Extending the CBAM charge would increase the EU’s own resources

Press release

Published: 03/02/2026

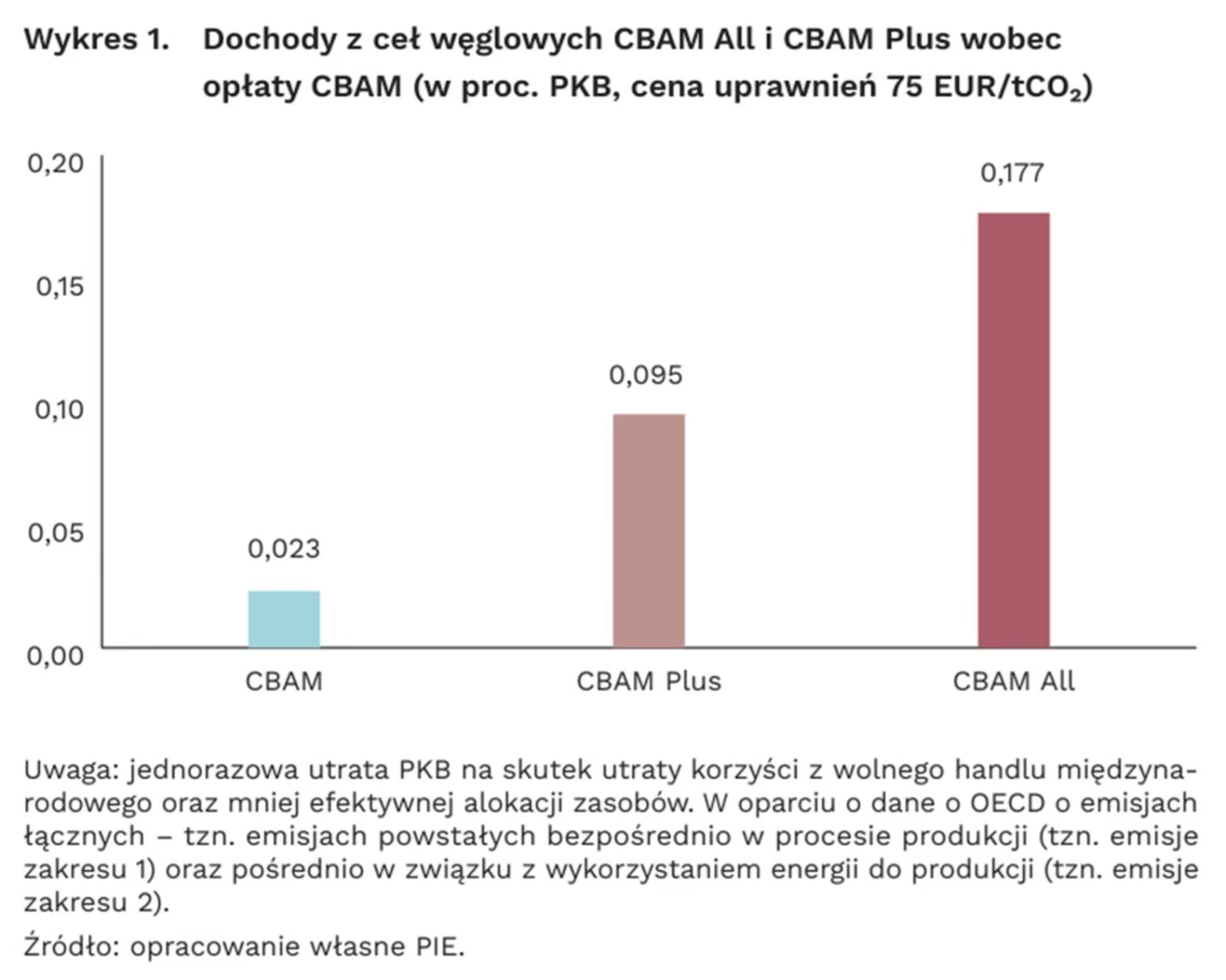

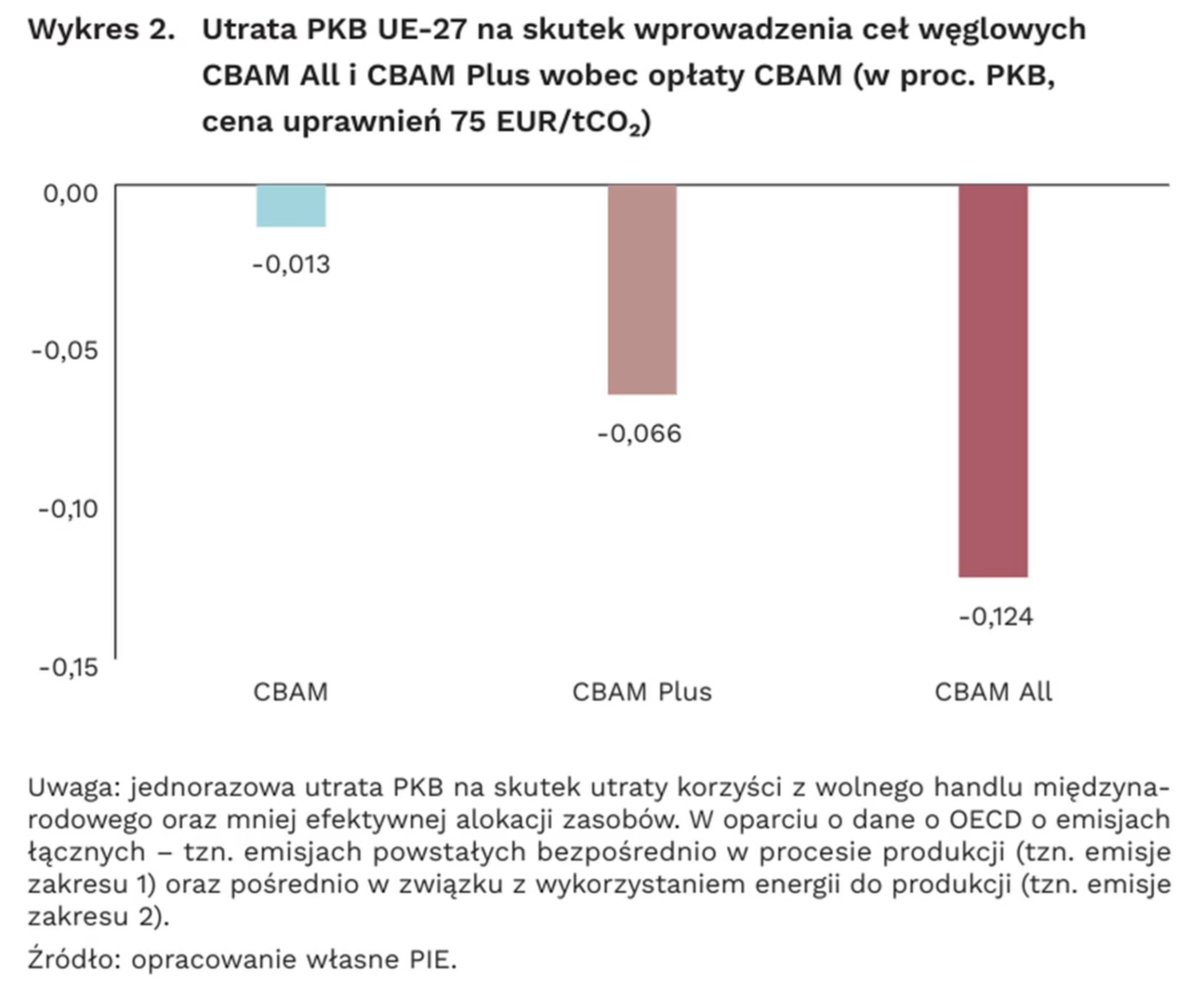

Estimates by the Polish Economic Institute show that extending the CBAM charge is the only option with a significant impact on the common European budget. Extending the charge to the entire industrial sector (CBAM All) could generate revenues of around 0.177% of EU-27 GDP, assuming an allowance price of EUR 75/tCO₂. By contrast, applying the mechanism only to sectors covered by the ETS would result in revenues of up to 0.095% of EU-27 GDP. This means that potential revenues could be up to seven times higher than under the currently applicable form of the charge – PIE estimates the potential impact of the non-extended CBAM at around 0.023% of EU-27 GDP. Of these amounts, 75% would flow into the EU-27 common budget as new EU own resources, while the remaining 25% would stay in the country collecting the charge as compensation for collection costs. These instruments support EU industry and protect against deindustrialisation. The cost, however, is a decline in GDP due to reduced gains from trade. Assuming an emissions allowance price of EUR 75/tCO₂, CBAM could lead to a one-off GDP loss of around 0.013% for the EU-27 and 0.03% for Poland. Extending the mechanism to CBAM All increases this cost to 0.12% and 0.33%, respectively. These are the main conclusions of the Polish Economic Institute’s report “Extending CBAM as a potential source of EU own resources”.

Current CBAM revenues are limited

CBAM (Carbon Border Adjustment Mechanism) is a mechanism for adjusting prices at borders to account for CO₂ emissions. Its purpose is to complement the EU Emissions Trading System (EU ETS) by addressing the gap related to international trade, thereby levelling the playing field for energy-intensive European industry vis-à-vis producers outside the EU. At the same time, revenues from CBAM may increase the EU’s common budget.

CBAM was proposed in 2021 as part of the Fit for 55 package. The mechanism applies only to a narrow group of highly emission-intensive goods (steel, iron and aluminium products, cement, fertilisers, electricity and hydrogen). Companies importing these goods are required to estimate greenhouse gas emissions generated directly in the production process and indirectly through electricity use, and then pay a charge calibrated to the emissions price under the EU ETS.

“The EU common budget amounts to just over 1% of the gross national income of all EU Member States and does not increase despite pressure from new expenditures, including defence, the energy transition and digitalisation. This is why EU authorities are looking for new sources of financing to fund EU policies. CBAM was meant to be one of them, i.e. an EU own resource, but the scale of potential revenues will be small. In the proposal for the new Multiannual Financial Framework from July 2025, EU revenues from CBAM will not exceed 0.01% of EU-27 GDP and therefore will not change the situation. Repayment of the debt incurred for the NextGenerationEU programme, which supported Member State economies during the pandemic, will be around 17 times higher,” says Marcin Klucznik, Senior Adviser in the World Economy Team.

Extending CBAM would significantly increase EU revenues

Introducing a carbon border levy for all sectors covered by the ETS (CBAM Plus) could increase revenues by up to four times compared with the current CBAM scenario. Assuming an emissions allowance price of EUR 75/tCO₂, depending on the emissions estimation method, this would generate revenues of 0.074–0.095% of EU-27 GDP, i.e. EUR 13–17 billion based on 2024 activity levels. PIE’s analysis shows that the greatest fiscal potential would be achieved if the emissions pricing mechanism accounted for indirect emissions from energy consumption and was based on emissions intensity in the countries where the goods are produced.

Introducing CBAM Plus tariffs could increase the share of industry in global production in Poland and the EU by around 0.09–0.11 percentage points at an allowance price of EUR 75/tCO₂. If allowance prices were to double, this effect would rise to 0.15–0.17 percentage points. This would imply a relocation of parts of production chains to the EU and a reduction in the Community’s import dependence.

Extending the carbon border levy to all industrial sectors (CBAM All) would result in a further increase in revenues. Assuming an allowance price of EUR 75/tCO₂, revenues would amount to 0.137–0.177% of EU-27 GDP, depending on the chosen emissions estimation method and geographic scope. This represents up to an 8.5-fold increase compared with the current CBAM charge. Additional fiscal effects compared with CBAM Plus (around a two-fold increase) are relatively smaller, as this scenario extends the mechanism to industrial sectors with lower direct emissions.

CBAM All could generate revenues equivalent to around 15% of the planned EU budget over the next eight years. At the same time, broad carbon border tariffs are an instrument supporting EU industry and protecting against deindustrialisation. The cost of this solution is the loss of some benefits from free trade and less efficient allocation of resources in the economy, reflected in a decline in real GDP. Assuming an allowance price of EUR 75/tCO₂, the one-off GDP loss could amount to around 0.12% for the EU-27 and 0.33% for Poland.

“Replacing the CBAM charge with a broader carbon border levy such as CBAM Plus or CBAM All would significantly increase revenues for the common budget. CBAM Plus applied to ETS sectors could increase revenues by up to four times, while CBAM All covering the entire industry could result in up to a nine-fold increase in potential revenues. We estimate this would amount to EUR 31.9 billion, of which EUR 23.9 billion would flow into the EU common budget, with the remainder going to Member State budgets. The potential associated with extending CBAM largely stems from the fact that the EU common budget is relatively small,”

notes Marcin Klucznik.

***

The Polish Economic Institute is a public economic think tank with a history dating back to 1928. Its main research areas include macroeconomics, energy and climate, the global economy, economic foresight, digital economy, sustainable development, and behavioral economics. The Institute prepares reports, analyses, and policy recommendations on key areas of the Polish economy and society, taking into account the international context.

Media Contact:

Ewa Balicka-Sawiak

Press Officer

T: +48 727 427 918

E: ewa.balicka@pie.net.pl