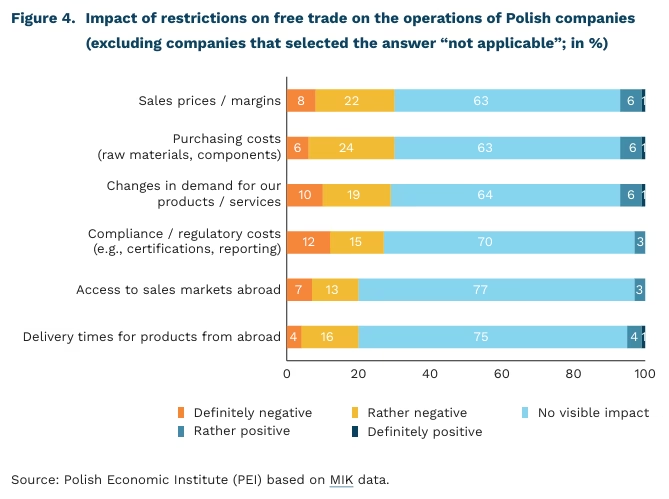

Nearly one in three companies felt the impact of turbulence in international trade

63-75% of companies (depending on the area) do not perceive a negative impact of restrictions on free trade on selected areas of their activity

30% of companies report a negative impact of restrictions on free trade on their sales prices and margins

42% of manufacturing companies indicated a negative impact of restrictions on free trade on purchasing costs (raw materials and components)

The operations of some Polish companies in 2025 were affected by restrictions on free trade and international economic cooperation (tariffs, export embargoes, and others). The largest share of companies (as many as 3 out of 10) declared that trade disruptions had a negative impact on their sales prices and margins, purchasing costs (raw materials and components), and demand for their products or services – according to research conducted for the MIK (Monthly Business Climate Index). Another 27% pointed to a negative impact on compliance/regulatory costs (e.g. certifications, reporting). In turn, one in five companies noticed a deterioration in access to foreign sales markets and longer delivery times for products from abroad. However, most companies did not observe any impact of the above-mentioned phenomena on their operations (63-75%, depending on the area), while declarations of a positive impact did not exceed 7%.

A negative impact on sales prices and margins is indicated primarily by micro and medium-sized companies (34% each) as well as service-sector enterprises (38%). This is related, among other factors, to rising costs of doing business. The cost of purchasing raw materials and components is the second most frequently mentioned area negatively affected by turbulence in international trade. It was cited by as many as 3 out of 10 micro, small, and medium-sized enterprises and by as many as 42% of manufacturing companies. The introduction of tariffs and other trade restrictions also affected changes in demand for the products and services of some companies. This primarily affected small companies (32%) and enterprises operating in transport, freight forwarding and logistics (36%).

Restrictions in international trade are also associated with bureaucratic obligations imposed on companies. Requirements related to environmental protection, determination of origin, and sustainable development are increasing. A negative impact of trade restrictions on compliance costs (certifications, reporting) was reported mainly by large companies (35%) as well as manufacturing (32%) and service companies (32%). The two areas least frequently indicated by companies were access to foreign sales markets and delivery times for products from abroad. Difficulties in accessing sales markets were reported mainly by microenterprises (23%) and service-sector companies (25%). Longer delivery times were observed primarily by medium-sized enterprises (24%) and companies operating in construction (17%).

Considering all areas affected by restrictions in international trade, manufacturing and service companies reported the greatest negative impact. This is likely related to the fact that enterprises in these sectors are more often active in international markets compared with other industries. By contrast, turbulence in international trade has the least impact on construction, as construction companies operate primarily in the domestic market. Among companies of different sizes, negative impacts were most often reported by microenterprises and medium-sized firms, and least often by small and large companies. Research results indicate that the outlook for Polish foreign trade, despite global uncertainty, is fairly stable, although Poland’s trade balance remains negative.

Anna Szymańska

Universities in China and the United States produce the most influential technology publications

42.4% is China’s share of technology publications, which are among the 10% most frequently cited

0.5% is Poland’s share in technology publications, which are among the 10% most frequently cited

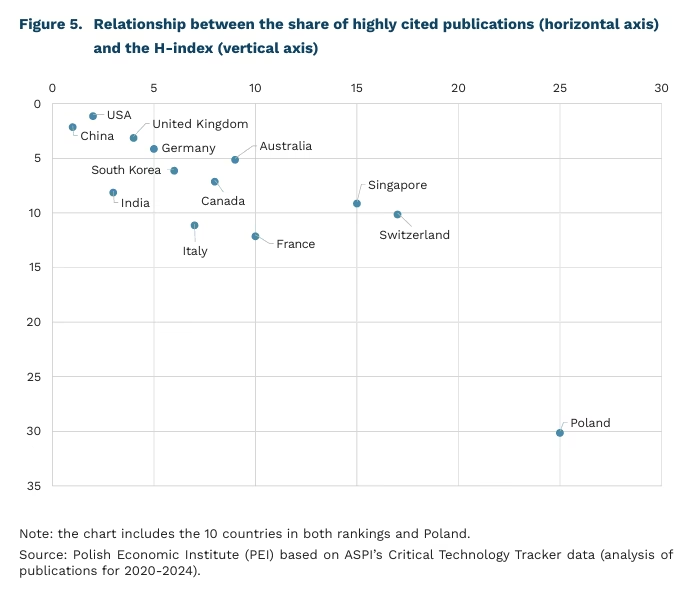

China and the United States dominate global science in terms of published and cited in the field of technology. According to ASPI Critical Technology Tracker data, China has the highest share of highly cited publications (42.4%), with the United States in second place (13.6%). If we look at the overall impact of scientific research as measured by the Hirsch index (H), the situation is reversed, the United States leads, with China close behind.

Data from ASPI (Australian Strategic Policy Institute) show that the global impact of scientific research in the field of technology is concentrated in a small group of countries. They have a high share of publications in the top 10% most cited and have strong research institutions capable of regularly producing work with high scientific impact.

To assess national research performance in the field of technology, ASPI uses two bibliometric indicators. The first is the share of highly cited publications, which shows what percentage of a country’s articles were among the top 10% most cited works in a given year. The second is the H-index, which is used to assess the quality and lasting impact of scientific output, taking into account both the number of publications and the scale of their citations.

The United Kingdom, Germany, South Korea, and Canada occupy similar positions in both rankings, indicating a stable, long-term impact of these countries on the development of science in the field of technology. India, Italy, and France perform relatively better in the highly cited publication ranking than in the H-index, suggesting high current research activity with a moderate long-term impact on global science. The opposite pattern can be seen in Australia, Singapore, and Switzerland, for which the H-index ranks them higher than the publication citation ranking, which may mean that although a smaller percentage of their publications are among the top 10% most cited, the articles produced in these countries have a relatively large impact on the development of science in the field of technology.

Poland ranks 25th in the ranking of highly cited publications and 30th in the H-index ranking. Therefore, that there is still room to increase the number of publications with international reach and to strengthen the presence of Polish research in the field of technology.

ASPI data show that several European countries are at the forefront in terms of the share of highly cited publications and the H-index, which confirms the activity of research centers in Europe with significant scientific achievements. At the same time, Europe lacks research centers capable of competing with global leaders in terms of the scale of impact of scientific publications in the field of technology. If this trend continues, Europe may remain a provider of high-quality research, but not the main global benchmark.

Magdalena Lesiak

Affordable housing will be a key objective for the European Commission in 2026

by 60% housing prices rose in the EU between 2013 and 2024

51% of residents of large EU cities consider the lack of affordable housing to be an urgent problem

In 2026, the European Commission intends to focus on the housing situation of Europeans. The first EU summit on housing has been announced, to be held in 2026. In the same year, the European Housing Alliance is to be established to support cooperation and exchange of experience between EU members. These events were preceded by the publication in December last year of the European Affordable Housing Plan, which sets out the areas in which the EC intends to take action.

The plan consists of four main pillars focusing on housing supply, legal reforms, investments, and support for those affected by the housing crisis. According to the EC, between 2013 and 2024, housing prices across the EU rose by 60% in nominal terms, while rents rose by 20%. At the same time, spending on housing investment fell, showing how housing supply in Europe has failed to keep pace with growing demand over the last decade. The EC estimates that in order to meet the current demand for housing in the EU, supply should be increased by 650,000 dwellings per year to 2.25 million.

According to a Eurobarometer survey, 53% of residents of large Polish cities believe that the lack of affordable housing is a problem requiring urgent action. This is slightly more than the EU average, where 51% of people indicate the urgency of this problem. In this respect, Poland ranks 10th in the EU, behind Spain, the Netherlands, and the Czech Republic, but ahead of Germany and Slovakia. Another 26% of people living in large cities in Poland indicated that the lack of affordable housing is a problem requiring action in the future – a result 4 percentage points lower than the EU average.

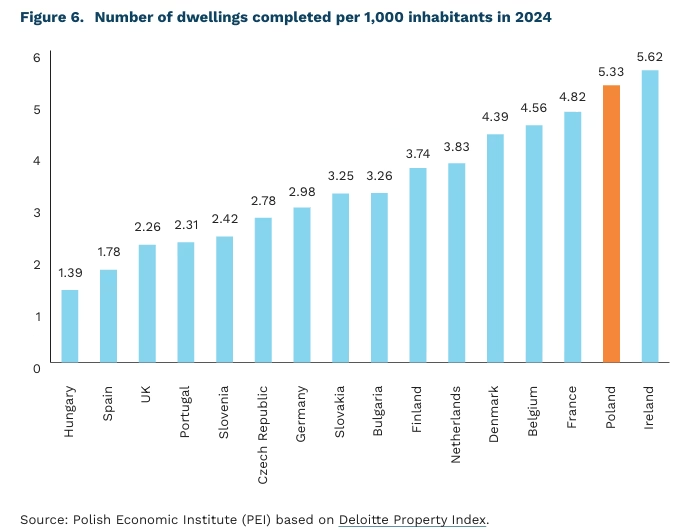

For several years now, Poland has been among the countries building the most apartments in the EU. The total annual number of apartments completed in Poland has not fallen below 200,000 since 2018. In 2024, the last year for which we have complete data, there were more than 5 completed apartments per 1,000 inhabitants in Poland. In this respect, Poland was one of the highest-ranking countries in the EU. Nevertheless, in terms of housing stock per 1,000 inhabitants, the situation in Poland is still worse than in many EU countries – in our region, we are surpassed by the Czech Republic and Hungary, for example (in both cases, there are over 470 dwellings per 1,000 inhabitants, while in Poland in 2024 there were 426). At the same time, as the ESPON study shows, the affordability of housing in Poland was relatively low. In many regions of Poland, renting or buying a flat requires spending a larger portion of the regional average salary than in other European countries.

One of the measures indicated by the EC in its plan is greater support for social housing, the supply of which has decreased in the EU in recent years. This resource has also decreased in Poland (on a national scale). At the same time, however, since last year, Poland has increased its spending on Social and Municipal Housing Programs and Social Rental Housing. In addition to social rental housing, the EC also mentions, among other things, reducing bureaucracy at various levels of government as a measure for structural reform in member states. For now, the European Commission is planning 17 events and actions for 2026 in connection with the plan published at the end of last year.

Jędrzej Lubasiński

The Digital Shift in Retail is an Opportunity for SMEs and Their Employees

50% of trade turnover in the EU is generated by small and medium-sized enterprises

16.5% higher productivity was achieved by retail companies that implemented digital solutions in 2024

52% of people employed in retail are women

As indicated by the latest OECD report, one of the drivers of development for small and medium-sized enterprises (SMEs) in the retail sector is the upskilling of their employees’ digital competencies.

A significant increase in the number of Europeans using e-commerce (from 59% in 2014 to 77% in 2024) has led to new challenges for retail SMEs, but it has also created new growth opportunities. Obvious threats include intense competition not only from a growing number of stores offering online shopping, but also from large e-commerce portals and so-called marketplaces, which enable consumers to compare prices of a given product across multiple sellers. The emergence of large platforms, as well as the implementation of digital solutions in stores, has contributed to an increase in the share of orders placed online – from 23% in 2013 to 43% in 2025.

The development of e-commerce and social media platforms, including their commercial extensions, requires SMEs not only to expand their infrastructure and technological capabilities, but also to invest in staff education. The digital transformation of retail creates new opportunities for the development of employee skills, enabling workers to gain competencies that are valuable not only to their current employer but also strengthen their position when seeking new employment. Through development programmes such as e-commerce internships and courses offered in Germany or Poland’s Dig.IT programme, employers and employees receive tools and funding to support digitalisation and related training. In the long term, this strengthens the competitiveness and business potential of enterprises, supports employee competencies, and enhances the employer brand, which can attract new employees through training and digital skills development opportunities.

Retail is a sector that employs a relatively high proportion of women. As many as 52% of people employed in retail in the EU are women. It is also a sector with a very high share of part-time employment (37% of total employment in 2023). These two indicators are interconnected and correlated, among other factors, with women’s greater burden of unpaid domestic work, which sometimes makes full-time employment more difficult. Another group that benefits from part-time employment and shows high employment levels in retail SMEs is young people and students. Both of these employee groups can benefit from developing their digital skills.

Participation in training programmes aimed at developing digital skills – whether in retail or other areas – will be particularly beneficial for women, who continue to be more digitally excluded than men. Programmes supporting women’s development in certain fields, such as the EU-backed Skills 4 Retail initiative, can open new paths for promotion and professional growth within their current workplaces. Although women make up more than half of retail employees, they represent only a small percentage of individuals in senior executive positions in the sector. Strengthening their competencies in such critical areas as e-commerce and digitalisation can significantly enhance their chances of advancing to higher-level roles.

Maksymilian Pyrkowski