The CIT gap may have amounted to as much as PLN 21.4 billion in 2017

Press release

Published: 03/08/2022

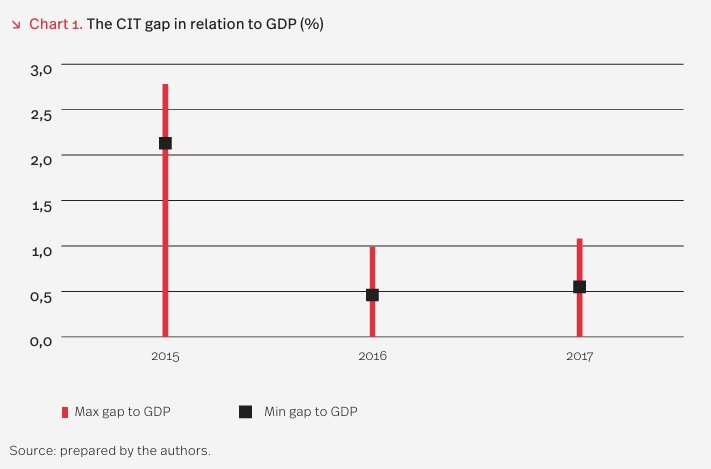

In 2017, the gap in corporate income tax (CIT) revenues may have reached a maximum of 1.08% of GDP, according to the latest report by the Polish Economic Institute (PIE) entitled “The horizon of optimisation – the origins, scale, and structure of the CIT gap.” This is one of the first comprehensive attempts in Poland to examine one of the most serious threats to public finances, alongside the VAT gap.

In 2017, the CIT gap ranged between PLN 11 billion and PLN 21.4 billion, corresponding to 0.55%–1.08% of GDP. When compared to theoretical tax revenues (the CIT gap plus actual budget revenues from CIT), the gap amounted to between 22.43% and 36%. The maximum value of the CIT gap was PLN 18.4 billion in 2016, and as much as PLN 50 billion in 2015. The wide range between the lower and upper estimates results from the maximin assumptions adopted in the analysis. This means that while the actual size of the gap lies within the indicated interval, its precise value cannot be determined with full certainty.

The report prepared by the Polish Economic Institute constitutes a comprehensive attempt to calculate the difference between the amount of tax revenue that should have been collected and the amount actually recorded. In recent years, considerable attention has been devoted to reducing the VAT gap, while analysis of the CIT gap has been much more difficult due to the lack of established standards and limited access to detailed data, explains Piotr Arak, Director of the Polish Economic Institute. This is why the Institute decided to undertake a comprehensive study of the issue, making use of the tools and resources at its disposal.

Methodology behind the estimates

The results presented in the PIE report were obtained using an original methodology based on calculating theoretical taxable income using national accounts data reported by Statistics Poland (GUS). This figure was then adjusted using selected data from the Ministry of Finance, as well as for differences between financial reporting and tax reporting, says Marek Lachowicz, Head of the Macroeconomics Team at the Polish Economic Institute.

Multiplying the estimated income by the effective tax rate yields the theoretical level of tax revenues, which is then compared with actual budget revenues. To the resulting gap, the analysis adds a foreign component and a tax audit component.

What is the CIT gap?

The CIT gap is defined as the difference between the theoretical revenues from corporate income tax that the state should receive and the actual revenues recorded in the budget. Interest in the CIT gap stems from the success achieved in reducing the VAT gap, which has demonstrated how significant financial reserves may be hidden in tax inefficiencies.

Apart from unintentional errors, the CIT gap results from failure to file tax returns, underreporting of the tax base, and arrears in tax payments, explains Marek Lachowicz. Mechanisms aimed at reducing the amount of tax paid can be grouped into three main categories: concealing revenues, inflating costs, and artificial cross-border transfers..

***

The Polish Economic Institute is a public economic think tank with a history dating back to 1928. Its main research areas include foreign trade, macroeconomics, energy, and the digital economy, as well as strategic analyses of key areas of social and public life in Poland. The Institute prepares analyses and expert studies supporting the implementation of the Strategy for Responsible Development and promotes Polish research in economic and social sciences domestically and internationally.

Media contact:

Andrzej Kubisiak

Head of the Communication Team

E-mail: andrzej.kubisiak@pie.net.pl

Tel.: +48 512 176 030