Economic Weekly 48/2025, December 4, 2025

Published: 05/12/2025

Table of contents

Poland’s Economic Outlook Continues to Improve, With More Optimistic Forecasts Ahead

3.8% real GDP growth y/y in Q3 2025

8% projected y/y investment growth in 2026 according to the market consensus

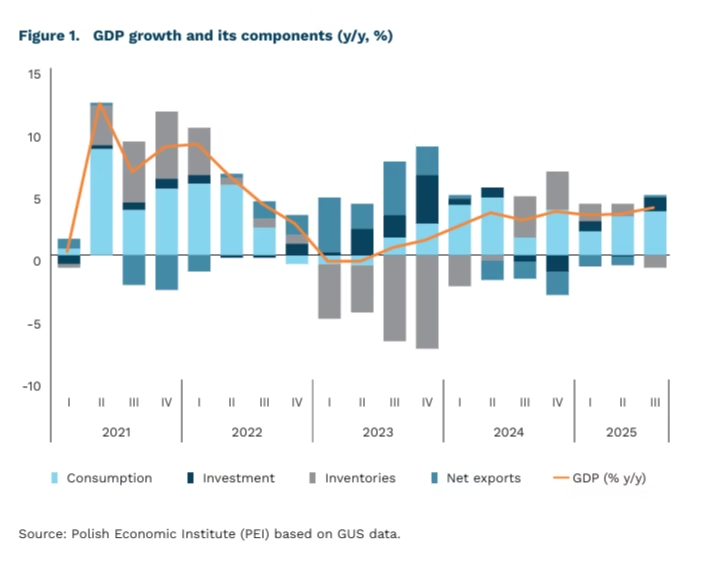

Poland’s economic growth is accelerating once again. According to Statistics Poland’s (GUS), latest estimate, real GDP increased by 3.8% y/y in Q3, compared with 3.3% in Q2. The result is 0.1 pp higher than the flash estimate. Private consumption remained the main growth driver, rising by 3.5% y/y. This marks a slowdown from 4.5% in Q2, most likely due to an increase in household savings. Investment surged strongly, accelerating to 7.1% y/y from -0.7% in the previous quarter. For the first time in over a year, net exports contributed positively to GDP growth, despite higher import dynamics partly driven by the high import intensity of investment.

The real-economy indicators for the start of Q4 were also positive. Construction output grew by 4.1% y/y in October, signalling that investment activity is gaining momentum. Residential and commercial construction continues to show signs of moderate stagnation, yet activity is expected to increase in the coming months, as suggested by the rising number of credit enquiries (34.3% y/y). Industrial output also surprised on the upside, recording 3.2% y/y growth in October. Among major industrial groupings, the strongest annual increase was observed in capital goods production (9.2% y/y). Elevated production levels in this segment are likely to continue in the coming quarters, driven by the standard cohesion-policy expenditure cycle and accelerated disbursement of funds under the Recovery and Resilience Facility.

As a result, economic growth is expected to accelerate next year. The OECD forecasts real GDP growth of 3.4% for Poland in 2026. Domestic analytical institutions are more optimistic. In its latest November projection, the NBP expects GDP growth of around 3.7%, while a growing number of market analysts are revising their forecasts upwards, pointing to scenarios “starting with a four”, provided that external conditions improve and EU funds are absorbed more rapidly. The expected acceleration should be driven by consumption and investment, with the market consensus forecasting an 8% y/y increase in investment. The outlook is, however, subject to risks, including the lack of a rebound in external demand, continued household savings accumulation and under-utilisation of EU funds. The IMF also notes that maintaining high growth in the longer term will require households to diversify their savings into a broader range of financial instruments.

Piotr Kamiński

Germany’s Power Capacity Deficit Threatens the Integration of European Electricity Systems

190% average annual increase in Norway’s electricity exports in 2020-2024 compared with 1991-2000

EUR 936 per 1 MWh hourly electricity price at the peak of the supply shortage on 12 December 2024

10 GW planned new gas-fired capacity intended to stabilise the German power system by 2032

Norway is considering abandoning the modernisation of its 500 MW HVDC link with Denmark. Minister of Energy Terje Aasland stated that the future of the Skagerrak 1 and 2 subsea cables, commissioned in the 1970s and now requiring refurbishment, will depend on additional analyses by the transmission system operator. This is another sign of growing reluctance among the Scandinavian Peninsula countries towards the existing model of European electricity-system integration. In 2024, Sweden blocked the construction of a new 700 MW interconnector with Germany.

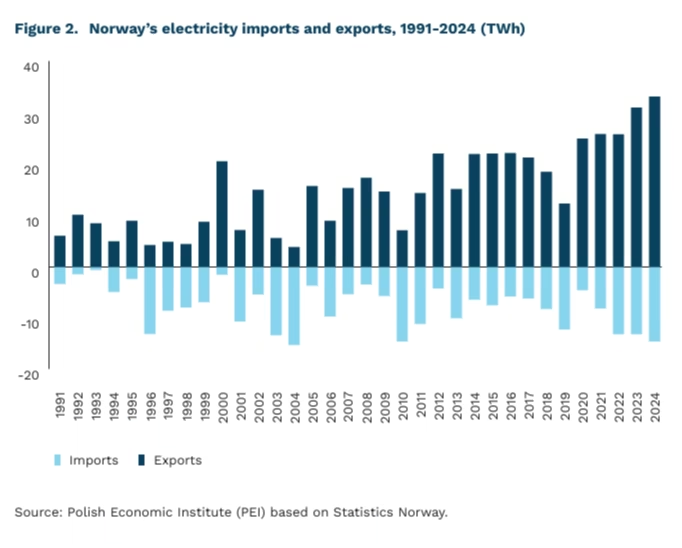

German demand pushes up prices in interconnected markets. During periods of low solar and wind generation (the so-called “dark doldrums”), German industry purchases electricity from neighbouring systems, including Norway’s hydropower plants. Norway’s average annual electricity exports increased from 8.1 TWh in 1991-2000 to 28.1 TWh in 2020-2024.

Episodes of extremely high prices in Central Europe result from capacity shortages. According to the German regulator, due to rising peak demand and the continued decommissioning of older capacity (nuclear and coal), Germany will need up to 20 GW of new dispatchable power plants already in the early 2030s. When, during system-critical periods (e.g. a windless winter evening), available dispatchable capacity is exhausted, partly due to outages and maintenance, prices may disconnect from the variable costs of fuel, emissions and generation, rising until demand is curtailed. This is what happened on 12 December 2024, when the hourly electricity price surged to 936 EUR per 1 MWh, triggering, among other effects, a shutdown of a steelworks in Saxony.

Norwegian consumers have had enough. Although electricity exports are a source of revenue for Norwegian power producers, rising prices undermine the competitiveness of domestic industry. Moreover, due to the popularity of dynamic-price contracts, price spikes are directly felt by households. In 2025, the dispute over Norway’s approach to energy integration with the EU even led to the collapse of the governing coalition and the introduction, from 1 October, of subsidised tariffs with a guaranteed fixed price.

The situation in the German and European power systems is expected to stabilise with the construction of 10 GW of new gas-fired power plants by 2032. The previous government had already initiated this process, but progress was delayed by protracted negotiations with the European Commission and the collapse of the coalition. Further development of energy storage will also contribute to stabilisation. However, no decision has yet been taken to split Germany into price zones – a measure that would reduce the impact on the Norwegian and Swedish markets. Moreover, the German government is introducing additional forms of relief and subsidies for electricity costs, particularly for industrial consumers, which may, in the coming years, lead to a further increase in imports from neighbouring countries.

Michał Smoleń

The Highest Number of Housing Sales in Poland This Decade in 2024

263 thousand dwellings were sold in Poland in 2024

39% of all dwellings sold were three-room units

17.3 thousand dwellings were purchased by foreign buyers

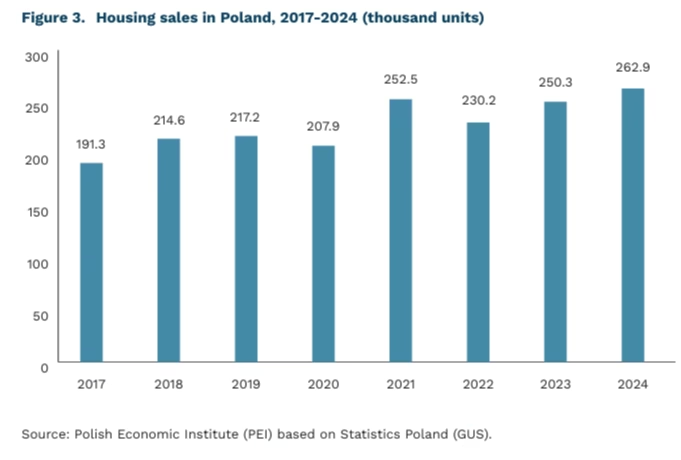

In 2024, 263 thousand dwellings were sold in Poland, according to newly published data from Statistics Poland (GUS). This is the highest figure recorded in the current decade. Previously, the largest number of transactions was noted in 2021, when 252.5 thousand dwellings were sold. On a year-on-year basis, the number of dwellings sold in 2024 increased by 5%. The total turnover in residential property consists of market transactions (97% of all sales), as well as tender and non-tender sales. Since 2021, the total number of transactions has not fallen below 230 thousand units.

The increase in market sales in 2024 was driven by the secondary market. Sales of existing dwellings rose by 12% compared with 2023. On the primary market, the situation was the opposite – the number of units sold decreased by 3% y/y. Overall, in 2024, 41 thousand more dwellings were sold on the secondary market than on the primary market.

Among all dwellings sold, three-room units accounted for the largest share – 39% of all transactions – followed by two-room units (29%) and units with four or more rooms (26%). On the secondary market, the dominance of three-room units was even stronger: 41% of transactions in 2024. On the primary market, two-room and three-room units each accounted for approximately 35%. In 2024, the average dwelling sold had 54 m².

In Warsaw, 24.4 thousand dwellings were sold – an increase of 3.5% compared with 2023. Kraków ranked second (15.3 thousand), followed by Wrocław (14 thousand). Gdańsk also exceeded the threshold of 10 thousand dwellings sold.

In 2024, foreign buyers purchased 17.3 thousand dwellings in Poland – 6.6% of total sales. This was slightly higher than in previous years. In 2022, foreign buyers accounted for 6.2% of transactions, and in 2023 for 5.7%, corresponding to around 14.3 thousand units in both cases.

Jędrzej Lubasiński

Venezuela Under Pressure From Sanctions and Declining Oil Production

3% projected drop in Venezuela’s GDP in 2026

32% y/y decline in Venezuelan crude oil exports to the US in January–September 2025

approx. 7.9 million people who left Venezuela by the end of 2024

According to IMF forecasts, Venezuela’s GDP will fall by 3% in 2026. The economic situation had already deteriorated in 2025, when GDP growth reached only 0.5%, compared with an average 4.6% in 2021-2024. That earlier growth had largely resulted from the easing of sanctions. At the same time, inflation has surged again since 2024, reaching 270% in 2025 and potentially rising to 680% next year. The latest results of ENCOVI, the only available living-conditions survey, show some improvement in poverty reduction: in 2024, 73% of the population lived in poverty (compared with 91% in 2021). While living conditions improved thanks to economic stabilisation, a reversal of this trend is likely in the coming years.

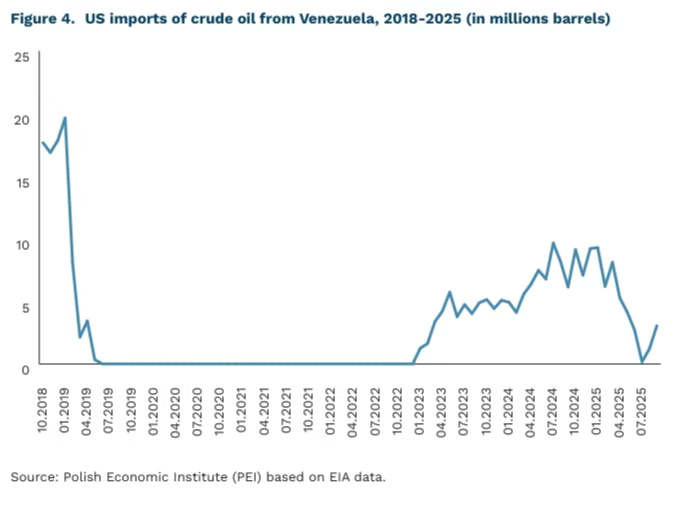

The current US policy towards Venezuela combines economic and military pressure, aiming to weaken Nicolás Maduro’s regime, strengthen the US position on the oil market, and limit Venezuela’s ties with China, Russia and Iran. US sanctions on the Venezuelan oil sector, tightened in spring 2025, revoked production and export licences for companies such as Repsol and Eni, allowing only the US company Chevron to continue operations, although even its activities are being phased out. As a result, US imports of Venezuelan crude fell by almost one third y/y in January–September 2025, accounting for around 2% of total US supply (compared with 3% in 2024). Trade relations between the US and Venezuela are now essentially limited to crude oil and petroleum products (over 90% of total US imports from Venezuela in 2024) and seafood (1.5%) (ITC data).

Each deterioration of the situation in Venezuela affects the entire region, primarily through outward migration. Between 2015 and 2024, roughly 7.9 million people left the country, 85% of whom remained in Latin America. The main host countries include Colombia (approx. 3 million people), Peru, Ecuador and Chile. In 2024, 83% of Venezuelan emigrants were employed. According to 2022 studies, Venezuelan labour-market participation has not had a significant negative impact on host-country labour markets. Any downward pressure on wages affected mainly low-skilled workers employed in the informal sector. However, under a severe scenario, such as a potential US military intervention, migration f lows could increase sharply, with destabilising effects across the region.

The rising likelihood of US military action against Venezuela may also have negative consequences for Caribbean island states. Their economies are heavily dependent on tourism: according to the ILO, total (direct and indirect) employment in tourism reached 91% in Antigua and Barbuda, 84% in Aruba, and 78% in Saint Lucia in 2019.

Katarzyna Sierocińska

Rising Energy and Fuel Prices and Labour Costs Will Drive Operating Expenses in Q4 2025

91.8% share of accommodation and food service firms identifying rising energy and fuel prices as a major cost driver in Q4 2025

81.7% share of accommodation and food service firms identifying rising labour costs as a major cost driver in Q4 2025

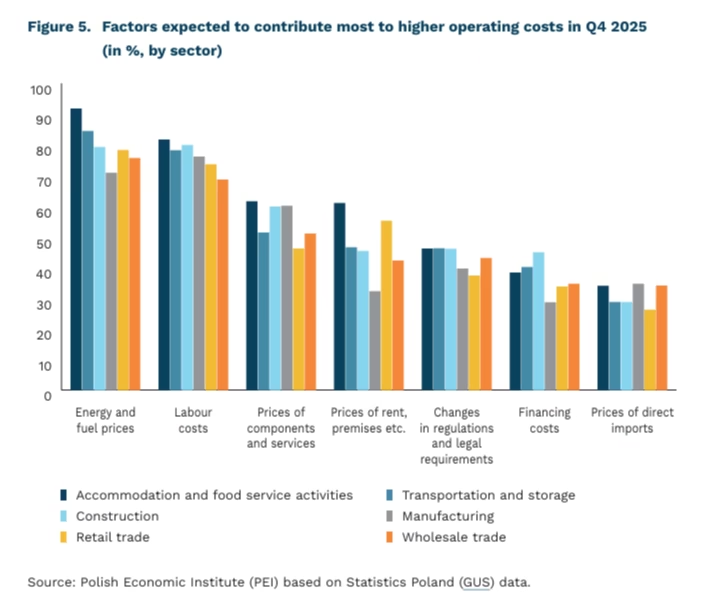

Rising energy and fuel prices, along with labour costs, will – according to business leaders – be the factors exerting the strongest upward pressure on companies’ operating expenses in the fourth quarter of 2025, according to data from Statistics Poland (GUS). More than 70% of surveyed firms pointed to these two categories. The impact of energy prices is particularly visible in accommodation and food service activities (91.8%) and in transport and storage (84.5%), where energy use is structurally high.

Managers’ opinions regarding the impact of rising labour costs on operating expenses are relatively consistent across sectors. With rapid wage growth in Poland, higher labour costs are becoming a challenge regardless of industry. The strongest concerns are reported in accommodation and food service activities (81.7%), where demand for temporary staff increases in the fourth quarter due to Christmas and New Year events.

Rising prices of components and services ranked third among the factors expected to increase operating costs in the final quarter of the year. The highest shares of responses came from accommodation and food service activities (61.6%) and manufacturing (60.2%), sectors in which input prices directly affect operating expenses.

Entrepreneurs’ views on the expected impact of prices of rent, premises etc. vary significantly across sectors. The highest shares of responses were recorded in accommodation and food service activities (61.1%) and retail trade (55.3%), both exposed to high and rising commercial rental rates, especially in prime locations.

Between just under 30% and slightly over 45% of firms indicated that regulatory changes and rising financing costs would increase operating expenses in the fourth quarter of 2025. Regulatory changes were cited most frequently by firms in transport and storage (46.4%) and accommodation and food service activities (46.3%). Rising financing costs were of greatest concern to construction firms (45.1%), which often rely on long-term loans, and least to manufacturing firms (28.8%).

Businesses’ assessments of the effect of rising direct import prices on operating costs are relatively even across sectors. More than one in three firms in manufacturing, wholesale trade, and accommodation and food service activities, as well as around one in four in retail trade, expect this factor to exert upward pressure on costs in the fourth quarter.

Firms in accommodation and food service activities, transport and storage, and construction were more likely than those in other sectors to anticipate strong cost pressures stemming from price increases across individual categories in the fourth quarter of 2025.

Urszula Kłosiewicz-Górecka

Preparation for ICT Careers Begins as early as High School

25 pp the difference in how much more often graduates of STEM-oriented classes in Romania express interest in a technology career compared with graduates of humanities/social-science tracks

approx. 50% the extent to which the impact of STEM-track education on women’s interest in STEM careers is weaker than the impact on men

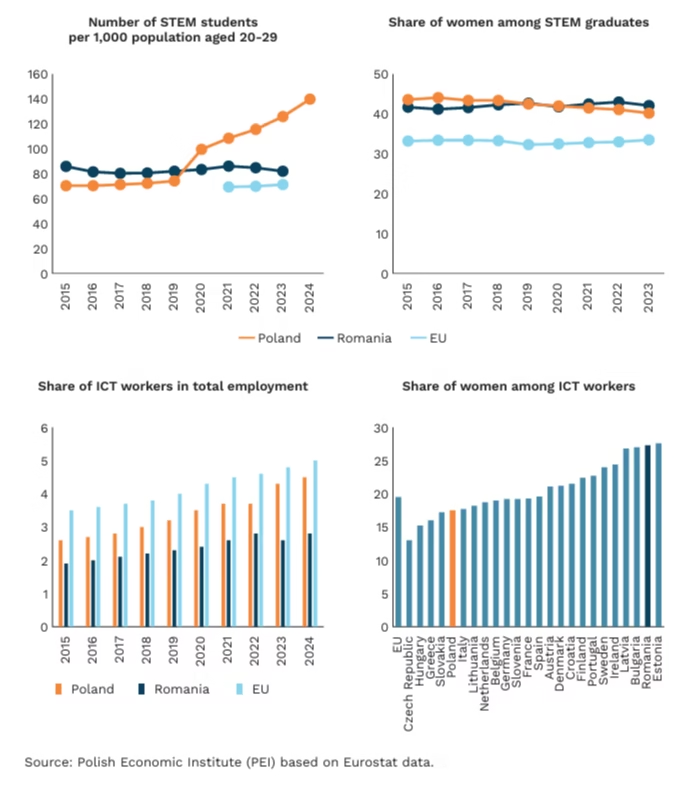

The level of technical competencies, including the availability of ICT specialists in the labour market, is one of the key determinants of the competitive potential of modern economies. At a strategic level, this is typically measured by the number of graduates in STEM(1) fields or the share of workers employed in relevant occupations. However, recent research shows that high school education has a significant effect on career choices.

High school students in Romania who attended STEM-oriented classes (with an extended curriculum in mathematics, computer science or natural sciences) are more likely to choose STEM university programmes, regardless of whether they initially expressed interest in a STEM or humanities track when applying to high school. They are also 25 pp more likely than humanities/social-science track graduates to declare interest in a technology-related career. The authors of the study, based on a large dataset covering several cohorts of Romanian high schools, refer to this as ”malleability of minds”. After controlling for initial preferences, gender and academic performance, they highlight how strongly adolescent educational pathways shape later choices.

Algorithmic career-recommendation tools that match individuals to occupations based on their stated preferences assign STEM-track students occupations involving technical tasks 10 pp more often, and humanities-related tasks almost 10 pp less often. As a result, graduates who followed a STEM-oriented track in upper secondary school have a higher likelihood of entering engineering and technical occupations, which are professions currently in shortage.

The study’s authors suggest that STEM-track students’ decisions to pursue STEM university programmes and careers originate from higher self-assessed competence in scientific subjects and a stronger preference for learning them. This effect persists over time (with a second measurement one year after graduation). More than 95% of surveyed secondary-school graduates stated that, when choosing a field of study and a profession, the alignment with their interests and skills is of paramount importance; therefore, strong self-assessed abilities in STEM subjects and genuine interest in them translate directly into choosing a pathway that nurtures these passions.

Interestingly, STEM-track graduates report higher subjective well-being despite the greater difficulty of their specialised subjects. Their higher well-being translates into stronger attachment to classmates and shorter time spent on social media than humanities/social-science graduates.

Negative consequences of specialising in STEM include lower development of verbal skills (e.g. less leisure-time reading), lower levels of empathy, and having fewer female friends. STEM-track graduates rate their abilities in reading, writing and memory-related tasks lower than graduates from humanities and social-science tracks.

Notably, the impact of STEM-track schooling on university choices, self-assessed skills and qualifications is very similar for male and female students. However, its influence on interest in technology careers is about 50% weaker for women than for men.

Poland’s current strategies aim to increase the share of ICT specialists from 4.5% of total employment today to 6% (from 770,000 to around 1 million). In this context, findings from the Romanian study may offer useful insights for shaping high school curricula – or at least for monitoring them, given that Poland does not currently collect data on the number of classes by educational track.

At the same time, labour-market trends show that technical skills alone are no longer sufficient; competencies such as creativity, curiosity and lifelong learning abilities are increasingly important.

The authors argue that education systems should avoid reinforcing a strict dichotomy between STEM and humanities/social sciences. Instead, they recommend fostering environments that combine technical knowledge with social and communication skills. Elements of this approach can be found in Poland’s Digital Competence Development Programme, but the key challenge remains scaling, measuring and embedding these elements into strategic objectives.

Mind plasticity, highlighted in the study, may be relevant for increasing the number of women choosing STEM studies and careers. However, existing research shows persistent gender differences in STEM labour-market entry. One contributing factor is the stronger need for flexible working conditions reported by women, often linked to balancing professional and family responsibilities. Thus, STEM education alone is often not sufficient to encourage women to pursue STEM careers.

Eurostat data show that Poland has outperformed Romania and the EU average since 2020 in the number of STEM students and in the share of ICT specialists in total employment. However, the share of women among STEM graduates has been slightly higher in Romania than in Poland (and much higher than the EU average), and the proportion of women employed in ICT in Romania is among the highest in Europe and well above the EU average.

- STEM – Science, Technology, Engineering, Mathematics.

Agnieszka Wincewicz-Price, Ignacy Święcicki