EU could replace Russian oil imports

Opublikowano: 09/03/2022

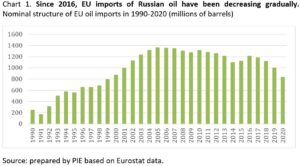

Russia exported over USD 100 billion worth of oil in 2021. The profits of selling oil to EU countries alone make up around 10% of Russia’s central budget. In January 2022, the higher prices on global markets mean that revenue from oil sales increase by over 90% compared to the monthly average the previous year. Russia uses some of the money from oil exports to finance investments in the territories it has been occupying since 2008 and 2014. Reducing this source of financing seems essential to halting further Russian expansion, the Polish Economic Institute’s analysts emphasize. In 2019-2020, Russian oil accounts for 25% of deliveries to the EU. Replacing it with oil from countries including Norway, the UK, the United States, Iran and Kazakhstan could make the EU independent from deliveries from Russia.

“Oil is the main product exported by Russia. Its oil exports mainly go to European countries; in 2021, the largest importers of Russian oil were the Netherlands (16% of the value of Russian exports) and Germany (8%). Russian oil imports to the EU need to be limited to cut off the key sources financing the country’s military expansion,” said Piotr Arak, director of the Polish Economic Institute. “In the case of Poland, one of the pillars of withdrawing from importing Russian oil is the Naftoport in Gdańsk. It has enough capacity to meet the demand for oil in Poland and some of that in Germany. Over the next few months, this will provide us with security if imports of Russian oil are discontinued. In the longer term, it offers us the potential to expand infrastructure, increase capacity and find new suppliers,” he added.

It is possible to limit oil imports from Russia

Since 2010, the share of Russian oil in EU imports has fallen from 34% to 25% in 2019 and 2020. Slovakia was the most dependent on Russian crude oil; all of its oil imports came from Russia and covered all of the domestic demand. In Finland, the share of Russian oil exceeded 80% of consumption. It is worth noting that, in 2020, 10 of the EU’s 27 member states did not import oil from Russia at all. In 2019-2020, Poland was the second-largest importer of Russian oil in the EU, after Germany. In 2019, Poland imported 195 million barrels of oil, including 133.4 million barrels from Russia (68%). The following year, this was 183.3 million barrels, 131.2 million of them from Russia (72%). “Russian oil dominated in Poland, mainly for price and structural reasons. However, while Poland imported as much as 93% of its oil from Russia in 2000, it has recently diversified supplies through contracts with Saudi Arabia, the United States and Norway,” said Magdalena Maj, head of the climate and energy team at the Polish Economic Institute.

In 2020, EU countries produced around 0.14 billion barrels of oil, less than 5% of EU demand. During the first phase, increasing the EU’s potential to become independent from oil from Russia should be based on the possibility to receive oil from the UK and Denmark. These countries recorded a surplus of around 300 million barrels of oil compared to their own consumption in 2019 and 2020 – almost 9% of EU demand, Magdalena Maj added.

An EU without Russian oil

The Polish Economic Institute’s experts have identified three potential sources that would diversify oil deliveries to the EU. These would allow the EU to stop importing oil from Russia completely:

- An agreement with Iran to restrict its nuclear programme. Iran currently produces 2.5 million barrels a day, but only 0.7-1 million is exported (mainly to China). By the end of the year, production could be increased by nearly 1.3 million barrels per day. Daily production in Russia is over 10 million barrels per day, of which around 2.3 million barrels were exported to the EU in 2020. According to these estimates, increasing exports from Iran would replace almost 60% of Russian oil deliveries to EU countries. In addition, if China were to replace oil imports from Iran with Russian oil, the EU’s import capacity could increase by another 0.6 million barrels per day.

- Greater use of the opportunities to import from Norway. So far, China and India have largely benefited from oil deliveries from Norway, but are likely to increase their oil imports from Russia as a result of the current war in Ukraine. This will create an opportunity for the EU to make better use of the existing infrastructure connecting it to Norway. Deliveries of oil and gas accounted for 40% of Norway’s entire exports in 2020. The largest importer of oil from Norway is China (15%), which received 0.24 million barrels of oil per day, and which could be redirected to Europe, where 1.1 million barrels of Norwegian oil per day were already being consumed in 2020.

- Increasing deliveries from the United States and Kazakhstan. The US has recorded a clear increase in oil exports. The European Environmental Agency’s analysts forecast that US oil production will increase in 2022 and 2023 from 9 million to a record 10.4 million barrels of oil per day. In addition, Kazakhstan plans to increase oil production, due to the increase in extraction from the deposit-rich Kashagan and Tengiz fields.

Kategoria: Analysis / Press releases / Russia's invasion of Ukraine