Economic Weekly 4/2026, January 30, 2026

Published: 30/01/2026

Table of contents

Embargo on butane tightens sanctions on Russian LPG

near-triple increase in the import of n-butane and isobutane from Russia to Poland in 2025

74.9% was the share of the transport sector in LPG consumption in Poland in 2024

54.1% of LPG supplies to Poland in H1 2025 came from Sweden, Norway, and the United States

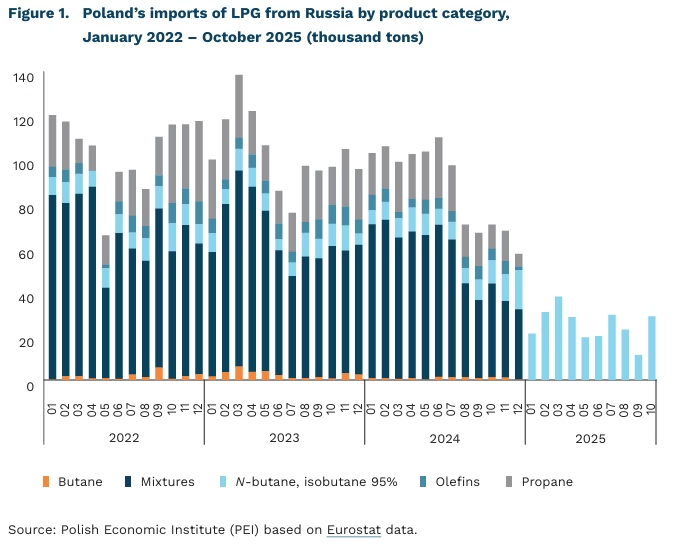

On 26 January 2026, a ban on imports of n-butane and isobutane (butanes with a purity above 95%) from Russia entered into force in the European Union. The new embargo, included in the 19th sanctions package, constitutes a tightening of the ban introduced on 20 December 2024 on imports of liquefied petroleum gas (LPG) from Russia. The earlier embargo covered propane, butane, olefins, and other liquefied gaseous hydrocarbons (LPG mixtures) – that is, all product categories collectively treated as LPG. Exempted from the restrictions were butanes with a purity above 95%, traditionally used in industry. The exclusion of n-butane and isobutane from the 12th sanctions package led to a near-triple increase in imports of this feedstock from Russia in 2025 (compared with the same period in 2024). In January–October 2025, imports from Russia accounted for 69% of Poland’s total imports of these products. N-butane and isobutane imported from Russia could be mixed with propane supplied from other directions and used for energy purposes in the EU. Despite this, total imports of LPG products from Russia in January-October 2025 amounted to 250 thousand tons, nearly four times less than in the corresponding period in 2024.

Poland remains the largest importer of LPG in the EU, primarily due to strong demand from the transport sector, which in 2024 accounted for 74.9% of domestic LPG sales. According to data from the European Automobile Manufacturers’ Association (ACEA), 12% of all passenger cars in Poland in 2024 were powered by LPG. As recently as 2024, Russia was Poland’s main LPG supplier, accounting for 42.7% of imported volumes. As a result of the embargo imposed in 2024, Sweden replaced Russia as the main supplier to Poland, accounting for 25.4% of imports in the first half of 2025. In 2022-2024, Poland’s refinery production of LPG remained at around 20% of domestic demand.

Transport and transshipment infrastructure is crucial in the context of changing LPG suppliers. In 2024, 52.7% of LPG imports to Poland were delivered by rail tank cars, just under 36% by sea, and 11.4% by road transport. In light of the embargo on Russian LPG introduced at the end of 2024, it can be expected that data for 2025 will show a significant increase in seaborne deliveries due to the growing share of Sweden, Norway, and the United States in total imports. The three transshipment terminals in Gdańsk, Gdynia, and Szczecin play a key role in maritime deliveries. In 2025, PKN Orlen completed the expansion of the Szczecin terminal, increasing its transshipment capacity to 400 thousand tons per year.

Marianna Sobkiewicz

The labour force participation of Polish women approaching retirement age is increasing

51.7% of women aged 55-64 in Poland were in the labour force in Q3 2025

29.5 percentage points this is how much the labour force participation rate of Polish women aged 55-64 has increased between 2010 and 2025

11.0 percentage points by this margin, the labour force participation rate of women aged 55-64 in Poland was lower than the EU average in 2024

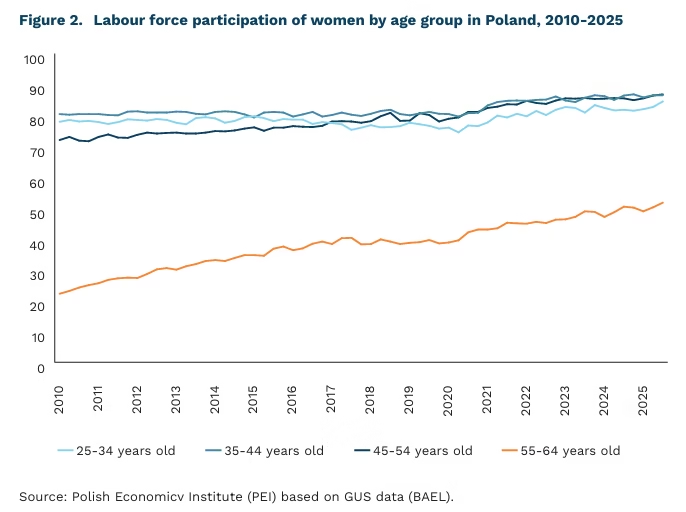

Over the past fifteen years, Poland has seen a steady increase in the labour force participation of women, especially those of preretirement and retirement age(1). Between Q1 2010 and Q3 2025, the labour force participation rate among women aged 55-64 more than doubled, rising from 22.2% to 51.7%, that is by 29.5 percentage points. This means that in this age group, more than half of women were either employed or actively seeking employment.

According to a report by the Central Institute for Labour Protection – National Research Institute, the rising educational attainment of women aged 55-64 has significantly contributed to the increase in their labour force participation. Higher education correlates with better professional qualifications, greater employment stability and higher earnings, which encourages women to remain in the labour market despite being close to retirement age. Women with higher education record a labour force participation rate of nearly 80%, whereas among women with lower levels of education this rate falls to 40-60%.

The increase in employment among women of around retirement age has also been driven by rapid wage growth and an intensifying labour shortage in the Polish economy. In the years 2022-2024, the average wage growth in the national economy exceeded 10% per year. This increased the economic gains from taking up employment for women who had previously been economically inactive. Another important factor behind this change has been the deepening labour deficit in the Polish economy, which encouraged firms to draw on the pool of people close to retirement age. This effect is particularly noteworthy given that, as a 2021 study showed, a substantial share of Polish employers previously expressed a preference for hiring younger workers.

Despite the marked rise in the labour force participation of women of around retirement age, Poland’s result still remains well below the EU average in this respect, with a gap of 11 percentage points. This is mainly due to the following factors: poorer health status of Polish women and their shorter „healthy life years” compared with women in other EU countries, low participation of adult Polish women in education and training

Good practices in activating women in the labour market can be found in Japan. In 2013, the Japanese government launched the effective “Womenomics” policy. It included, among other things, tax and regulatory incentives for companies that increased female employment, enabled flexible forms of work and facilitated combining work with family duties. It also promoted the career advancement of women – the government put pressure on companies while simultaneously increasing the number of women in senior positions in public administration. In 2023, the employment rate of women aged 55-64 in Japan was 1.5 times higher than in Poland, and for women aged 65 and over it was nearly five times higher.

- Women in Poland acquire the universal right to a pension upon reaching the age of 60.

Cezary Przybył, Paula Kukołowicz

In 2026, firms will invest in employee competencies

63% of firms plan to invest in human capital in 2026

45% of entrepreneurs intend to introduce new products and services into their offering

6% of medium sized firms will strengthen their cybersecurity

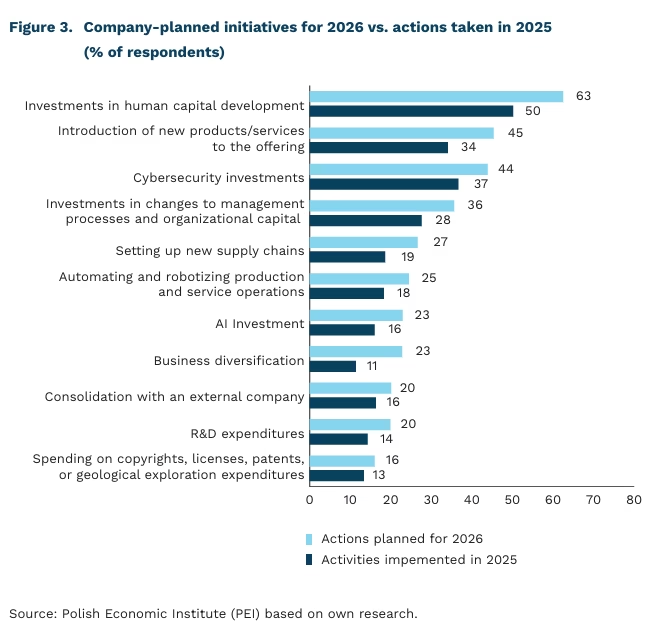

Investing in human capital is the most popular initiative planned by companies for 2026 – according to research by the Polish Economic Institute (PIE) (sample of 1,000 companies, December 2025). As many as 63% of entrepreneurs declared that they will provide staff training in 2026. This was also the most frequently implemented action in 2025, as reported by half of the surveyed companies. The second most common plan is the introduction of new products and services (45%), followed by investments in cybersecurity (44%). 36% of companies declared they will introduce changes in management processes and organisational capital, while launching new supply chains is planned by 27% of firms. Thus, companies are focusing on skills development, cybersecurity, and product innovation. Purchasing licenses, patents, or copyrights is the least popular plan (only 16%). Meanwhile, 20% of firms aim to consolidate with an external company, and 23% plan to diversify their activities. This suggests a preference for bolstering existing resources over riskier ventures. Notably, across all measures, the share of companies planning these actions for 2026 significantly exceeds the share that carried them out in 2025.

Large firms are strongly focusing on human capital, whereas medium-sized companies are gearing up to invest in technology. Notably, 72% of large enterprises plan employee training in 2026, but medium-sized firms lead in cybersecurity investments (64%) and AI adoption (43%). Micro-enterprises show a relatively strong interest in adding new products to their offering (41%). The manufacturing sector stands out with particularly ambitious plans for 2026, more frequently planning new product introductions (59%), new supply chains (40%), automation and robotization (37%), business diversification (27%), and R&D spending (31%). Service-sector prioritize human capital investments (65%), management process changes (43%), AI (31%), and copyrights (22%) more than others. Consolidation with external entities is most common in the TSL (transport, storage, logistics) sector (25%), while over half of trade firms plan cybersecurity investments.

The Polish economy – as highlighted in the report Polska 2026+ – now faces the challenge of transitioning from a phase of modernization to building resilience based on its own technological competencies. Companies’ plans for 2026 confirm this direction: businesses are strengthening the foundations of resilience by investing primarily in people, digital security, and product/service development. However, to translate these efforts into lasting innovative advantage, there is also a need to simultaneously strengthen the domestic technological base: developing local content and technological sovereignty.

Katarzyna Zybertowicz

EU Public Aid Redirects Toward Green Technologies and Energy

EUR 168 billion was the amount of public aid spending in the European Union in 2024

EUR 69 billion was the amount of public aid spending by EU member states in the “Environmental protection and energy efficiency” category in 2024

25% of total EU public aid spending in 2024 was accounted for by Germany’s expenditures

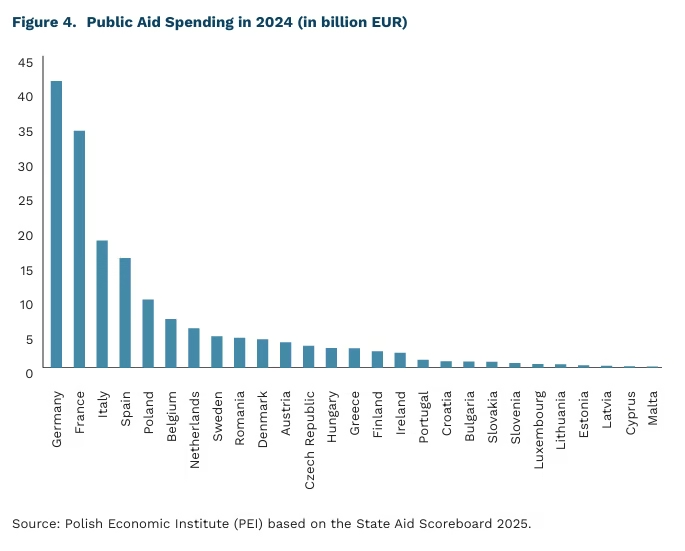

EU member state spending on public aid fell from EUR 203 billion in 2023 to EUR 168 billion in 2024. This information comes from the latest European Commission data on the “State Aid Scoreboard”. It indicates a significant reduction in public aid spending related to addressing the economic consequences of Russia’s invasion of Ukraine – these expenditures fell from nearly EUR 50 billion to EUR 16 billion. This allowed public aid spending levels to return to values similar to those before the pandemic.

The importance of the “Environmental protection and energy efficiency” category increased significantly. These expenditures rose from EUR 62 billion in 2023 to EUR 69 billion in 2024. However, due to the overall decline in spending, in 2024 it already accounted for 41% of total expenditures, whereas in 2023 it was only 31%. Its importance in coming years will likely continue to grow in connection with the introduction in 2025 of the Clean Industrial Deal State Aid Framework (CISAF), which retained industrial policy tools introduced in 2022 in response to Russia’s invasion of Ukraine. This category encompasses the most important industrial policy instruments, enabling subsidies for key enterprises, including compensation for their high energy costs. An earlier PIE publication has already highlighted this aspect.

Germany’s public aid spending in 2024 accounted for only 25% of total EU spending, which would not indicate the dominance of a single state – Germany’s share of EU GDP in 2024 was 24%. However, Germany’s share in “environmental protection” spending was 44% (EUR 30 billion), accounting for nearly half of all funds intended for this purpose, almost doubling Germany’s share of EU GDP. Taking into account the increasing scale and strategic importance of this category, in the longer term this could lead to a deepening of competitive imbalance between German industry and the industries of other EU member states. This country’s advantage in utilizing this aid category may intensify further in connection with the slow but consistently pursued fiscal expansion by the CDU government. Other states that made extensive use of this public aid category were France (EUR 11 billion, 15% of total public aid for this purpose) and Spain (EUR 6 billion, 9%), although this corresponded to their significance in the EU economy.

Meanwhile, Poland’s public aid spending fell from EUR 1.2 billion in 2023 to EUR 1 billion in 2024. This decline was related, similar to the case of other member states, to the reduction in spending aimed at counteracting the economic consequences of Russia’s invasion of Ukraine.

Marek Wąsiński, Michał Kowalski

EU Commission urges behavioral tools to boost supplementary retirement savings

from 50.5% to 57% increase in PPK (Employee Capital Plans) participation rate in 2025

over 4 mln Poles are saving in PPK

over 1 mln Poles own IKE accounts (Individual Retirement Accounts)

At the end of November last year, the European Commission adopted a package of measures aimed at providing systemic support to European Union citizens in accumulating additional financial resources to secure their financial situation in retirement. The proposed tools are intended to complement the pension systems operating in the Member States. Their purpose is to increase individual retirement savings through personalized incentives to save in supplementary schemes, while also expanding opportunities to save outside the mandatory pension system. The design of these tools is largely based on proven behavioral solutions, whose implementation and effectiveness do not require significant financial outlays.

The proposed tools include:

- Implementation and further development of pension information tracking systems that enable citizens to gain transparent insight into the details of their current entitlements and projections of future pension benefits. This solution aims to raise awareness of the need to accumulate additional savings for the retirement period, as statutory benefits may prove insufficient – particularly for many women and low-income earners. The Commission recommends that these systems be compatible with the European Pension Tracking System, an initiative designed to provide reliable information on pension entitlements accrued across different national systems.

- Creation of national pension dashboards that compile key data and indicators clearly illustrating the level of citizen participation in individual savings schemes, and that allow policymakers to monitor and analyze the stability and adequacy of existing multi-pillar pension systems. Data from national platforms would feed into a common European system comprehensively monitoring the pension security of EU residents.

- Introduction of additional savings schemes based on automatic enrolment with an opt-out option, drawing on the experience of countries where such solutions are already in place. The objective is to increase participation in supplementary savings programs and to foster the development of the market for additional private pension insurance.

Poland is among the few Member States that have implemented the latter solution, in the form of the Employee Capital Plans (PPK) launched in 2019. Analogous schemes are also in place in Italy and Slovakia, and as of 1 January this year in Ireland and Lithuania, which has just introduced an opt-out option from the previously mandatory automatic enrolment into the second pillar.

The year 2025 proved to be a record year in terms of increased participation in PPK, rising to over 4 million participants (with the average participation rate increasing from 50.5% to 57%), as well as growth in net asset value (up 49% year on year). However, Poland still lags behind the United Kingdom and New Zealand, where more than 80% of eligible individuals save through comparable schemes. At the same time, participation in voluntary savings programs remains significantly lower: around 1 million Poles save through IKE accounts, and approximately 600,000 accumulate savings in IKZE accounts. There is therefore a clear need to create additional incentives and simplify access to alternative forms of saving.

The European Commission’s targeted proposals are a step in the right direction, complementing the traditional set of tools based on education and communication, but they do not fully exhaust the potential of behavioral tools to encourage saving and improve the effectiveness of existing saving arrangements. The latest research shows that personalized tools and messages tailored to individuals’ specific circumstances, capacities, and needs are equally important.

Agnieszka Wincewicz-Price

AI in education should primarily support knowledge acquisition

45% of teachers of grades 5-8 surveyed in Poland used AI in their work

31% reduction in the time teachers spend planning lessons thanks to AI

9 percentage points increase in math pass rates among students of the lowestperforming teachers supported by AI

According to the TALIS 2024 survey, 45% of Polish teachers in grades 5-8 of primary schools used AI in their work, significantly above the OECD average (36%)(2). This scale of AI tool use prompts active analysis of the benefits and risks of implementing new technology in education. The latest OECD Digital Education Outlook 2026 focuses on the effective use of AI tools in the education process.

The use of AI by students may give the illusion of increased competence in the short term. The study found that students using GenAI (GPT-4) performed better on math exercises, but the use of the tools had a negative impact on their exam results compared to students who did not use generative AI in their learning process. The education system must therefore balance the short-term benefits of increased productivity with the longterm impact of AI on the learning process.

In response to these challenges, AI-based tools are being developed that focus on improving students’ actual competencies. Researchers see potential in AI tools that are specially designed for educational purposes and appropriately tuned. In studies, these tools have been shown to increase students’ knowledge acquisition in a shorter period of time, as well as increase their engagement and motivation to learn. Such tools have been designed to replicate the good practices of human teachers in their contact with students, implementing active learning techniques, emphasizing questioning, small hints, and the search for in-depth arguments, rather than offering ready-made solutions.

AI can also have a positive impact on the quality of education and improve teachers’ working conditions. The authors point out that the appropriate use of GenAI tools by teachers can lead to measurable positive effects among students. A study conducted on mathematics teachers showed that the use of GenAI translated into increased pass rates among their students. The greatest positive effect, amounting to 9 percentage points, was observed among students of teachers classified as the lowest performing. This meant that they almost matched the results of students of the top-rated teachers, narrowing the competence gap. These findings are consistent with another study that showed particularly positive effects of using generative AI among low-skilled workers. In addition, AI support in the lesson planning process by teachers resulted in a 31 percent reduction in the amount of time needed for this purpose over the course of a week, without compromising the quality of teaching.

The conclusions of the report can be seen as a warning against the rushed implementation of technological innovations into the education system. Despite the observed benefits, it is worth taking steps to reduce long-term risks that may be underestimated in light of the initial positive impression. The authors therefore argue that the costs of research into the effectiveness and safety of tools should be treated as an essential part of implementing AI into education systems.

2. The OECD TALIS survey covers teaching at level 2 in the ISCED classification. In Poland, this corresponds to teaching in grades 5-8 of primary school. The questionnaire included the question: “During the last 12 months, have you used artificial intelligence in your teaching or to facilitate student learning?”.

Jakub Witczak

Bull market in metals – record highs for gold and silver

16.6% increase in gold prices since the beginning of 2026 (a total increase of 92.4% since the beginning of 2025)

52.3% increase in silver prices since the beginning of 2026 (a total increase of 272.7% since the beginning of 2025)

Gold and silver have set new all-time price records, confirming the scale of the bull market in precious metals. Gold prices briefly exceeded USD 5,300 per ounce, while silver climbed to USD 116-117 per ounce, reaching the highest levels in history. The rally encompassed both metals simultaneously, although the relatively stronger performance of silver pushed the gold-to-silver price ratio below 50, its lowest level since 2012.

The current rally in metals reflects the interaction of several macroeconomic, institutional and sector-specific factors. First, gold and silver have once again assumed their role as hedges against heightened geopolitical and political uncertainty, while a weaker US dollar has increased their attractiveness for non-US investors, strengthening global demand. Second, sustained purchases by central banks reinforce gold’s perception as a structural reserve asset, which the market interprets as a long-term signal of stable demand and, indirectly, extends to silver. Third, in the case of silver, industrial demand plays a growing role – expansion in photovoltaics, electronics and technological infrastructure means that silver is increasingly viewed as a strategic raw material rather than merely an investment or jewellery metal.

On the Warsaw Stock Exchange, a natural beneficiary of the metals bull market is KGHM Polska Miedź. Over the past twelve months, the company’s share price has risen by more than 150-170%, placing KGHM among the fastest-growing large-cap companies on the Polish market. The sensitivity of its valuation to metal prices reflects not only its exposure to copper but also its significant position in global silver production.

Caution regarding gold price forecasts remains warranted, as the past two years have shown how quickly the market can diverge from consensus expectations. In both 2024 and 2025, realised prices repeatedly exceeded earlier analytical scenarios, limiting the usefulness of short-term forecasts based on traditional macroeconomic relationships. Following this year’s record highs, institutions have again raised their targets, but the dispersion of forecasts remains wide – Goldman Sachs points to around USD 5,400 per ounce, while Deutsche Bank allows for scenarios reaching as high as USD 6,000. Such a broad range suggests that, in the current cycle, price dynamics are increasingly driven by factors that are difficult to model precisely, including central bank demand and volatile investment capital flows.

Sebastian Sajnóg