Poland leads the way in Europe by reducing its dependence on Russian gas

Published: 20/06/2023

Russia’s invasion of Ukraine in 2022 has forced countries in the European Union to end their dependence on Russian gas. Although EU imports of gas (including LNG) increased by 37% in 2014-2021, after the invasion daily flows of Russian gas through pipelines to the EU fell sixfold within a year. Of the main gas markets in the EU, Poland — which was historically the most dependent on Russian supplies — managed to reduce its dependence on Russian imports to the greatest extent. Between 2014 and 2021, it reduced gas imports from Russia by 14% and, in Q1 2023, ended them completely. In its report Secure gas supplies for the winters to come. The European path from crisis to independence, the Polish Economic Institute analyses EU countries’ efforts to end their dependence on Russia and increase their energy security.

The EU’s growing dependence on Russian gas — from the annexation of Crimea to the invasion of Ukraine

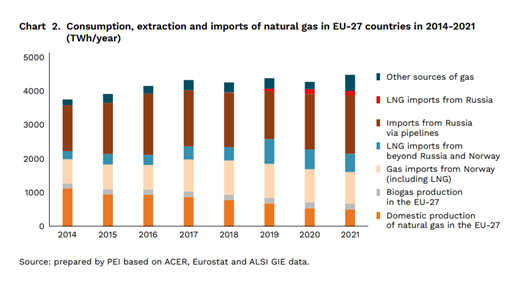

Between 2014 and 2021, the volume of the EU’s gas imports from Russia rose by 37%. The two main factors influencing the EU’s dependence on Russian gas were the increased use of natural gas (not only from Russia) in the “gas seven” countries, the seven EU member states that dominate the gas market and account for 80% of consumption — primarily in Germany (+19%), Italy (+23%), Spain (+24%) and Poland (+35%) — and the increase in imports of Russian gas in Germany (+35%).

During the same period, Poland expanded its infrastructure for diversifying supplies. As a result, it reduced gas imports from Russia by 14% in 2014-2021, and ended them completely in Q1 2023. Poland’s efforts to become independent from Russian gas included Russian LNG. Poland is the only country in the “gas seven” with terminals that does not import it.

“In 2014-2021, gas consumption in the EU increased and domestic production fell. Gazprom took advantage of the situation, using its advantage when it comes to infrastructure, low costs, political lobbying and consistent abuse of its dominant position on the European market. Russian gas filled the gap created by the irresponsible policy of European countries, which did not counterbalance the increase in consumption by diversifying supplies. Gazprom and Novatek became the beneficiaries of EU countries’ irresponsible energy policy,” says Kamil Lipiński, a senior analyst on the Climate and Energy Team at the PEI.

Europe’s response to the challenges of the gas market in 2022

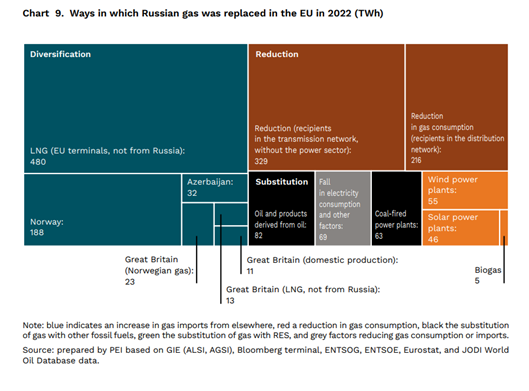

Russia’s invasion of Ukraine in 2022 led to an unprecedented fall in Russian gas supplies to Europe. Average flows of Russian gas through pipelines to the EU decreased sixfold. In 2022, EU imports of Russian gas (including LNG) fell by 955 TWh (52%). Member states also increased their storage reserves by 336 TWh (56%) compared to the beginning of 2021. Countries were able to use less Russian gas thanks to existing LNG infrastructure and industry sacrifices. The diversification of supplies played the biggest role in replacing Russian gas (46%). Without the increase in LNG imports in 2022, mainly from the US (42% of total LNG imports), the fall in gas consumption in the EU would have had to be 88% higher; over 24% year on year, rather than 13%. The fall in consumption also played an important role (34%), primarily driven by industry connected to the transmission network (65% of the total reduction).

“Despite the challenges, 2022 was a success when it comes to European solidarity and coordination in the gas sector. European countries — often under pressure from Russia, which uses gas to achieve its aggressive political goals — began seeking alternative supply routes. The gas market underwent a revolution in 2022: sources of supply, flow directions, relations between market areas, prices and consumption volumes changed. Previously declarative, real diversification has become a necessity,” Lipiński adds.

Expanding gas infrastructure is key to energy security

Although Europe has managed to weather the crisis, much remains to be done. As competition for resources among member states intensifies, and gas deliveries from Russia to the EU — which have already fallen — may be halted completely, Germany, Italy and Poland will be forced to reduce consumption during the 2023-2024 heating season by 23%, 24%, and 11% respectively compared to 2021 unless EU countries cooperate, rather than competing for resources. Cooperation and the coordinated sharing of gas reserves will help mitigate shortages, resulting in a reduction in consumption of just 9% during the winter season. The challenge will be the bottlenecks in Europe’s gas infrastructure, which limit the opportunities to cooperate. The PEI report identifies the European gas system’s critical limitations and infrastructure; its security and efficient functioning will be of decisive importance for Europe.

“LNG terminals were the main way to replace Russian gas in 2022. The development of LNG infrastructure in Central Europe in 2023-2028 sets the timeframe for the EU’s emergence from the energy crisis. These projects should have the highest priority in the coming years. Efforts should be made to ensure that potential barriers that might hamper these plans, such as difficulties in obtaining permits or challenges relating to financial liquidity, do not cause delays in construction and expansion,” Lipiński emphasises.

***

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research primarily spans macroeconomics, energy and climate, the world economy, economic foresight, the digital economy and behavioural economics. The Institute provides reports, analyses and recommendations for key areas of the economy and social life in Poland, taking into account the international situation.

Media contact:

Ewa Balicka-Sawiak

Press Spokesperson

T: +48 727 427 918

E: ewa.balicka@pie.net.pl

Category: Analysis / Climate and Energy / Press releases / Report / Reports 2023