Electric vehicle battery exports in the EU will triple by 2030

Published: 26/10/2022

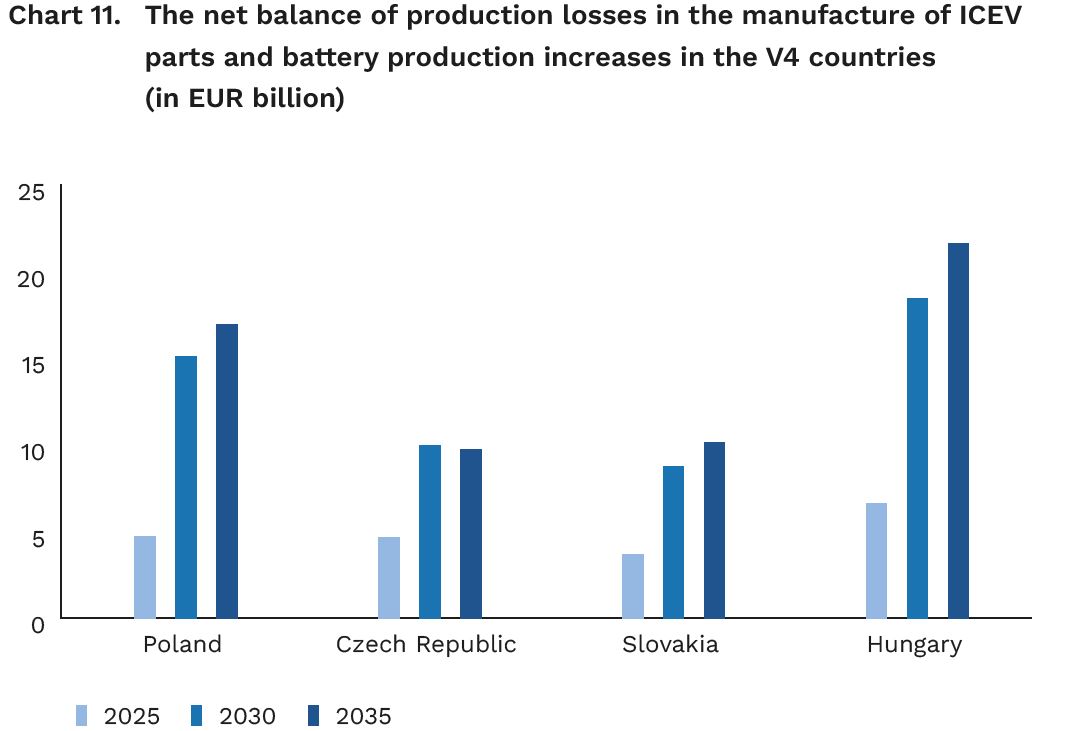

In 2019, Poland’s automotive production was EUR 45 billion, whereas the respective figure for the Visegrad Group exceeded a total of EUR 160 billion. Due to the planned legislative changes in the EU, the share in the Polish industry of the production of ICEV* parts to become unnecessary after the entry into force of a ban on the registration of internal combustion engine vehicles by 2035 will be 35 per cent; the expected loss of production value added in the traditional automotive sector in the V4 countries by 2035 can be EUR 22.8 billion, of which EUR 7.2 billion will be lost in Poland. However, the net balance of the automotive and battery production in the V4 countries by 2035 will be positive, at EUR 58.5 billion, whereas the respective figure for Poland will be EUR 16.9 billion. The development of battery production investments could increase the respective rates of GDP growth in the V4 countries and in Poland by 5.3 per cent and by as much as 2.6 per cent by 2035. Moreover, electric vehicle battery exports in the European Union will triple by 2030 – according to the PEI report entitled ‘The impact of the Fit for 55 package on the automotive industry in the Visegrad Group. Budgetary effects of more restrictive emission performance standards’.

‘As shown in the report, the EU regulations will significantly affect the automotive sector. The estimated increase in public revenues in the V4 countries by 2035 as a result of the lost production of ICEV parts and rising battery production for the automotive sector will be as much as EUR 13.3 billion, of which EUR 7.4 billion will be generated in Poland. The sector already ranks among the fastest growing industries. In 2021, Poland’s exports of Li-ion batteries totalled EUR 6.6 billion and represented more than 2 per cent of Polish exports. The value added of the EV battery market in Europe could be EUR 625 billion by 2030. The respective figures for the Visegrad Group and for Poland could then be EUR 73.2 billion and EUR 24.1 billion’, says Magdalena Maj, the head of the energy and climate team at the Polish Economic Institute.

What will be the main consequences of the Fit for 55 package for the automotive sector?

The implementation of the Fit for 55 package and its proposal for amending Regulation (EU) 2019/631 of the European Parliament and of the Council regarding emission reduction in the manufacture of passenger cars and light commercial vehicles intended for sale in the EU market will bring about major changes on the map of the automotive industry in Poland. Total average emissions from such vehicles newly registered in the EU are supposed to be cut from the current level of approx. 100 g CO2/km to 0 g CO2/km by 2035.

The expected loss of production value added in the traditional automotive sector in the V4 countries by 2035 as a result of the introduction of the Fit for 55 package could be nearly EUR 23 billion, of which EUR 7.2 billion would be lost in Poland. But the anticipated budgetary gains considerably exceed potential financial losses as the net balance of automotive and battery production in the V4 countries by 2035 – i.e. the year from which it will be impossible to buy and register within the Community a new vehicle running on petrol, diesel, LPG or CNG – could be around EUR 60 billion, of which EUR 16.9 would be generated in Poland. It means a rise in GDP in the V4 countries by an average of 5.3 per cent by 2035 and an increase in public revenues by over EUR 13 billion.

‘On banning the registration of internal combustion engine vehicles and as electromobility develops, around 35 per cent of the current production of automotive parts in Poland will become unnecessary. The respective shares for Hungary and Slovakia will be even higher, at about 50 per cent. As regards Polish production, approx. 22 per cent of subassemblies can be adapted for use in electric vehicles, whereas the remaining production (43 per cent) includes parts fully compatible with electric vehicles’, summarises Krzysztof Kutwa, a PEI analyst.

* all references to internal combustion engine vehicles (ICE vehicles, ICEV) include passenger cars and light commercial vehicles

The report was prepared in cooperation with the Electric Vehicles Promotion Foundation.

Kategoria: Analysis / Climate and Energy / Press releases / Report / Reports 2022