Economic Weekly 34/2025, August 29, 2025

Published: 29/08/2025

Table of contents

Consumption Rebounds, Optimism Rises in the Economy

+4.8% y/y growth in retail sales in July (clearly above expectations)

+1.9 pts m/m increase in the Current Consumer Confidence Index (BWUK) and

+1.4 pts m/m increase in the Leading Consumer Confidence Index (WWUK) in August

43.9% of households say “now is a good time for major purchases” (vs. 39.5% a year earlier)

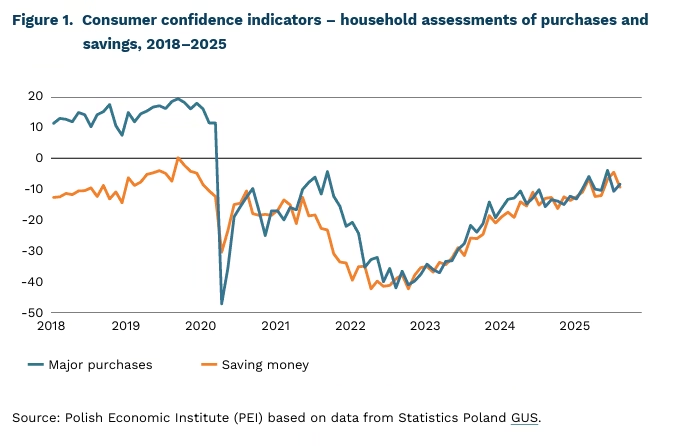

After a period of weaker dynamics, consumption is once again becoming an important driver of the economy. Falling inflation and rising real wages have visibly improved households’ disposable incomes, translating into a stable recovery in retail sales.

Sales signal a sustained rebound. July’s retail sales result was a positive surprise – an increase of 4.8% y/y, one of the strongest readings in recent years. While partly attributable to a favourable calendar effect, averaged data indicate a continued moderate upward trend. After excluding the most volatile categories (cars, food, fuels), sales growth reached more than 7.5% y/y – the highest since the beginning of the year. Durable goods sales accelerated sharply: clothing and footwear up 14.7% y/y, furniture and consumer electronics/appliances up 15.3% y/y. These figures confirm that real incomes are gradually restoring consumers’ purchasing power. Private consumption in the second half of the year will most likely maintain growth above 3% y/y, playing a significant role in stabilising economic growth.

Consumer sentiment strengthens the picture of improvement. In August, the Current Consumer Confidence Index (BWUK) rose by 1.9 pts m/m to –12.1, while the Leading Consumer Confidence Index (WWUK) increased by 1.4 pts m/m to –6.3. Most components improved markedly: expectations for the country’s future economic situation, households’ ability to make major purchases, and their own financial situation all strengthened, while inflation expectations weakened. This is also visible in detailed responses: 43.9% of respondents believe that now is a good time for major purchases (vs. 39.5% a year earlier), and a larger share also consider it a good time to save.

The combination of rising real incomes, solid retail sales, and a clear improvement in sentiment indicates that in the coming quarters private consumption will be a key contributor to GDP growth, even if its import-intensive nature reduces some of the benefits for domestic production.

Sebastian Sajnóg

Uranium Demand Grows More Slowly Than Expected

–10% Kazatomprom cut its 2026 uranium output plan from 33,000 t to 30,000 t

67,500 t global uranium demand in 2024

90,000–142,500 t projected uranium demand in 2050

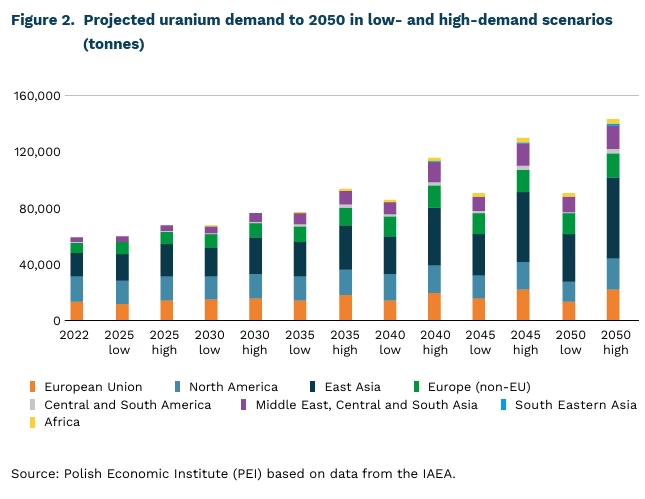

Kazatomprom, the world’s largest producer of natural uranium, has lowered its 2026 production target to 30,000 tonnes, down from the previously planned 33,000 tonnes. The company explained that the decision reflects weaker-than-expected growth in demand. Nevertheless, the revised target remains above the 2025 production plan of 25,000–26,500 tonnes. In 2024, despite a 10% increase in output, Kazatomprom recorded an 8% decline in uranium sales.

In 2024, Kazatomprom’s total output exceeded 23,000 tonnes of natural uranium, including 11,000 tonnes attributable to other companies through joint ventures(1). Global uranium demand reached 67,500 tonnes, with the largest consumers being the United States (18,100 t), China (13,100 t), and France (8,200 t). Together with Russia and South Korea, these five countries accounted for 79% of total global demand.

A key factor behind Kazatomprom’s decision may have been the decline in uranium spot prices in 2025. While long-term contract prices remained relatively stable at around USD 80 per pound (ca. 0.45 kg), spot prices fell in March 2025 to USD 63.5 – the lowest level since October 2023 and more than USD 40 below the January 2024 peak of over USD 100. Although spot prices have since rebounded to USD 74, volatility remains high.

Looking ahead, forecasts by the International Atomic Energy Agency (IAEA) point to steady and significant growth in uranium demand. Depending on the scenario for nuclear energy development, demand could reach up to 76,500 tonnes by 2030, while projections for 2050 range between 90,000 and 142,500 tonnes. The sharpest increase is expected in East Asia, driven primarily by large-scale investments in nuclear reactors in China, where demand is projected to rise from 16,400 tonnes in 2022 to 34,000–56,500 tonnes. Total identified uranium resources are estimated at 16.4 million tonnes, including 667,000 tonnes that can be extracted at costs below USD 40/kg and nearly 1.9 million tonnes at costs below USD 80/kg. The IAEA further estimates that undiscovered deposits may contain an additional 6.5 million tonnes of uranium.

- Production at some of Kazatomprom’s mines, although operated by the Kazakh company, is carried out through joint ventures. For example, the company operating the Inkai deposit is 40% owned by the Canadian firm Cameco.

Adam Juszczak

Ukraine’s Reconstruction Will Not Succeed Without Institutional Reforms

4 largest businesses in manufacturing sectors account for over half of Ukraine’s industrial sales in 2019

27% lower entry rate of new firms in sectors receiving investments from tax havens

+26% potential increase in Ukraine’s GDP from EU accession

Structural institutional problems have long been a barrier to Ukraine’s economic growth, according to a World Bank report. An analysis of firm-level data over the past 25 years shows that productivity in Ukraine has remained very low due to these structural weaknesses. The authors found that entrenched dominant firms consolidated market power through influence over regulation rather than productivity gains. As a result, more dynamic companies risked losing product lines to incumbents, which discouraged innovation and expansion. A sharp decline in competition and firm turnover became particularly evident after 2008, when the influence of large, state-connected enterprises over regulation intensified. Despite weaker resource allocation and lower innovation capacity, these f irms steadily increased their market share. At the same time, the relationship between f irm size and productivity weakened.

Foreign direct investment (FDI) also played a smaller role in development than its potential for technology transfer and modernization would suggest. First, compared with other Central and Eastern European countries, Ukraine attracted relatively little FDI. In addition, a very large share of FDI inflows took the form of round-trip investments from tax havens – domestic investors transferred funds abroad and reinvested them back into Ukraine to benefit from legal and financial advantages, without contributing to a real inflow of new capital or technology. Investments originating from tax havens not only reduced tax revenues but also delivered weaker benefits for the economy. For example, in sectors with a significant share of tax-haven investments, employment growth was weaker, and the entry rate of new firms was 27% lower. Interestingly, in 2024 Poland ranked ninth among the largest investors in Ukraine, with Polish FDI concentrated mainly in manufacturing and in financial and insurance activities.

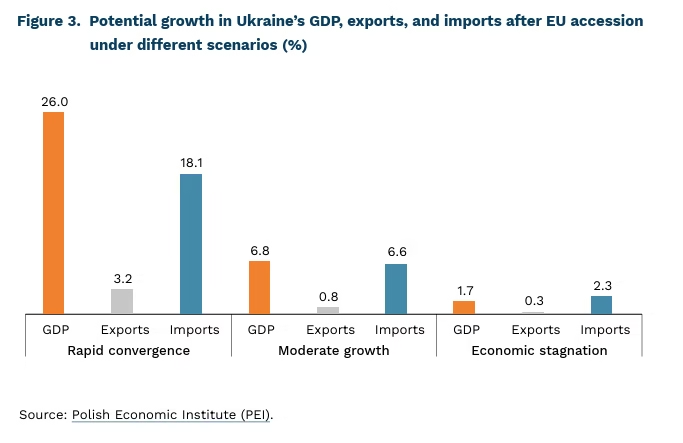

Structural challenges mean that, even after peace is achieved, Ukraine may find it very difficult to replicate the kind of economic miracle experienced by West Germany after World War II. In the context of reconstruction, the central challenge will be reforms that strengthen market competition. Ukraine’s transformation requires an emphasis on institutional reforms similar to those that underpinned Germany’s post-war recovery, where dismantling industrial cartels and promoting competition became the foundation of economic policy. The success of these reforms will determine whether Ukraine can achieve a “Polish-style” trajectory of rapid productivity growth.

Successful reforms and post-war reconstruction could also deliver significant spillover benefits to Central and Eastern Europe. As shown in the Polish Economic Institute (PEI) report Mutual Benefits: The Economic Consequences of Ukraine’s Integration with the EU for Central Europe, the scale of these benefits will depend on how quickly Ukraine raises productivity and how effectively Kyiv implements reforms. In the most optimistic scenario, EU accession could lead to a 26% increase in Ukraine’s GDP, an 18% rise in imports, and a 3% increase in exports, supported by integration into regional supply chains and economic reforms linked to EU membership. The countries expected to benefit most from expanded trade, alongside Ukraine, are Poland, Lithuania, and Hungary.

Jan Strzelecki

Employment Prospects Have the Greatest Impact on Refugees’ Choice of Host Country

31 million total number of refugees worldwide in 2024

5.1 million number of refugees from Ukraine in 2024

+15.2 pp higher probability of choosing a country where it is easy to find a job matching qualifications

In 2024, there were 31 million refugees worldwide, including 5.1 million from Ukraine (UNHCR data). The global refugee population has doubled since 2014. Poland ranks seventh worldwide and second within the EU in terms of the number of refugees it hosts. Understanding the factors that shape refugees’ choice of destination is therefore essential for designing effective public policies.

Research by Adema et al. (2025) shows that employment prospects outweigh social benefits in influencing the destination choices of Ukrainian refugees. The likelihood of choosing a given country increases by 15.2 percentage points if it is easy to find work matching one’s qualifications, and by 16.4 percentage points if average wages are one standard deviation higher. By comparison, similar differences in the level of social assistance and child benefits raise the probability of choosing a country by only 4.5 and 3.2 percentage points, respectively.

The findings draw on two complementary surveys conducted by the study’s authors among Ukrainian refugees. The first covered refugees across all EU countries, recruited via social media. The second focused on a representative sample of Ukrainian refugees in Germany, based on administrative data.

Refugees’ hypothetical choices in the experiment closely mirrored their actual choices. In the survey, participants selected a destination country from two hypothetical options differing in distance from Ukraine, presence of family and friends, ability to communicate in the local language, ease of finding work matching their qualifications, average wages, level of social assistance, child benefits, and housing costs. Refugees already living in a country whose language they spoke, or in places where it was easier to find suitable employment, placed greater weight on these factors in their hypothetical choices.

Both women and men value employment prospects more highly than social benefits when choosing a host country. Gender differences appear in two dimensions: greater distance from Ukraine is more important for men, while the presence of family and friends is more important for women. The authors suggest that men’s preferences may be influenced by concerns about possible deportation from neighbouring countries.

The importance of job quality in migration decisions is confirmed by other studies. Research on Ukrainian refugees in Poland (Lewandowski et al., 2025) shows that the ability to work in line with one’s qualifications affects intentions to return to Ukraine. Comparing refugees’ last job in Ukraine with their current job in Poland, the study found that high employment rates are accompanied by occupational downgrading and increased task routinisation. Refugees experiencing greater increase in task routinisation were more likely to plan a return to Ukraine, particularly those who had not expressed such intentions in an earlier 2022 survey. This effect persisted even after controlling for wages and occupational group.

Working below one’s qualifications reduces earning potential, undermines well-being, and erodes human capital. For host countries, this can result in lower overall productivity, heightened competition in low-skilled sectors, and potential downward pressure on wages for native low-skilled workers (Dustmann et al., 2013).

Marta Palczyńska

Poland in the European Skills Index: Strong Skills Matching, Weak Digitalisation

9th Poland’s position among 31 countries in the 2024 edition of the European Skills Index (ESI)

+12 points improvement in Poland’s ESI score in 2024 compared with 2017

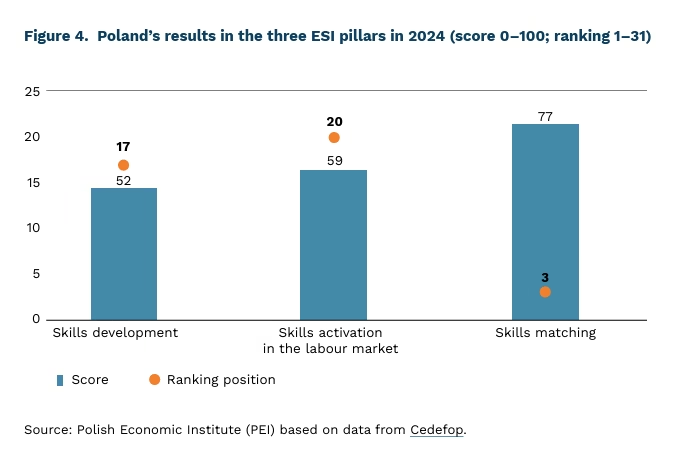

The European Skills Index (ESI), developed by Cedefop, measures and compares the skills and qualifications of workers across 31 European countries. It evaluates three pillars: skills development, skills activation, and skills matching. A score of 100 represents the best possible outcome in Europe.

In the latest edition (2024), Poland ranked 9th, with a score of 63.7 points, placing it in the upper tier of the ranking and clearly above the EU average. Compared with 2017, Poland improved its position by four places and its score by 12 points. The Czech Republic has consistently held first place in every edition of the index, most recently scoring 70 points in 2024.

Poland achieved its highest score in the “skills matching” pillar – 76.7 points, giving it 3rd place in Europe. Four elements contributed to this strong result: 1) low levels of long-term unemployment among the economically active population; 2) a relatively small share of involuntary part-time workers (underemployment) – in other words, most people are employed full-time; 3) a low share of low-paid employees with higher education; and 4) a limited mismatch between qualifications and labour market needs. The weakest component of this pillar is graduate overqualification – in 2023, nearly 25% of university graduates aged 25–34 were working in positions below their education level, which did not require a higher degree.

In the other two pillars, Poland ranks in the lower half of the table. In “skills development”, Poland scored 52.2 points, placing it 17th. The main weakness is the low participation rate in adult learning. In 2022, only 7.6% of Poles had taken part in training during the previous four weeks – one of the lowest results in the EU. The score is also weakened by the fact that only 21% of Poles possess advanced digital skills, which places Poland 29th in Europe. Poland performs even worse in “skills activation”, with a score of 59.1 points (20th place). Although graduate employment rates have improved – more than 84% of young people now find work after completing education compared with 77% in 2017 – labour force participation among 20–24-year-olds remains low, having risen by only 1.4 pp since 2017, to 56.7%.

The ESI results show that Poland has made significant progress in recent years in harnessing its human capital potential, but structural challenges remain. While the country has improved in terms of skills matching, maintaining competitiveness in Europe will require greater investment in digital skills, adult education, and youth labour market activation – areas that remain the weakest points of Poland’s human capital development.

Dominika Prudło

Europeans View the Impact of Digital Technologies on the Workplace Positively

66% – Average share of EU respondents who view the impact of digital technologies, including AI, on the workplace positively.

69% Poles who view the impact of digital technologies on the workplace positively

70% Poles who view the use of robotics and AI in the workplace positively

74% Poles who support regulations protecting employee privacy

In EU countries, an average of 66% of respondents view the impact of digital technologies, including AI, on the workplace positively. Favourable effects are also noted for the economy and quality of life (62%) and for society more broadly (56%). In Poland, the shares are slightly higher: 69% of Poles view the impact of digital technologies positively in the workplace, 68% for the economy and society, and 66% for quality of life (based on Artificial Intelligence and the future of work, Eurobarometer Report, published February 2025).

In the EU, digital technologies in the workplace are viewed positively primarily for enhancing employee safety, supporting better decision-making, and allowing more efficient task allocation and work scheduling. Negative perceptions, however, centre on concerns about redundancies, monitoring of employee activity, candidate screening, and performance appraisal.

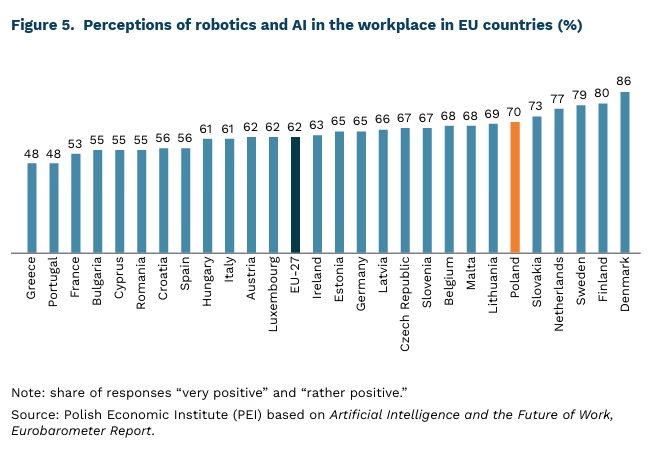

While Europeans overall express a positive attitude towards digital technologies, there are considerable differences across EU Member States in perceptions of the impact of robotics and AI on work. The gap between countries is as wide as 38 percentage points. Poland stands out for its relative optimism: 70% of Polish respondents view the use of robotics and AI in the workplace positively. Even higher levels of approval are reported in Slovakia (73%), the Netherlands (77%), Sweden (79%), Finland (80%) and Denmark (86%). By contrast, the most sceptical attitudes are found in Portugal and Greece (both 48%) as well as in France (53%).

High levels of acceptance may facilitate the faster introduction of digitalisation solutions, including AI. This does not mean, however, that users have no reservations. Europeans clearly favour safeguards, with 82% supporting the protection of employee privacy, 74% supporting a ban on fully automated decision-making, and 72% supporting limits on automated monitoring of employees. Poles are less likely to perceive these risks, with corresponding shares of 74%, 71% and 67%. The gap between the EU average and Poland may reflect Poles’ more limited exposure to advanced technologies and the relatively low visibility of AI ethics in public debate on work.

Magdalena Lesiak

Fewer Europeans Are Working More Than 49 Hours a Week

6.6% share of EU employees working more than 49 hours per week in 2024.

43 hours average weekly working time of the self-employed in Poland in 2024.

74% young employees who value job stability and financial security.

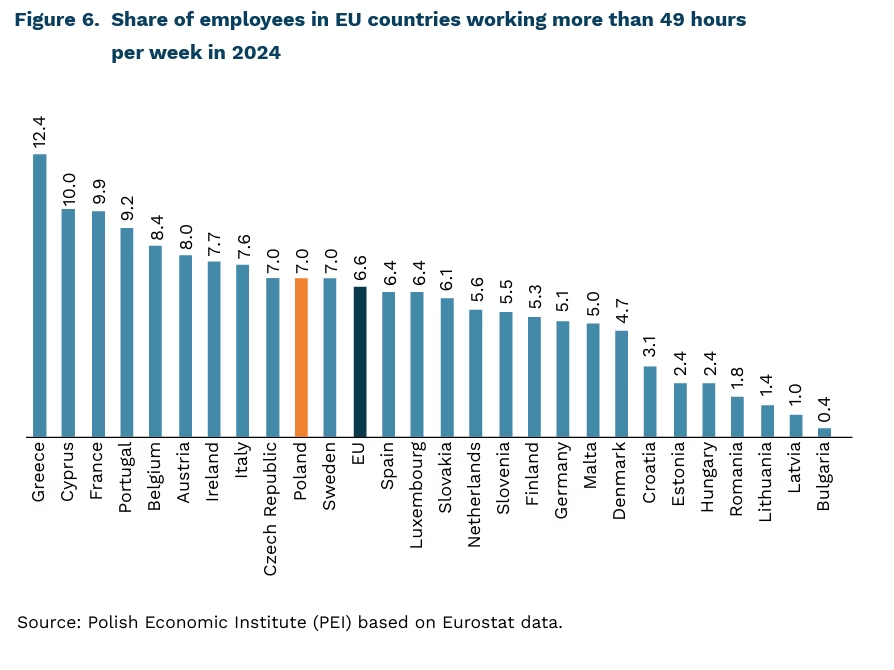

According to the latest Eurostat data, in 2024 6.6% of employees in the EU worked more than 49 hours per week. This serves as a benchmark for assessing the scale of long working hours, indicating that nearly 7% of people aged 20–64 were spending an excessive amount of time each week to work. Although the trend is declining (the share was 7.1% in 2023, 9.5% in 2015, and 11.7% in 2005), the World Health Organization estimates that long working hours contribute to around one-third of occupational diseases, including those resulting in premature death.

Among EU Member States, the highest proportions of employees working excessively long hours in 2024 were recorded in Greece (12.4%), Cyprus (10%), and France (9.9%). In Poland, the share was 7%. This figure is also on a downward trajectory: for comparison, it stood at 13.2% in 2015 and 18.3% in 2005. The lowest rates in 2024 were observed in Bulgaria (0.4%), Latvia (1.0%), and Lithuania (1.4%).

Although the European labour market has undergone profound changes in recent decades, achieving a sustainable work-life balance remains a challenge. In many countries, weekly working hours have been reduced, flexible schedules introduced, and new models of work organisation adopted. On the one hand, employment has diversified with the spread of remote work, short-term contracts, freelancing, and the so-called gig economy. On the other hand, these trends have blurred the boundary between professional and private life for many workers. The issue is particularly acute among the self-employed and those holding more than one job. In 2024, in most EU countries, the self-employed worked longer hours per week than employees. The longest weekly hours among the self-employed were recorded in Greece (almost 47 hours), Spain (43.3 hours), and in Belgium and Poland (both 43.1 hours).

Younger generations, particularly Generation Z, are increasingly reshaping the European labour market rejecting a model based on sacrifice and overtime. For them, the key values are meaningful work, autonomy, personal development, and free time. While workaholism has not disappeared, its social acceptance is waning, and firms are increasingly investing in well-being programmes, flexible working arrangements, and a workplace culture that supports work–life balance. According to the report “Work War Z” (2025), however, 74% of Generation Z still place financial stability and job security as their top priorities, ahead of work–life balance or alignment between company values and personal beliefs. At the same time, young workers expect employers to communicate clearly and concretely (33% of responses) and to show directness and honesty (25%).

Katarzyna Zybertowicz