The electrification of heavy road transport will create over 20,000 new jobs

Published: 13/11/2023

Poland is one of the leaders in the EU in terms of road freight transport. It was responsible for the transport of 380 billion tonne-kilometres (tkm) in 2021 — the most in the entire EU and 24% more than Germany, which ranks second. The Polish truck fleet consisted of 1.15 million vehicles in 2021. The sector employed 486,000 people in 2020, 15% of the EU total. The TSL industry is currently facing changes resulting from EU CO2 emission standards for trucks, which will force it to electrify. In its report entitled The electrification of the heavy-duty road transport created in cooperation with the Polish Alternative Fuels Association (PSPA), the Polish Economic Institute analyses the electrification scenarios for the sector and the potential economic consequences.

Poland ranks first in the EU in terms of road freight transport

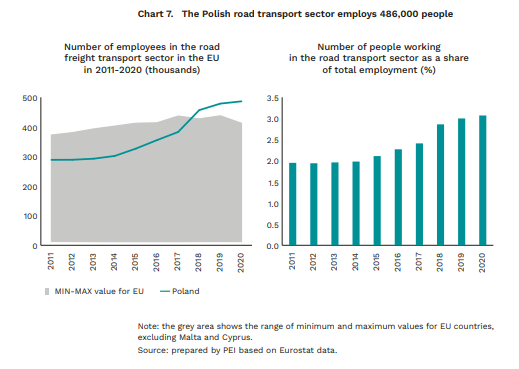

More people are employed in the road freight transport sector in Poland than in any other country in the EU. In 2020, the number of employees amounted to 486,000 — 74,000 (18%) more than in Germany, which ranks second. People employed in Poland account for 15% of employment in this sector in the EU. The importance of the freight transport sector in Poland’s employment structure, as well as the demand for employees, is growing. The share of people working in this sector rose from under 2% in 2011 to over 3% in 2020. The growing number of people employed in the sector is coupled with high demand for employees, including professional drivers. According to estimates by analysts and industry representatives, Poland may still have a shortage of 100,000-150,000 truck drivers.

Poland has the largest fleet of trucks with a GVW above 3.5 tonnes in the entire EU. In 2021, the fleet in Poland consisted of nearly 1.15 million trucks, an increase of 33,000 y/y. On average, they are slightly newer than the EU average (13.2 years, compared to 13.9 years), but older than in two of the Polish market’s competitors, Germany (9.6 years) and France (9 years).

“Among the European economies, the Polish heavy-duty road transport sector dominates. For years, we have gradually been observing an increase in employment and a larger fleet. However, the sector’s value added in our country remains lower than in more developed EU countries and conventional vehicles dominate the existing fleet. Today, the sector faces the challenge of replacing it with zero-emission vehicles as quickly as possible. Delays in the electrification of the fleet could reduce the Polish TSL sector’s competitiveness in the coming years,” says Maciej Miniszewski, a senior adviser in the PEI climate and energy team.

Not enough infrastructure for electric vehicles

Although the HDV fleet is relatively small, it causes significant emissions. As it seeks to implement the European Green Deal’s assumptions, the EU is supporting the electrification of road transport. Pursuant to Regulation (EU) 2019/1242 of the European Parliament and of the Council of 20 June 2019, manufacturers must reduce the emission intensity of their fleet of newly-registered HDVs by 15% in 2025 and by 30% in 2030, compared to the emissions of HDVs registered for the first time between 1 July 2019 and 30 June 2020. The AFIR draft adopted by the European Parliament on 28 March 2023 imposes requirements on member states regarding the expansion of the charging station network. Exhaust emissions will also be regulated in accordance with the Euro 7 standard.

EU efforts to reduce CO2 emissions will force road transport to electrify. Adding charging infrastructure will be key to the development of electromobility in the eHDV segment. Meanwhile, in Poland, not one of the approximately 2700 public charging stations are intended for vehicles with a GVW above 16 tonnes. This is accompanied by a low number of electric trucks — just 11 had been registered in Poland by 2022. For representatives of the TSL sector in Poland, this is one of the greatest barriers to the electrification of the fleet.

“One of the biggest barriers to the electrification of the transport sector, both heavy and passenger, is the lack of developed charging infrastructure. Appropriate infrastructure investments are needed, especially since the registration of electric trucks could increase the demand for electricity in Poland by approximately 2-4% in 2030-2035. The charging profile or the use of fast-charging infrastructure during peak hours will require investments in generation, storage and network systems,” says Magdalena Maj, head of the PEI climate and energy team.

The electrification of heavy road transport will benefit the economy

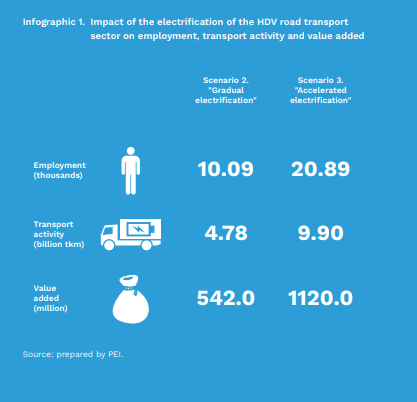

The PEI report shows that the electrification of the fleet could allow Poland to expand in the heavy transport sector. The country’s growing share in the EU transport market and the growing number of trucks will increase the number of jobs in the sector. Gradual or accelerated electrification will increase employment at the expense of other countries, mainly Germany, by 10,100 or 20,900, respectively, by 2035 — compared to the scenario in which the current electrification rate is maintained.

The transition could also accelerate the increase in the transport activity of Polish companies in the TSL sector. Depending on the pace of electrification, transport activity will be 4.8 billion tkm or even 9.9 billion tkm higher by 2035, compared to the status quo scenario. Moreover, with the accelerated electrification of its fleet, the Polish heavy-duty road transport sector could grow by EUR 1.1 billion by 2035, compared to the business-as-usual scenario.

“Poland remains the only leading market in the TSL sector that has not yet offered a support system encouraging investment in zero-emission trucks. With the development of electromobility in the heavy transport sector in other EU member states, maintaining Polish carriers’ competitiveness will require the introduction of a system of subsidies for eHDV and infrastructure, as well as optimising the law. Road tolls for eHDVs must be abolished, eHDVs must be allowed to enter restricted traffic zones for electric trucks, and tax relief for companies that invest in environmentally-friendly means of transport must to be provided, among other things. These types of incentives will enable the positive scenario of the impact of progressive electrification on the heavy transport sector in Poland to go ahead. PSPA has sent an open letter with its recommendations in this regard to Minister of Climate and Environment Anna Moskwa,” says Piotr Ziółkowski, a new mobility expert at the PSPA.

***

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research primarily spans macroeconomics, energy and climate, the world economy, economic foresight, the digital economy and behavioural economics. The Institute provides reports, analyses and recommendations for key areas of the economy and social life in Poland, taking into account the international situation.

Media contact:

Ewa Balicka-Sawiak

Press spokesperson

T: +48 727 427 918

E: ewa.balicka@pie.net.pl

Category: Report / Reports 2023