Economic Weekly 31/2025, August 8, 2025

Published: 08/08/2025

Table of contents

5. Non-formal education includes various types of courses, training, and workshops organised outside the formal education or higher education system. These activities typically do not lead to formal qualifications but help to acquire new skills. Informal learning refers to knowledge and skills acquired independently, e.g. at home or in everyday situations (GUS).

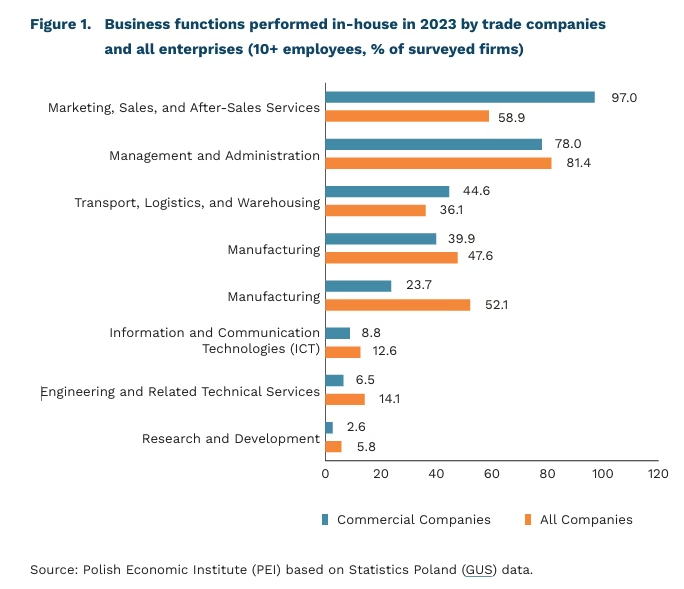

17.9% of trade enterprises in Poland outsourced business functions in 2023

97% of firms handled marketing, sales, and after-sales services exclusively in-house

only 0.4% of employees in the trade sector were involved in R&D activities

Trade companies in Poland have been increasingly affected by rising labour costs (65%), energy prices (51%), and economic uncertainty (57%), according to the July edition of the Monthly Business Climate Index (MIK). In response to these challenges, many companies are showing a strong inclination toward adopting new technologies – aiming to reduce costs, improve operational efficiency, and enhance customer service quality. One of the strategies being implemented is the outsourcing of selected business functions, also referred to as enterprise tasks.

In 2023, 82.1% of surveyed trade companies with 10 or more employees performed their business functions in-house, according to Statistics Poland (GUS). Meanwhile, 17.9% outsourced at least some business functions, either fully or partially. Among those, the vast majority (95.9%) contracted domestic partners, while only 4.1% outsourced these functions abroad.

According to GUS data, at the end of 2023, the surveyed trade enterprises most frequently carried out the following functions in-house: marketing, sales and after-sales services (97% of companies), management and administration (78%), and transport, logistics and warehousing (44.6%). The least commonly performed in-house were research and development (R&D) tasks (2.6% of surveyed firms).

Marketing, sales and after-sales services involved 65% of all employees in the surveyed trade companies, according to GUS. The next two groups of business functions, i.e. management and administration, and transport, logistics and warehousing, jointly accounted for 19.8% of employees in the trade sector. Only 0.4% were involved in R&D-related activities.

Trade enterprises were more likely than those in other sectors to carry out core business functions internally. This applied particularly to marketing, sales and after-sales services (97% in trade vs. 58.9% across all companies) and transport, logistics and warehousing (44.6% vs. 36.1%).

Notably, in 2023, compared to 2020, fewer trade companies performed certain business functions in-house. The share of firms independently implementing modern information and communication technologies declined from 13.2% in 2020 to 8.8% in 2023. Similarly, the share of firms managing marketing, sales, and after-sales services internally fell slightly from 97.7% to 97% (GUS data). This trend may reflect a growing inclination among trade firms to adopt cutting-edge technologies and rely on the expertise of specialised external providers.

Ongoing integration processes in the trade sector are expected to encourage greater use of outsourcing among small enterprises, which often lack in-house R&D departments. Leveraging the know-how of leading companies within integration groups allows for faster implementation of innovations, reduced technological risk, and lower costs associated with change – particularly when business services are tailored to the needs and scale of smaller businesses.

Urszula Kłosiewicz-Górecka

Wage Growth in the Enterprise Sector Remains Strong

4.7% y/y real wage growth in the enterprise sector in June

8.7% y/y nominal wage growth in June (excluding mining)

The pace of average wage growth in Poland’s enterprise sector remains elevated. In June, the average monthly salary reached PLN 8,881.84, representing a 9% y/y increase (compared to 8.4% y/y in May). The acceleration was driven primarily by a higher volume of additional payments such as bonuses and awards. Adjusted for inflation, real wages rose by 4.7% y/y, maintaining positive growth since August 2023 and peaking at 9.8% y/y in February 2024. In other words, Polish wages have been rising faster than prices. The strong annual increase is also supported by the January hike in the minimum wage, which, in terms of purchasing power, now ranks among the highest in the EU.

Wage growth varies across sectors. The sharpest increases in June were seen in mining (up to 21.4% y/y from 3.3% y/y in May) and energy (15.2% y/y from 8.7% y/y). In other sectors, the pace of wage growth remained broadly stable. Excluding mining, the overall wage growth rate rose slightly to 8.7% y/y from 8.5% y/y in May, but remained elevated. Wages in industry are now rising faster than in services – a reversal of last year’s trend, when wage growth in services outpaced that in industry. Over time, such dynamics may increase operating costs and put pressure on the financial health of firms, especially in low-margin sectors.

The continued rapid growth in nominal wages is an important consideration for decisions on the future path of interest rates. Strong wage dynamics and their slow deceleration exert pro-inflationary pressure, which may support the case for the Monetary Policy Council (MPC) to keep rates unchanged at its September meeting. However, upcoming data to be published in August will be key in shaping this decision. It is already clear that the moderation in wage growth will be uneven, following a slowdown in Q1, the pace of increase picked up again. In the months ahead, real wages are also expected to rise further due to lower inflation, driven by statistical base effects. This would be a positive signal for domestic demand, economic growth, and consumer sentiment.

Piotr Kamiński

Uncertainty Weakens Global Trade in Services

5% growth in global trade in services in Q1 2025

4 pp y/y decline in the growth rate of trade in services in Q1 2025

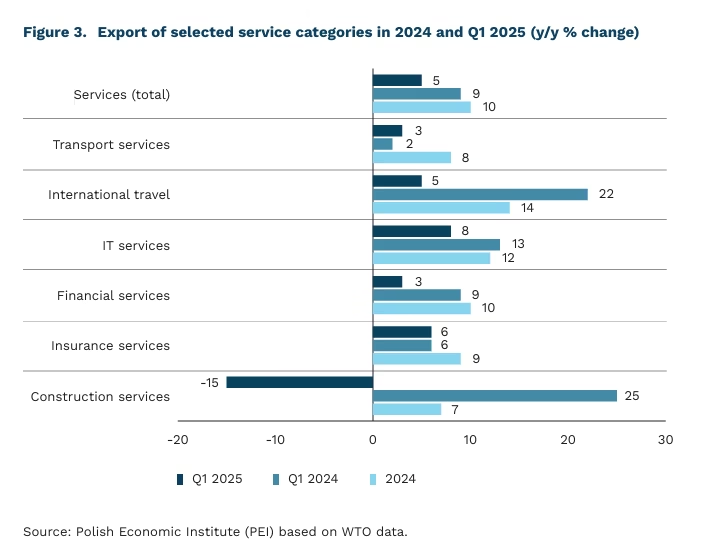

65% share of global services exports from North America and Europe in 2024

In Q1 2025, the pace of global trade in services slowed by half compared to the same period in 2024. During the first three months of this year, trade in services increased by 5%, down by 4 percentage points year-on-year. Nonetheless, this rate still exceeded the growth in global goods exports during the same period (4%). The slowdown likely reflects both a correction following rapid growth in recent years and mounting global uncertainty, including increased currency volatility. Between September 2024 and June 2025, the World Uncertainty Index (WUI) (WUI) nearly tripled. According to the July edition of the World Economic Outlook, global trade in goods and services is expected to decline by 0.9 pp y/y in 2025. While recent U.S. tariffs primarily target goods, they may also indirectly dampen demand for services.

The slowdown in services trade was most evident in Europe and North America, where growth reached just 3%. These regions remain the largest contributors to global services exports, accounting for 65% in 2024, according to WTO data (38% from the EU, including 19% from EU exports outside the bloc). In contrast, Asia maintained stronger momentum, with a 9% increase in services exports and a 25% share of the global total. Between January and May 2025, the highest year-on-year increases were recorded in China (+13%, January-June), India (+12%), and Japan (+11%). In Europe, Romania (+12%) and Lithuania (+11%) led the region, while Poland’s services exports grew by 6%.

The pace of service export growth declined across nearly all categories, except for transport services and manufacturing-related services (including repair and maintenance). Construction services also saw a drop, though their impact was limited as they made up just 1.4% of total service exports in 2024. The main categories of internationally traded services in 2024 were: other business services (24%), travel (20%), transport (17%), and computer services (12%). Among these, IT services maintained the highest growth rate in Q1, though it slowed from 13% to 8%. Outside of construction, the steepest decline was seen in financial services, where growth fell from 9% to 3%, likely reflecting weaker investment activity and greater currency volatility.

Katarzyna Sierocińska

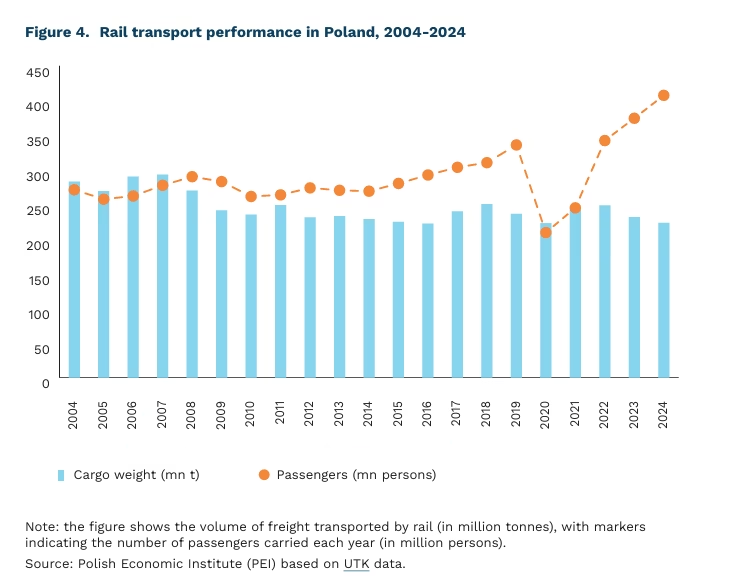

Rail Freight Stagnates Despite Record Passenger Volumes

223.5 million tonnes goods transported by rail in Poland in 2024 (-3.5% y/y)

70.7% share of mining and energy resources in total rail freight by weight

Unlike passenger rail transport, which is reaching record levels (407.5 million passengers in 2024, +8.8% y/y – the highest in the 21st century), rail freight in Poland remains stagnant with a slight downward trend. In 2024, 223.5 million tonnes of goods were transported by rail (-3.5% y/y). Operational output declined by 2.5% to 84.4 million train-kilometres, while tonne-kilometres dropped by 5.4% to 58.3 billion. The average haul distance fell by 2% y/y to 260.7 km. Despite this, Poland’s freight performance remains high in the EU. According to Eurostat, in 2023 Poland recorded 60 billion tonne-kilometres, compared to 125 billion in Germany and 29 billion in France.

In 2024, over 70% of rail-transported cargo by weight consisted of mining and energy-related products – including hard coal, lignite, coke, briquettes, crude oil and refined petroleum products, natural gas, metal ores, and other extracted materials. Their share in total rail freight continues to decline: 70.7% by weight and 66% by tonne-kilometres in 2024, compared to 74% and 68.5% respectively in 2021.

According to the Office of Rail Transport (UTK), the decline in the volume of goods transported by rail, the maintenance of a high average haul distance, and changes in the commodity structure of freight were influenced by the ban on imports and exports to Russia, as well as restrictions on rail transit of goods to and from Ukraine. Other contributing factors included the low commercial speed of freight trains – recorded in 2024 at 20.5 km/h or 30.7 km/h, depending on the calculation method – as well as ongoing issues with punctuality and service reliability.

Poland’s rail freight market is characterised by greater fragmentation and a different operating model than passenger rail. In 2024, 118 freight operators were active in the market, 94 of which reported cargo transport. By contrast, 24 passenger rail operators were active on the standard-gauge passenger network. Rail freight in Poland operates on a commercial basis, while passenger services largely rely on public service contracts. In 2024, 57.5% of passenger rail operators’ revenues came from subsidies. Public service passenger transport accounted for 98% of passengers, 91% of tonne-kilometres, and 94% of train-kilometres in the same year (UTK).

Krzysztof Krawiec

AI Is Reshaping Graduates’ Career Plans

75% of over 7,000 surveyed students from 9 countries expressed concern that AI will negatively affect their job prospects

11% UK university graduates changed career plans due to fears of competition from AI

A growing body of research indicates that the rapid advancement of artificial intelligence is fueling anxiety among students and graduates across various fields of study. Many fear that AI will reduce the demand for their skills and qualifications. In a 2024 survey conducted by Yugo, a global student housing provider, covering over 7,000 students from 9 countries,1 75% of respondents expressed concern that AI could negatively impact their employment prospects. In contrast, fewer than half (48%) viewed AI as a source of opportunity and innovation.

Job market anxiety tends to be highest in countries with more advanced AI adoption. The greatest levels of concern were reported among students in the United States and the United Kingdom (79%), Ireland (78%), and Portugal (75%). In contrast, students in countries where AI integration is still developing expressed more optimism: 65% in Australia, 62% in Italy, and 58% in Poland saw strong potential in AI. Germany stood out for its neutrality, with 47% of students indicating an indifferent attitude toward artificial intelligence.

Students’ concerns are increasingly influencing their decisions regarding future skill development. A survey conducted by the British career advisory organisation Prospects, involving over 4,000 graduates in the UK, revealed that 11% of respondents had changed their career plans due to concerns about competition from artificial intelligence. Moreover, half expressed uncertainty about their future prospects in the labour market. Among the fields of study most commonly perceived as being at risk from AI were programming, graphic design, data analysis, law, film, and other arts-related disciplines.

Data from the Polish National System for Monitoring the Economic Outcomes of Graduates show that the risk of unemployment among new labour market entrants steadily declined between 2014 and 2021, but has slightly increased in recent years. In the context of low overall unemployment, this may indicate a growing mismatch between higher education outcomes and labour market needs. In many professions requiring specialised skills, labour shortages have emerged – a trend driven not only by demographic changes but also by the misalignment of university curricula with industry demands. While the adoption of AI in the Polish economy remains relatively low, graduates currently face little direct competition from advanced technologies. Nonetheless, strong AI literacy and the ability to use such tools effectively may significantly enhance their attractiveness to prospective employers.

Agnieszka Wincewicz-Price

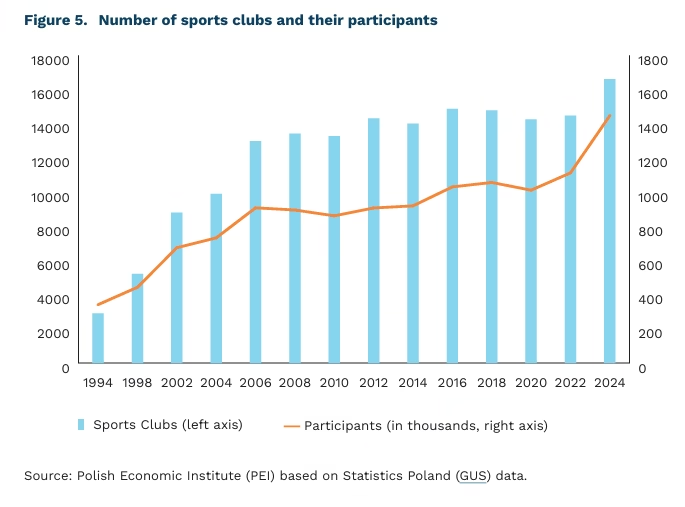

Record Number of Sports Clubs in Poland in 2024

1.447 million people training in sports clubs in Poland in 2024

0.48% share of employment in sports in total employment in Poland in 2024

28% share of women among all individuals training in sports clubs

+15% growth in the number of sports clubs between 2022 and 2024

According to Statistics Poland (GUS), the number of sports clubs operating in Poland in 2024 reached 16.6 thousand. This is an increase of 2.1 thousand clubs (i.e. 15%) compared to the previous count from 2022.2 Previously, the highest number of sports clubs had been recorded in 2016, with 14.9 thousand active clubs. The largest number of clubs is located in the Mazowieckie, Wielkopolskie, Śląskie, and Małopolskie voivodeships, which together account for 40% of all sports clubs in Poland.

In 2024, a record 1.447 million people trained in sports clubs. This represents a 30% increase compared to 2022. The number of participants in sports clubs has been steadily growing in Poland since 2012, when 907 thousand people were enrolled. In this context, it is important to consider not only the nominal figure but also its relation to the overall population. According to GUS, in the past year, 39 people per 1,000 inhabitants in Poland trained in sports clubs. This is significantly more than in previous years: 29 per 1,000 in 2022, 27 in 2018, and 26 in 2020.

In recent years, the number of women participating in sports clubs has seen a marked increase. Although women made up only 28% of all club participants in 2024 (approximately 405,000 individuals), their numbers have been rising at a faster pace than those of men. Between 2022 and 2024, the number of female participants grew by 32%, compared to a 29% increase among men. The gap in growth rates was even more pronounced in the 2020-2022 period, when the number of women training in clubs rose by 17% – 9 percentage points more than the growth observed among men.

The rise in sports participation has gone hand in hand with the growing significance of the sports sector in the labour market. In 2024, employment in sports3 accounted for 0.48% of total employment in Poland – the highest level recorded since Eurostat began collecting such data in 2011. The previous peak was in 2018, at 0.45%. This upward trend is also reflected in national data: according to Statistics Poland (GUS), the number of training staff in sports clubs, including coaches and instructors, increased by 24% between 2022 and 2024.

Jędrzej Lubasiński

AI Is Impacting Users’ Mental Well-Being

1+ billion users of the two largest U.S.-based AI chatbots

Generative artificial intelligence has evolved beyond being merely a tool for work or education – it is increasingly becoming a companion in users’ private lives, often serving as a conversational partner. This new form of human–machine interaction raises important questions about boundaries and risks that go beyond traditional concerns about technology’s impact.

Early interactions with AI may have positive psychological effects. A study conducted by researchers from OpenAI and MIT found that AI use can initially reduce feelings of loneliness. The analysis, based on more than 3 million user conversations with ChatGPT, used AI-driven methods to preserve privacy, without human access to content. Voicebased chatbots with emotionally engaging tones were shown to be particularly effective in alleviating loneliness.

However, the study also identified potential risks associated with GenAI. Intensive, long-term use of AI chatbots for personal conversations was linked to increased feelings of loneliness, emotional dependency, and compulsive behaviors resembling addiction. Features such as instant gratification, adaptive dialogue, and the absence of criticism may create an artificial sense of closeness. According to another study, this dynamic may serve as a substitute for authentic human relationships. Personalized responses and constant availability contribute to the emergence of pseudo-relationships between users and AI models.

The mode of interaction plays a crucial role. Chatbots with engaging, human-like voices elicited more empathy and emotional involvement than those using neutral voices or text alone. This effect is attributed to the vocal layer’s ability to mimic familiar patterns of human conversation. While it improves the quality of interaction, it also increases the risk of emotional overattachment. It is essential to recognize that AI systems are not neutral: they are commercial products designed by tech companies whose primary goal is user retention. From this perspective, the addictive potential of AI, despite its social costs, may be financially beneficial to the companies behind these tools.

ChatGPT currently has nearly 700 million users, while Gemini has around 450 million. These figures should prompt serious reflection from both technology providers and policymakers on the design and deployment of such tools, with a focus on mitigating potential social harm. The EU’s AI Act addresses this issue by allowing the prohibition of AI systems that pose risks to mental health. This creates a mechanism to pressure providers into making their products safer, at least within the European Union.

Jakub Witczak