Economic Weekly 46/2025, November 21, 2025

Published: 21/11/2025

Table of contents

China’s Share in Polish Imports Exceeded 15% in Q1-Q3 2025

2.6% year-on-year growth in exports in Q1-Q3 2025

EUR 4.6 bln trade deficit after Q3 2025

15% China’s share in Polish imports surpassed this threshold in Q1-Q3 2025

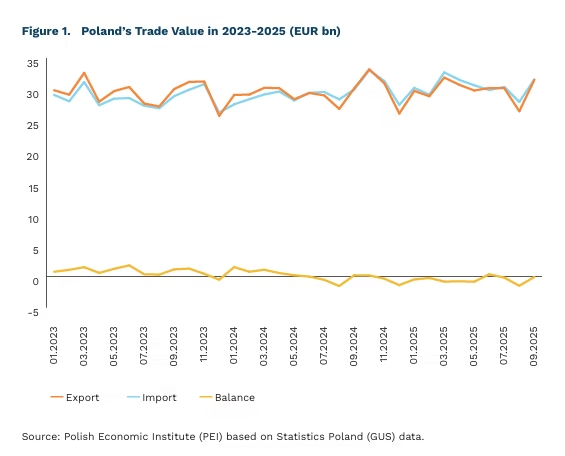

Polish imports grew twice as fast as exports at the beginning of 2025. While exports increased by 2.6%, imports rose by 5.2% in the first three quarters of 2025 compared with the same period in 2024. In Q3, export growth slightly outpaced import growth, although the trade deficit continued to widen, reaching EUR 4.6 bn year-to-date. Volume indices for Polish trade for January-July 2025 indicate smaller discrepancies between exported and imported quantities. Year-on-year, export and import volumes increased by 4.5% and 5.5% respectively, suggesting that price fluctuations played a smaller role and that changes in trade value increasingly reflect actual volume dynamics.

Only minor shifts occurred in Poland’s export destinations in the first three quarters of 2025. Germany’s share remained stable at 27%, which is slightly (1 pp) below its 2023 level. The United States continues to be Poland’s 8th largest export market, although its share declined in August and September. Compared with the same period in 2024, the largest decreases were recorded in exports to Belarus and Russia (-0.4 pp and -0.2 pp respectively), as well as to Italy (-0.11 pp). The drop in exports to Italy resulted in a reordering of key export markets: the Netherlands overtook Italy as Poland’s 5th most important trading partner. Conversely, the largest increases were recorded for exports to Sweden (by 0.21 pp), Ireland, Norway and Canada (all above 0.1 pp).

China’s importance in Polish imports continues to grow. China’s share exceeded 15% for the first time in Q1-Q3, an increase of 1.5 pp compared with the same period of 2024. Passenger cars accounted for 10% of this rise: their import value reached EUR 820 million, more than double the volume recorded a year earlier.

Polish exports of data-processing equipment are rising. Exports of routers, servers and computers increased their share in total exports to 2.2% – up by 0.3 pp from the first three quarters of 2024. Exports of poultry and beef, as well as turbojet engines, also increased. However, exports of electric batteries continued to decline (-0.36 pp). As a result, the share of batteries in Polish exports has fallen by more than half – from 3.5% to just 1.6%.

Marek Wąsiński

The IEA Forecasts an Increase in Global Oil and Gas Consumption by 2050

32% projected increase in global natural gas consumption by 2050 under the Current Policies Scenario presented by the IEA

2030 the year by which global coal use is expected to reach a historic peak, even under the conservative pathway

40% the projected global share of electric vehicles in new passenger car sales in 2035-2050 under the IEA’s cautious scenario, implying continued growth in oil consumption

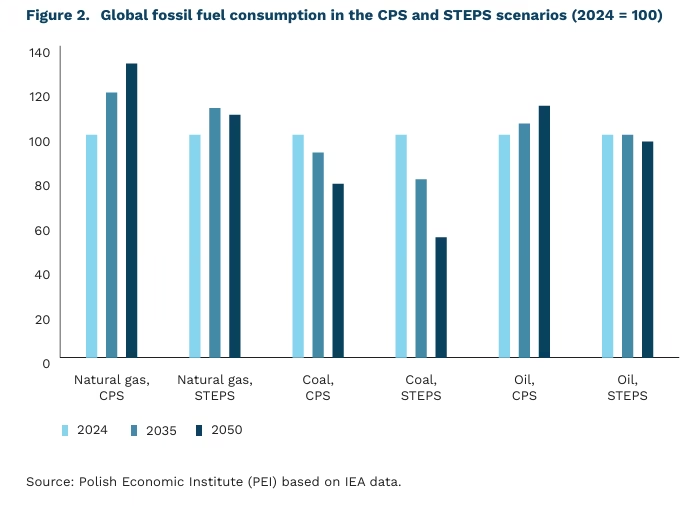

The International Energy Agency (IEA) has returned to analysing the slow-transition pathway of the global energy system. For the first time since 2019, World Energy Outlook includes the Current Policies Scenario (CPS), under which existing regulations are simply extended and the pace of deployment of low-emission technologies remains moderate. The Stated Policies Scenario (STEPS), based on official strategies and policy commitments, as well as more optimistic technological assumptions, continues to be assessed. Both trajectories diverge sharply from the normative Net Zero Emissions by 2050 Scenario.

The IEA’s methodology has recently faced strong criticism from the US administration. Earlier analyses under the STEPS pathway indicated that global fossil fuel consumption could begin declining as early as 2030, calling into question the rationale for further investment in oil and natural gas extraction. US Secretary of Energy Chris Wright described these results as ‘nonsensical’ and threatened to withdraw the United States from the IEA unless US reservations were taken into account. Parallel shifts in US energy policy have also slowed the pace of transition within the STEPS scenario.

Under the Current Policies Scenario, global energy-related emissions are projected to remain at today’s level (approx. 38-39 Gt CO₂ annually) through 2050. Despite rapid growth in renewables and electrification, particularly in China and the EU, fossil fuels would continue to play a key role in meeting rising global demand for energy.

Global oil demand is expected to increase from today’s 100 million barrels per day (2024) to 113 million barrels per day by 2050. Although demand from power generation and heating is set to decline, this will be more than offset by industrial use and aviation. Long-term projections for transport electrification are also very pessimistic: electric vehicles are expected to reach only a 40% share in global new car sales in 2035 and remain at that level.

Annual natural gas consumption is projected to increase by around 32% by 2050 (from 4.3 trillion cubic meters to 5.6 trillion cubic meters). This growth will stem, among other factors, from rising use in the power sector. In the United States, demand will be boosted by the expansion of large-scale data centres; in Asia, by industrial growth and continued coal-to-gas switching. In developing countries, gas will play a major role in modernising space heating, cooking and even transport. International LNG trade will be crucial for supplying European and Asian markets.

Global coal consumption is expected to peak in this decade (around 6 billion tonnes of coal equivalent). However, the subsequent decline will be slow – to approx. 5.6 billion tonnes in 2035 and still above 4.7 billion tonnes in 2050. Gradual decarbonisation of the power sector in China and advanced economies will be partially offset by rising consumption in India and other Asian countries. Differences in the pace of coal phase-out in the power sector account for more than half of the emissions gap between the CPS and STEPS scenarios by 2035.

Under the CPS pathway, global warming will exceed 2°C around 2050 and rise to 2.9°C by 2100. Even the more optimistic STEPS scenario projects crossing the 2°C threshold around 2060 and reaching 2.5°C by the end of the century. Even if countries fully implement their commitments, the world remains far from achieving the goals of the Paris Agreement.

Some of the assumptions underlying the CPS scenario have been subject to criticism. The analysis assumes that electric vehicle sales shares will continue rising in China and the EU, but will remain at today’s low levels in the United States and developing countries. Yet in recent quarters EV sales have grown significantly in several of those markets, including Vietnam, Thailand, Ethiopia, Turkey and parts of South America. CPS scenarios from previous IEA reports have consistently underestimated the pace of subsequent developments, especially in solar power.

Michał Smoleń

Staff Shortages in Healthcare Will Become Increasingly Severe

2 doctors per 1,000 inhabitants in non-urban areas in Poland

Fewer than 6 nurses per 1,000 inhabitants in Poland

260,000 nursing positions potential shortage projected for 2039

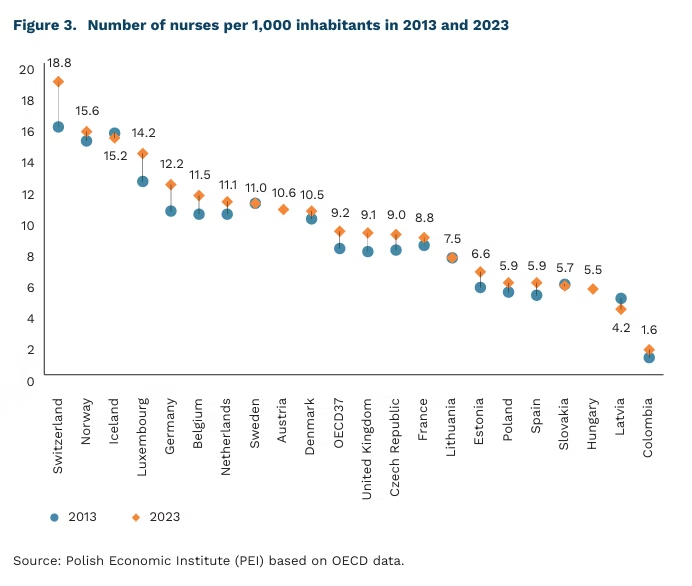

According to Health at a Glance 2025, report by the OECD, the overall performance of Poland’s healthcare system is close to the OECD average across most indicators. The report nevertheless identifies several critical areas where the system is already under strain, and where demographic ageing will intensify existing challenges. One of the most alarming findings concerns the low share of young people interested in becoming nurses. Poland currently has 5.9 nurses per 1,000 inhabitants, yet fewer than 0.5% of teenagers express interest in pursuing this profession. At the same time, Poland ranks second in the OECD in terms of the ratio of nurses’ wages to the national average and fourth in terms of annual wage growth in the profession.

The nursing workforce gap, estimated at up to 260,000 missing full-time positions by 2039, is likely to significantly increase demand for migrant healthcare workers as the population continues to age. Equally concerning is the limited access to medical services outside major cities. Poland and Turkey are the only OECD countries where non-urban areas have fewer than two doctors per 1,000 inhabitants. The lack of medical practices in smaller localities restricts access to specialist care, which disproportionately affects older residents and those facing transport exclusion.

Poland also faces substantial ‘brain drain’ pressures. It is one of the three largest exporters of nurses globally, alongside India and Pakistan, and Polish doctors constitute a major component of the foreign workforce in Swedish hospitals. Measures aimed at retaining nurses in Poland include funding for further professional development (qualification and specialist courses) and regular wage increases. Additionally, new medical programmes have been launched at universities, and admission limits have been expanded. Interest in medical studies remains strong: the number of students entering medical school in the 2023/24 academic year was 33% higher than in 2015/2016. In 2024, the number of nursing graduates was more than twice as high as in 2016, while the number of medical graduates increased by 50%.

To improve access to healthcare in rural and non-urban areas, several OECD countries have introduced dedicated incentives such as higher wages and housing subsidies (e.g. Portugal), or targeted programmes encouraging students from smaller localities to pursue medical degrees (e.g. Japan).

Maksymilian Pyrkowski

Rising Labour Costs Are the Most Burdensome Barrier to Doing Business

67% firms identifying labour costs as a major or very major barrier in November 2025

65% medium-sized firms citing economic uncertainty as a barrier

60% construction companies indicating labour shortages as a barrier

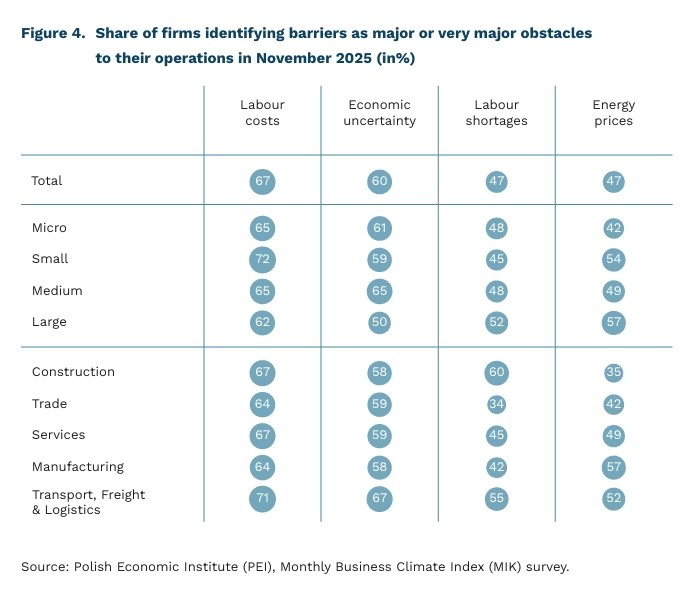

Labour costs have remained the most frequently cited barrier to doing business since December 2023. In November 2025, 67% of firms pointed to labour costs as a major or very major obstacle, according to the Monthly Business Climate Index (MIK). Economic uncertainty was indicated by 60% of companies, while labour shortages and energy prices were each cited by 47%. The relative importance of these barriers has shifted over recent years. From early 2022 (when this question was first included) until mid-2023, economic uncertainty was the dominant barrier. At the same time, labour shortages were long perceived as less burdensome than rising energy prices. Since August 2025, however, the share of firms pointing to staffing problems has gradually increased, driven by the low unemployment rate (5.6% in September) and demographic changes.

Small firms bear the highest burden of rising labour costs – 72% indicated them as a major barrier, compared with 62% of large firms. This may stem from limited room for cost optimisation and weaker bargaining power in the labour market. Economic uncertainty is a greater challenge for medium-sized enterprises (65%), while among large companies the figure stands at 50%. Labour shortages are more burdensome for large f irms (52%) than for small ones (45%), reflecting the greater scale of operations. Energy prices are least problematic for micro-enterprises and large firms (42% and 44%, respectively).

Labour costs are the primary barrier across all sectors, with the strongest impact in the transport, freight and logistics sector, where 71% of firms identified them as a major obstacle, largely due to the high labour intensity of the sector and the shortage of drivers and specialists. Economic uncertainty affects transport, freight and logistics companies most severely (67%), as the sector is highly sensitive to fluctuations in demand and economic conditions. Labour shortages pose the greatest challenge in construction (60%), reflecting the high demand for manual and highly skilled labour. In trade, this barrier remains the least severe (34%). Rising energy prices are felt most acutely in manufacturing (57%), due to their significant share in total operating costs.

The combination of high labour costs and limited labour supply is becoming one of the key structural challenges. Rising demand for workers and persistent recruitment difficulties are also confirmed by the NBP Quick Monitoring Survey, in which firms indicated staffing shortages as one of the constraints on their operations, reinforcing cost pressures in labour-intensive sectors. According to Statistics Poland (GUS), wages continue to grow faster than labour productivity. This increases labour costs, particularly in industries with low levels of automation. Staffing shortages slow down order fulfilment in the transport, freight and logistics sectors and construction sectors, while wage pressures weaken firms’ price competitiveness.

Aleksandra Wejt-Knyżewska

Stagnation Rather Than Acceleration in the Race for Innovation

18-24 months the time EU countries need to replicate patents from China or the United States in advanced technology fields

1.41% Poland’s R&D expenditure as a share of GDP in 2024 (down from 1.56% in 2023)

€0.63 the amount returned to Poland for every €1 contributed to the Horizon Europe budget

In his book Growth, economist D. Susskind argues that the perception of human history as a trajectory of constant progress is mistaken. He presents evidence that most of human existence has been characterised by stagnation rather than development. Only around 1800 did a breakthrough occur, what J. Mokyr describes as the Industrial Enlightenment.

considering its costs and quality. The solution is not a retreat from economic growth (as proposed by the degrowth movement) but its redirection. This is the purpose of directed technological change (D. Acemoğlu), which allows societies to counteract the negative externalities of growth, such as environmental degradation, social inequalities, weakened local communities, or dependence on technologies beyond one’s control.

Easing the diffusion of innovation and strengthening research and development (R&D) are key tools for shaping future development. New ideas are essential for achieving well-directed progress. The growth engine should increasingly rely on the intangible (non-rival and cumulative ideas) rather than the tangible (finite material or human resources).

Yet EU countries require approximately 18-24 months to replicate innovations (in AI, semiconductors and quantum technologies) originating from China or the United States. China, by contrast, replicates breakthrough patents from the US or the EU in just six months. The United States is similarly fast in reproducing Chinese patents. Even more concerning: the time needed for an innovator in one EU country to copy a breakthrough solution from another EU member state is just as long – if not longer – than the time required to replicate a Chinese patent.

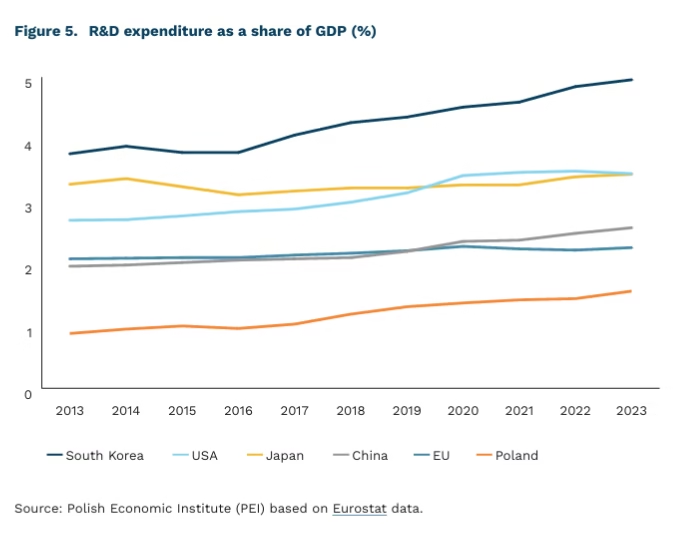

The share of R&D expenditure in the EU has remained broadly unchanged for a decade (2.08% of GDP in 2013 vs. 2.26% in 2023). This is below the levels observed in South Korea, the United States, Japan and – since 2020 – China. Between 2012 and 2023, stagnation in R&D funding was evident in both the EU and Japan, whereas China, the US and South Korea increased their R&D expenditure relative to GDP by around 30%.

The latest data show that in 2024 – despite the previously observed upward trend – Poland’s R&D expenditure declined. It amounted to PLN 51.5 billion, down 3.1% from the previous year. The decrease results from lower investment spending, which may be linked to the completion of EU-co-financed projects from the previous financial perspective in 2023. The number of personnel involved in R&D also fell (by 1.9% compared to 2023).

A major opportunity, both for Poland and the EU, to strengthen innovation capacity lies in the upcoming Horizon Europe 2.0 programme, expected to have a budget 83% larger than the current research and innovation framework. Today, Poland receives only EUR 0.63 from every €1 contributed to the Horizon Europe budget. To increase the participation of Polish institutions in the next programme, domestic capacity must be strengthened through higher R&D investment and better institutional preparation.

Cezary Przybył

The Total Population of the EU is Projected to Decline by 1.5% by 2060 Compared With 2022

28.4 million projected population of Poland in 2060 under the low-fertility scenario, according to Statistics Poland (GUS)

27.1 million projected population of Poland in 2060 under the low-fertility scenario, according to the UN

31.3 million projected population of Poland in 2060 under the low-fertility scenario, according to Eurostat

The latest population projections published by Statistics Poland (GUS) present a more pessimistic outlook. The report Symulacja liczby ludności do 2060 r. [Simulation of Poland’s Population until 2060], designated as an experimental study, revises downward the official 2023 projections, which had estimated that Poland’s population in 2060 would reach 30.9 million.

The new simulation includes three scenarios. The most pessimistic, based on maintaining the low fertility rate recorded in 2024 (TFR 1.10), shows that Poland’s population would fall to 28.4 million by 2060. The second scenario, which primarily assumes an increase in life expectancy, points to a population of 32.3 million. The third scenario – combining low fertility with longer life expectancy – projects 29.4 million inhabitants in 2060.

Other forecasts also confirm that Poland’s population is shrinking. The scenarios developed by other institutions likewise follow a what-if logic. In its central scenario in the 2024 World Population Prospects (the world’s largest long-term demographic study), the UN projects that Poland’s population will reach 30.1 million in 2060, and 27.1 million under the low-fertility variant.

Forecasts for the EU also point to a decline. Eurostat’s EUROPOP2023 projection, with a horizon to 2100 and covering 27 EU Member States and three EFTA countries, indicates 33.4 million as Poland’s population in 2060 in the central scenario, 31.3 million under the lower-fertility variant, and 33.9 million under the lower-mortality assumption.

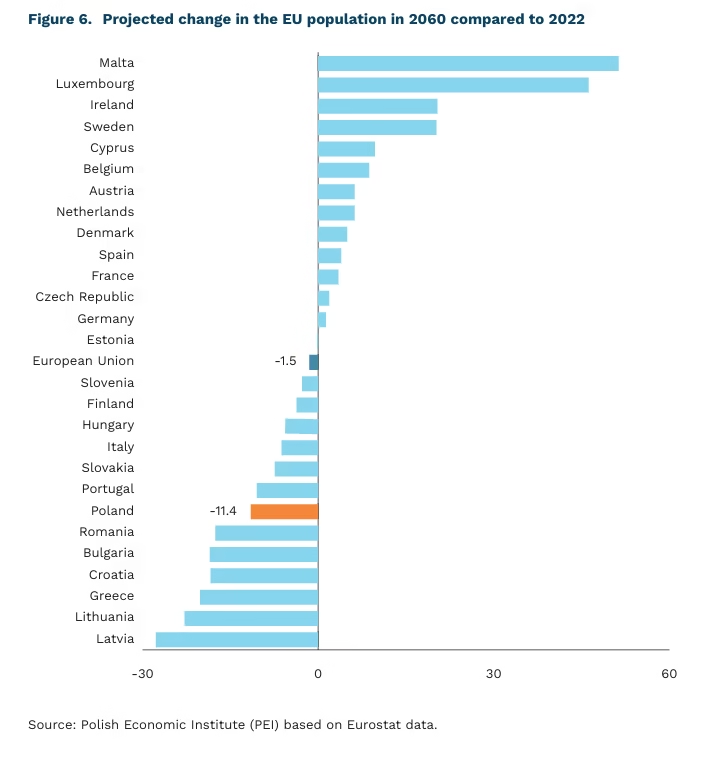

Demographic conditions within the EU vary significantly. The total population of the EU is projected to fall by 1.5% by 2060 relative to 2022. In Poland, the decline is expected to reach 11.36%, similar to the projected reduction in Portugal.

In other countries, demographic shifts will be even more pronounced. The largest decline is projected for Latvia (-7.66%) and Lithuania (-22.76%), while the strongest increases are expected in Malta (51.30%) and Luxembourg (46.17%).

Demographic change is one of the key social challenges not only for Poland but for all EU Member States. Governments must address two parallel issues: low fertility rates and a growing senior population. This relates primarily to challenges concerning the quality of life of older people, including the availability of healthcare and long-term care services. Increasingly important are measures aimed at supporting the labour-market, social and civic engagement of older adults, which help prevent their exclusion and make better use of the potential of this expanding segment of society.

Jakub Kubiczek

Europeans Are Moderately Concerned About Job Automation

15.9% share of surveyed employees who feel fear of automation

25.9% share who believe their current tasks will be automated within ten years

66% share of Europeans who think robots and AI ‘steal’ people’s jobs

Europeans express relatively limited concern about job automation. Only 15.9% of respondents report feeling fear of automation, according to a survey conducted by researchers from the University of Warsaw among more than 6,500 employees in six Central and Eastern European EU Member States(1).

Some 17.2% of respondents believe they will lose their current job within the next ten years, while 25.9% expect their current tasks to become automated in that period. Moreover, one-third of respondents believe that technological progress and the resulting automation of work will lead to mass technological unemployment within the next decade.

Employees who have already experienced automation, whether supportive or substitutive, more frequently fear losing their jobs to technology. Higher levels of fear are also observed in sectors with relatively greater use of industrial robots. At the same time, an interesting pattern emerges: people tend to underestimate the risk in their own case. Only around 30% of individuals who believe their tasks will be automated and that changes will lead to mass unemployment actually fear losing their own position.

According to the 2024 Eurobarometer survey conducted across all EU Member States, public sentiment toward automation is gradually improving, though distrust still prevails. As many as 66% of Europeans believe that robots and AI ‘steal’ people’s jobs. Although this remains the dominant narrative, the share has fallen by 6 percentage points compared with 2017. At the same time, 32% of respondents view the presence of robots and AI in the workplace as a negative development.

While 66% of Europeans agree that automating repetitive and ‘boring’ tasks is necessary, it is precisely workers who perform such tasks who report heightened fear of automation. These concerns are consistent with theoretical research indicating that repetitive and routine tasks are the most susceptible to automation.

The rapid pace of change driven by digitalisation, and now also by advances in AI, raises questions about workers’ actual preparedness for technological transformation. Although 75% of Europeans state that they have sufficient digital skills to perform their current job, this confidence has weakened significantly in recent years (a decline of 7 percentage points since 2019). At the same time, 68% of Europeans say their employers provide them with the necessary digital tools and training. Even assuming that declared skills and training accurately reflect reality, a substantial share of workers may still not be ready for changes stemming from technological progress. This may, in turn, lead to resistance among those who are technologically underprepared, further deepening fear of automation.

Jakub Witczak