Official data may have overestimated inflation during the energy crisis in 2021

Published: 20/10/2022

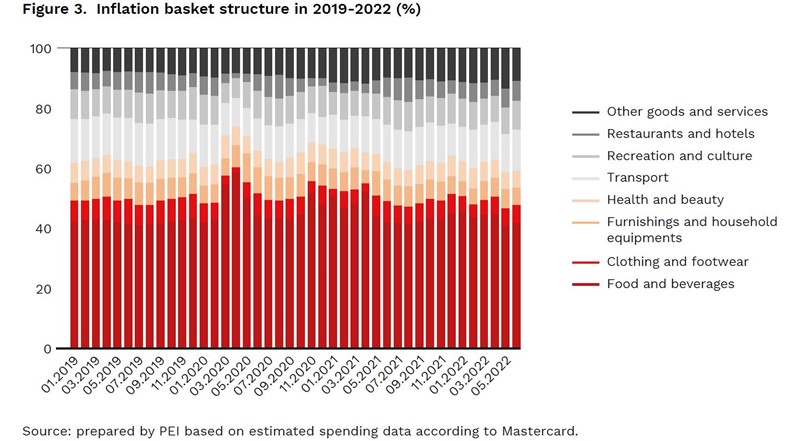

Three main events affected the structure of the inflation basket: the COVID-19 pandemic, first in the spring of 2020 and then during the second wave, the energy crisis caused by Russia’s manipulation of the gas market and, more recently, its attack on Ukraine. Thanks to access to high-frequency data, the Polish Economic Institute has been able to estimate that in April 2020, during the spring lockdown, inflation in Poland may have been 1.25 pp. higher than the official measure. At the same time, during the escalating energy crisis in December 2021, the official CPI was overestimated by 0.34 pp. Poorer households were hit by inflation 0.23 pp. more than wealthier ones – according to the Polish Economic Institute’s report entitled ‘Calculating inflation in Poland during the COVID-19 pandemic and aftermath of Russia’s attack on Ukraine using transactional data’.

Statistical offices and scientific bodies are seeking innovative ways to improve the measurement of consumer price index (CPI). Spending estimated by Mastercard allows us to update the inflation basket monthly, instead of the annual changes used in official statistics. As a result, we can observe rapid changes resulting from sudden events and shocks more quickly. The report is an update of ‘Consumption in the pandemic’, released in 2021, where such estimates were made for the first time.

‘The advantage of the transactional data is its high frequency, which makes it possible to observe changes in consumption in real time. In general, the consumption basket based on Mastercard’s estimates and spending data showed convergence with the official inflation basket. However, in some periods, the real inflation rate may have been higher than the official measure. The underestimation reached 0.72 pp. in March 2020 and 1.25 pp. in April. Since June 2020, the discrepancy has oscillated around 0.1 pp. On the other hand, at the peak of the energy crisis in December 2021, the official CPI may have been overestimated by 0.34 pp. The other sudden events did not have a clear impact on the inflation rate’, says Piotr Arak, the director of the Polish Economic Institute.

How has the consumer basket been shaped in the past 3 years?

Three events influenced the composition of the consumer basket in 2019–2022: (a) the first spring of the pandemic (March–May 2020), (b) the second wave of the pandemic, between 2020 and 2021 (November 2020 – April 2021) and (c) the gas crisis and Russian invasion of Ukraine (December 2021 – April 2022). Consumers mainly saved money on clothing and furnishings.

Inflation affects people unequally

Inflation affects people unequally because of differences in the basket structure. The energy crisis and the pandemic have deepened the inequalities. In December 2021, inflation affected the poor more than the rich by as much as 0.23 pp. In the first half of 2020, the price change was 0.2–0.3 pp. more severe for the bottom 20% of spenders, compared to the top 20% of spenders.

‘An increase in inflation affects poorer people more as their spending structure is focused on essential products, whereas the top spenders do not have to save that much money and, in certain periods, have very different consumption patterns. During the lockdowns, this measure decreased due to the limited spending opportunities. Both the top 20% and the bottom 20% of spenders showed a higher share of food and a lower share of restaurants and hotels in their respective inflation baskets. Since mid-2021, the rising CPI has also increased inflation heterogeneity within spending groups. We observed a huge difference during the energy crisis in November–December 2021 due to “food and beverages” and “furnishings” spending. In 2022, the high prices have influenced both inflation baskets. Consumers have been spending more on transport and less on clothing and furnishings. In May 2022, the difference could increase due to the wealthier e-commerce spending on other goods and services, which might be caused by increased promotional activities on the cryptocurrency market’, says Maciej Miniszewski, a senior analyst at the climate and energy team of the Polish Economic Institute.

***

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research primarily spans macroeconomics, energy and climate, foreign trade, economic foresight, the digital economy and behavioural economics. The Institute provides reports, analyses and recommendations for key areas of the economy and social life in Poland, taking into account the international situation.

Media contact:

Ewa Balicka-Sawiak

Press Spokesperson

T: 48 727 427 918

E: ewa.balicka@pie.net.pl

Kategoria: Analysis / Press releases / Report / Reports 2022