Economic Weekly 18/2025, May 9, 2025

Published: 09/05/2025

Table of contents

Straight to University and Work After Secondary School

275,000 secondary school graduates will take their final exams this year

84% of secondary school graduates plan to combine study with work (SW Research)

19% of people aged 20-24 combine study with work (Eurostat)

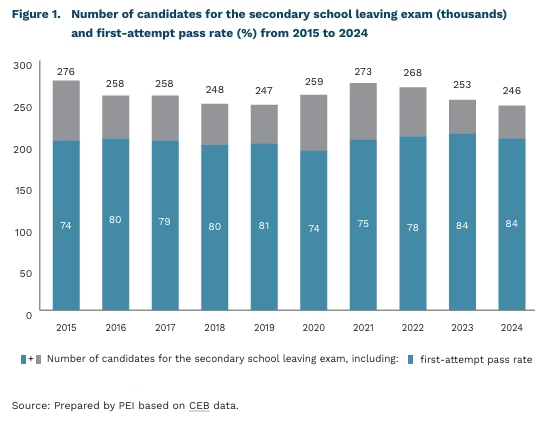

More than 275,000 students from general secondary schools, technical colleges and second-level vocational schools have declared their intention to take the final exams this year, according to the Central Examination Board (CEB). In addition to current graduates, the exams will also be taken by individuals from previous years who either did not take the exam, failed it, wish to sit a new subject, or aim to improve their previous results. In total, around 573,000 oral and over 1.4 million written exams will be conducted in 2025. In 2024, 246,000 people took the exam, with 84% passing on the first attempt. This high pass rate has been sustained for the second consecutive year. Previously, it only reached or exceeded 80% in selected years. Among the candidates in 2025 are 706 Ukrainian citizens who arrived in Poland following the outbreak of Russia’s war on Ukraine – more than double the 268 war refugees who took the exams the previous year.

In 2025, 38% of secondary school graduates will take only one subject at the extended level. One in three candidates intends to take two extended-level subjects, while 24% will take three. As in previous years, English remains the most popular additional subject (72%). Far fewer graduates choose extended mathematics (26%), geography (23%), Polish (19%) or biology (16%). English, mathematics and geography have consistently been the three most frequently selected extended subjects in recent years. However, the increasing popularity of English is particularly notable. At the same time, mathematics has overtaken geography to become the second most frequently chosen extended-level subject since 2021.

Only 12% of secondary school graduates do not plan to enter higher education. Among those who do, as many as 84% intend to combine their studies with work, according to a survey conducted by SW Research on behalf of OLX in April 2025. Most of them cite gaining professional experience (65%) and achieving financial independence from their parents (64%) as key motivations. The importance of professional experience is further confirmed by data from the The Polish Graduate Tracking System (ELA). According to ELA, individuals who combine study with employment tend to secure higher earnings after graduation and face a lower risk of unemployment. The Polish Economic Institute (PIE) has also emphasised the role of work experience in increasing labour market value – particularly in relation to salary bonuses.

Survey declarations and actual outcomes often differ significantly. In 2024, 54% of people aged 20-24 were enrolled in education and training – slightly below the EU average of 56%, according to Eurostat. At the same time, only 19% of individuals in this age group combined study with employment, also below the EU average of 23%. However, this share has grown rapidly in recent years – from just 11% in 2020.

Anna Szymańska

Poland Among the Leading OECD Countries in Intergenerational Educational Mobility

26 p.p. was the gap between the share of people aged 25-34 with higher education and that of those aged 55-64 in Poland in 2023

17 p.p. was the average difference across OECD countries

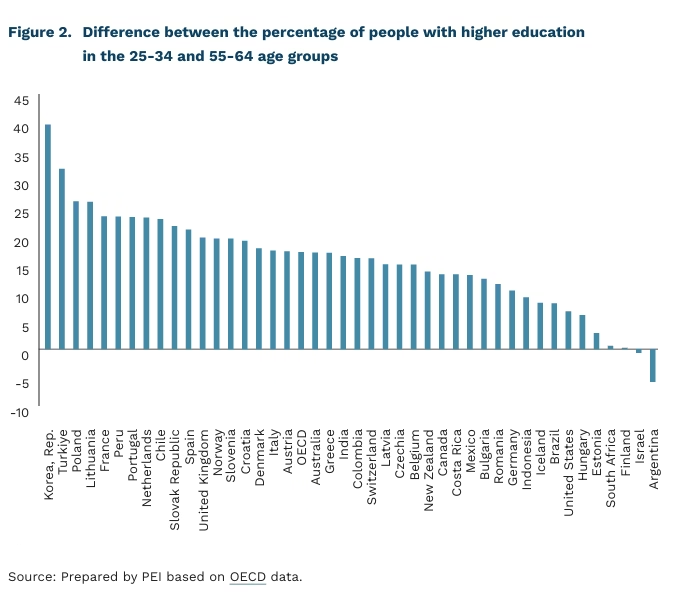

Poland ranked among the leading OECD countries in terms of intergenerational educational mobility. In 2023, 46% of individuals aged 25-34 had completed higher education, compared with just 20% of those aged 55-64. This represents a 26 p.p. difference between the younger and older cohorts – significantly above the OECD average. This result placed Poland third among OECD countries, following South Korea (40 p.p.) and Turkey (32 p.p.).

The high level of intergenerational educational mobility observed in Poland since 1989 has brought the Polish population closer to the OECD average in terms of higher education attainment. In 2023, 38% of adults in Poland had completed higher education, compared with 40% on average across OECD countries. A high share of tertiary-educated individuals contributes to the skills and competencies of the workforce, enhances productivity, and has been – and continues to be – a key factor in attracting foreign investment to Poland. It also serves as a foundation for the growth of knowledge-based industries.

However, such a rapid increase in the share of people with higher education, concentrated within a relatively short time, may have adverse implications for fertility rates and broader social cohesion. Research by Claudia Goldin suggests that countries which modernised their economies rapidly experienced the steepest declines in fertility. In contrast, those where economic modernisation progressed more gradually now report higher fertility rates.

Using the gap in higher education attainment between younger and older age cohorts as a proxy for the pace of economic transformation, we find further evidence supporting Goldin’s thesis: the larger the gap in higher education attainment between age groups, the lower the fertility rate. The Pearson correlation coefficient stands at -0.48. Poland is among the countries where economic transformation occurred in a short timeframe. The educational gap between younger and older cohorts is one of the largest in the OECD, and Poland’s fertility rate remains among the lowest in Europe.

Paula Kukołowicz

Iberian Blackout: The EU’s Most Severe Power Crisis in Over 20 Years

55 million people affected by a 12-hour power outage in Spain and Portugal on 28-29 April 2025

EUR 0.5-4.5 billion is the estimated cost of the blackout in Spain

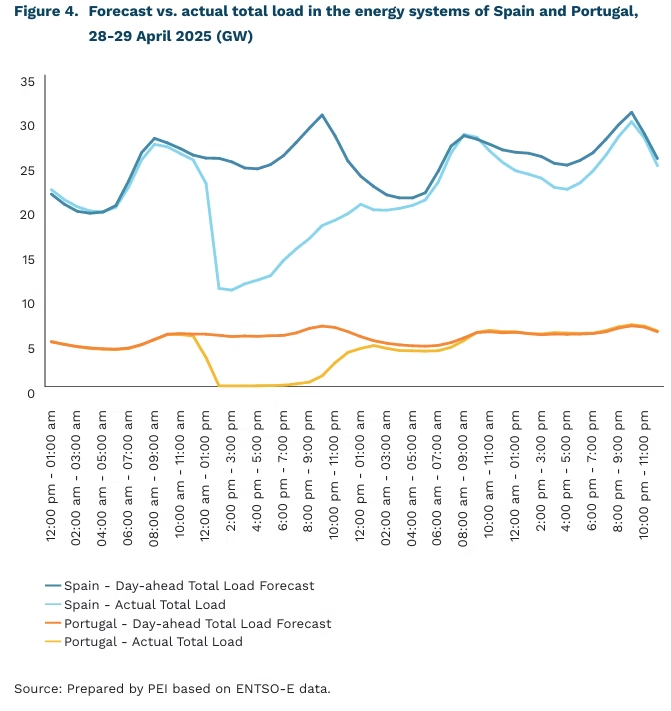

60% of Spanish citizens believe that the information provided by the Spanish government during power outage 28-29 April 2025 was “insufficient”. The blackout(1) that struck Spain and Portugal on 28 April 2025 resulted in a 12-hour power outage, affecting 55 million people. Due to a network failure, more than 15 GW of capacity was lost from the Spanish power system within just five seconds. The disruption also temporarily affected the French Basque Country. According to RTE, the French transmission system operator, households in the region experienced an outage lasting several minutes on 28 April. Largescale power failures of this magnitude have been extremely rare in the EU. The only more extensive blackout in recent European history occurred in Italy in 2003. Globally, the Iberian blackout is the most significant since 2012, when 700 million people in India were left without electricity for over 13 hours.

Preliminary estimates of the economic cost to Spain and Portugal vary significantly, ranging from EUR 0.49 billion to EUR 4.5 billion. The Spanish meat industry was particularly hard hit, potentially incurring losses of up to EUR 190 million. The Spanish Centre for Sociological Research (CIS) surveyed on the government’s crisis management and communication during the event. Nearly 60% of Spaniards considered the government’s communication during the blackout to be inadequate. When asked about preventive measures, 44.2% of respondents prioritised modernising the power grid, 41.7% pointed to increased investment in critical infrastructure, and 32.6% believed it was necessary to increase the number of generators in public services.

The European Network of Transmission System Operators (ENTSO-E) will establish an expert panel to investigate the causes of the failure. A Spanish government commission is also conducting its own inquiry. It has been confirmed that the failure originated in Spain and subsequently affected neighbouring Portugal. REE, the Spanish transmission system operator, has narrowed the cause to two incidents of generation loss at substations in south-western Spain. European Commission Vice-President Teresa Ribera stated that, in response to the blackout, ‘Europe will draw conclusions on the need for energy storage and investment in energy networks’, while cautioning against premature assumptions about the precise causes. The disruption experienced by Spain and Portugal is likely to intensify debate on grid security, where flexibility and stability are key components. As renewable energy sources play an increasingly central role in Europe’s energy mix, there is a growing need for additional stabilisation measures – either through energy storage or controllable low-carbon sources with greater system inertia, such as nuclear power.

- A sudden and sustained power system failure leading to a prolonged disruption of energy supply.

Marianna Sobkiewicz, Kamil Lipiński

India Emerges as a New Investment Alternative in Asia

USD 108 billion in greenfield investments announced in India in 2024

6.2% projected economic growth rate in 2025

28.8 years is India’s median age

As a result of the US–China trade dispute, other Asian countries are becoming increasingly important destinations for foreign direct investment (FDI). India, in particular, is emerging as a highly attractive alternative, as demonstrated by recent high-tech sector projects. Apple and its Taiwanese partner Foxconn are relocating iPhone production for the US market to India, with a new factory in Bengaluru playing a central role. Google is considering a similar move, intending to shift part of its Pixel smartphone assembly from Vietnam to India. Meanwhile, Taiwanese company PSMC, in partnership with Tata, is planning to build India’s first semiconductor factory.

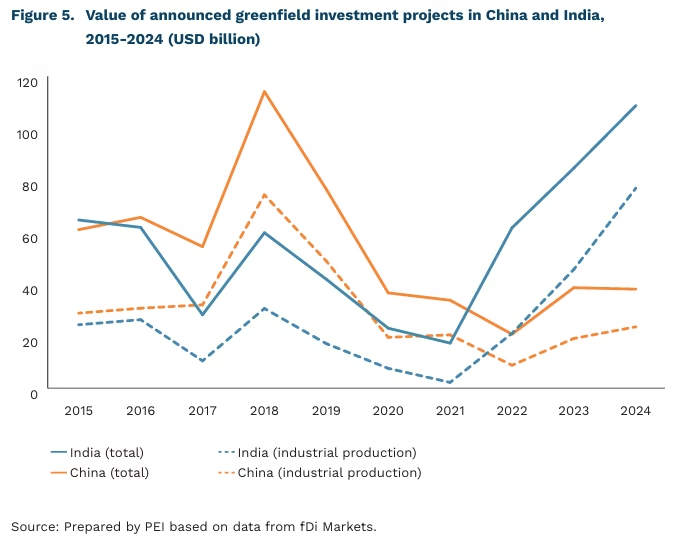

The record value of announced greenfield investments – especially in industrial production – signals a growing level of investor interest. According to fDi Markets, greenfield projects worth USD 108 billion were announced in India in 2024, nearly three times the amount in China. Over the past decade, one in every two dollars of greenfield investment in India has gone into manufacturing, followed by research and development and electricity. The United States remains the largest investor, followed by Japan and China.

India’s appeal extends beyond being a mere alternative to China amid ongoing trade tensions. Its attractiveness stems from a combination of factors, including market size, economic growth, and favourable demographics. With a nominal GDP of USD 3.91 trillion, India is currently the world’s fifth-largest economy. Based on purchasing power parity (PPP), it accounts for 8.53% of global GDP. The IMF forecasts indicate that in 2025, India’s GDP will grow by 6.2%, and by 2030, the country is expected to overtake Germany and Japan to become the world’s third-largest economy.

India is also the most populous country in the world – of its 1.42 billion inhabitants, as many as 624 million are under the age of 25, and the median age is 28.8 years. This demographic structure ensures a stable supply of labour, the cost of which in industry is, on average, half that of China. At the same time, India’s middle class is expanding, and now represents as much as 30% of the population. For investors seeking not only production capacity but also market access, this translates into growing demand potential and opportunities to benefit from economies of scale.

However, investing in India presents significant challenges, and the growing attractiveness of this market should therefore be approached with a degree of caution. Despite notable efforts by the government to deregulate and liberalise the business environment, the country continues to face persistent issues such as bureaucratic inefficiency, regulatory instability, and restrictive import regulations – all of which pose considerable barriers, particularly for industrial investors. Another commonly cited concern is the rigidity of the labour market and the high level of trade union activity. In 2022, nearly 38,000 trade unions were registered in India, a factor that may constrain companies’ operational flexibility. As a result, India remains less competitive than some other Asian economies, such as Vietnam, which have been successful in attracting relocated investments from China.

Dominik Kopiński

The Value of AI Investment Continues to Rise

USD 252 billion – global corporate investment in AI in 2024

USD 151 billion – record private investment in AI in 2024

15 private AI investments exceeded USD 1 billion in 2024

The rapid development of artificial intelligence (AI) is driven by a global race to secure technological leadership. Achieving this requires intensive research and development, substantial data-processing infrastructure, and the pursuit of innovative AI applications – all of which demand significant financial resources.

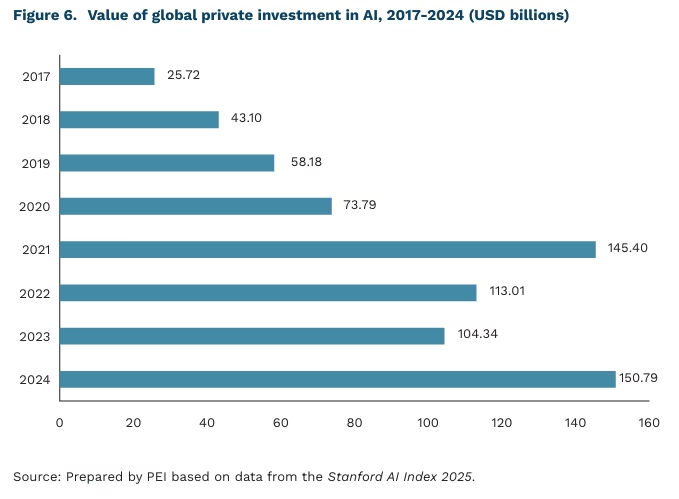

According to Stanford University’s AI Index report, global corporate investment in AI reached USD 252 billion in 2024, representing a 25% increase compared to 2023. Within this total, private investment reached a record high of nearly USD 151 billion, accounting for the largest share. This marks a 44.5% increase year on year, and a more than sixteenfold rise since 2013. Private investment in generative AI also continues to expand, reaching USD 34 billion in 2024 – an 18.7% increase over the previous year. Since 2019, this segment has grown by a remarkable 8.5 times in value.

The United States remains the clear leader in private AI investment, allocating over USD 109 billion in 2024. In the same period, European entities invested USD 19.4 billion, with Sweden (USD 4.34 billion), France (USD 2.62 billion), and Germany (USD 1.97 billion) leading the region. China also plays a significant role in the global AI investment ecosystem, contributing USD 9.29 billion to private investment. However, it is important to note that AI development in China is also heavily supported by public funding.

AI investments exceeding USD 1 billion are becoming increasingly common – there were 15 such investments in 2024, up from 9 in 2023. An additional 20 investments fell in the USD 0.5 to 1 billion range. The average value of individual AI investments is also rising; in 2024, it stood at USD 45.43 million.

AI investment is expected to remain a key component of the economic landscape in 2025. The United States, China, and the European Union have all announced extensive funding programmes to maintain or expand their competitive advantage in AI. This surge in capital is expected to fuel innovation, support the growth of AI-driven companies and start-ups, and increase demand for AI specialists.

Jakub Witczak

Growing Savings Among Polish Employees

52.14% – participation rate in Employee Capital Plans (PPK) among eligible individuals

PLN 34.5 billion – net asset value of PPK funds at the end of Q1 2025

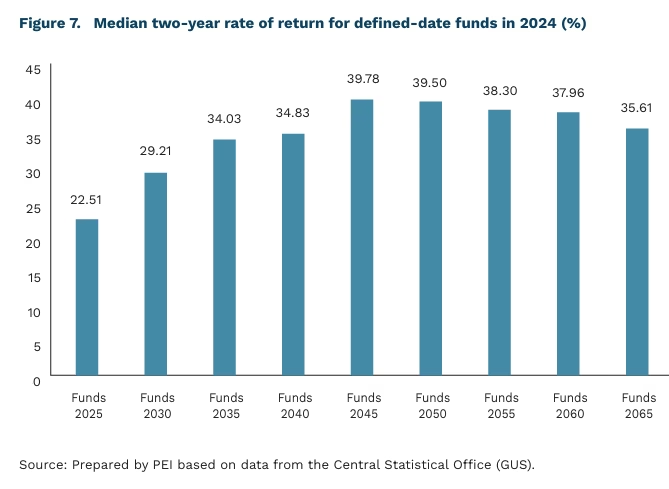

Employee Capital Plans (PPK) are gaining in popularity. The latest data shows that in 2024, the number of programme participants(2) increased by nearly 450,000 compared to the previous year, reaching 4.34 million savers. By the end of March 2025, this figure had risen to 4.61 million, representing an increase of 270,000 in just three months and a participation rate of 52.14%. For comparison, in the first quarter of 2024, the number of participants increased by 170,000, with a participation rate of 46.77%. Funds accumulated in PPK are invested in investment vehicles, whose net asset value also rose significantly – exceeding PLN 30 billion at the end of 2024 and reaching PLN 34.5 billion by the end of Q1 2025. This represents a year-on-year increase of 38.98% and 39.55%, respectively.

Fund returns remain strong, with performance differing significantly based on the risk profile of the investment portfolio. Each participant is assigned to a fund based on their age, specifically the year in which they will turn 60. For example, 2025-dated funds invest primarily in low-risk instruments, such as debt securities, and recorded the lowest – though still relatively high – median two-year rate of return in 2024 at 23.51%. By contrast, the 2045 fund delivered the highest median two-year return, reaching 39.78% in the same year. According to official disclosures, the 2045 fund allocates approximately 40-70% of its portfolio to higher-risk instruments, which are designed to offer greater potential returns over time.

Despite the growing popularity of Employee Capital Plans (PPK), Poland’s retirement savings system remains less developed than those in countries such as the United Kingdom or New Zealand. The British Workplace Pension scheme, a comparable programme launched in 2008, achieved a participation rate of 88% in 2023. A significant disparity is also evident in the value of assets under management. The Workplace Pension holds assets exceeding PLN 1 trillion, equivalent to approximately 8% of the UK’s nominal GDP. By comparison, the total assets held in PPK account for only around 1% of Poland’s GDP. A similarly high level of participation is observed in New Zealand, where the KiwiSaver scheme has been operating since 2007. In 2023, KiwiSaver reached a participation rate of approximately 81%, and the total assets accumulated by savers exceeded PLN 251.3 billion, representing around 26% of New Zealand’s GDP.

2. Calculated as the total number of PPK participants managed by individual financial institutions.

Piotr Kamiński

Unlike Their Neighbours, Poles Become Less Happy with Age

7.63/10 – average overall well-being score of Poles, measured across six dimensions in the Global Flourishing Study

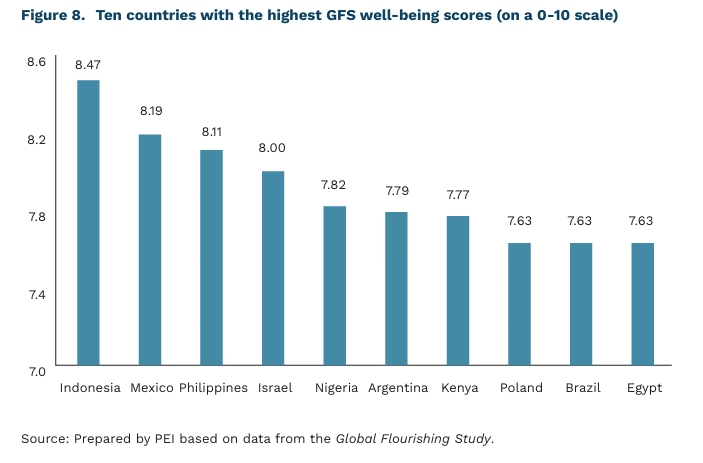

According to recently published data from the Global Flourishing Study (GFS), which applies an innovative methodology to assess human well-being globally, Poland ranked 8th out of 23 countries, with an overall well-being score of 7.63 on a 10-point scale. The originality of the Harvard University research team’s approach lies in its comprehensive framework for evaluating happiness and fulfilment. It accounts for cultural differences between populations and incorporates factors often overlooked in traditional well-being indices. In addition to standard measures such as life satisfaction, financial stability, and health, the study also includes dimensions such as meaning and purpose, or character and virtue (assessing character dispositions, grounded in virtue ethics). As a result, the study’s rankings may yield outcomes that differ markedly from other international indices.

Given the relatively small number of countries included in the analysis, the specific well-being dimensions that raised or lowered Poland’s overall score are more insightful than the ranking itself. In Poland, the main deficit is observed in the area of character & virtue. For instance, Poles were comparatively less likely to agree with the statement: „I am always able to give up some of my happiness now for greater happiness in the future”. By contrast, mental health has a significantly more positive than negative influence on Poles’ overall well-being. This pattern is also observed in most developing countries, and in only a few developed ones.

For respondents in Poland, the impact of financial and material circumstances on overall well-being is only marginally negative. This influence reduces the overall well-being score to a lesser extent than in countries such as the United States, Spain, or the United Kingdom. This may indicate that, in contrast to many developing countries, financial security in Poland is relatively stable. By comparison, in countries like Japan and Sweden, the f inancial situation contributes positively to well-being scores. This suggests that financial well-being is just one of many factors contributing to life satisfaction – and by no means the most decisive.

In Poland, life satisfaction tends to decline with age – with individuals reporting the highest levels of happiness in youth. This trend runs counter to that observed in other developed countries, such as Germany, and more closely resembles patterns found in lower-income countries of the Global South. However, the differences between age groups in Poland are relatively modest. The oldest respondents (aged 60+) reported being only about 5% less happy than 20-year-olds. The primary barrier to achieving greater well-being in later life is the sharp decline in physical health associated with ageing.

The Global Flourishing Study (GFS) stands out for the rigour and originality of its methodology. It is a longitudinal study in which the same group of over 200,000 individuals is surveyed over several years on various aspects of well-being. Crucially, the questionnaire is designed to reflect cultural nuances in a way that mere translation cannot guarantee, allowing for greater relevance to the local context of each country. This approach enables a more accurate understanding of the factors that genuinely influence human happiness, while limiting the bias introduced by implicit assumptions often embedded in conventional measurement tools.

Łukasz Baszczak