80 per cent of investment in human capital in the EU comes from the public sector

Published: 06/07/2021

Spending on infrastructure makes up just 20 per cent of all public investment in EU countries. The remaining 80 per cent can be classified as investment in human capital – spending on citizens’ health and education

For comparison, just 12 per cent of private investment aims to develop human capital. Annual return on the state’s investment in citizens’ education and health can exceed 10 per cent. As countries emerge from the crisis, this is a good time to increase the volume of public investment and broaden how it is defined, according to the author of the Polish Economic Institute’s report Can the state be a good investor?.

The PEI’s report considers whether the state can invest in a productive way and what area public investment should focus on. It presents the evolution of thinking about fiscal policy, influenced by lessons learnt from mistakes made while emerging from the financial crisis of 2007-2009 and by the pandemic crisis. It also proposes a conception for incorporating public investment in human capital into the official definition of public investment and the consequences of doing so.

“A restrictive policy should not be used while emerging from crises. According to the European Commission’s estimates, interest on the public debt incurred by individual countries will amount to 1.2 per cent of GDP in 2022 and be 0.3 percentage points lower than before the pandemic crisis, despite the significant increase in public debt in individual countries. This is a good time to plan public investments, especially in human capital – it stimulates growth, translating into higher GDP, wages and tax revenues in the future. We propose to broaden the definition of public investment to include not only traditional investment in physical capital, such as buildings and roads, but also in human capital – that is, citizens’ education and health,” says Jakub Sawulski, head of the macroeconomics team at the Polish Economic Institute.

The old dogmas no longer apply – time to take advantage of that

Expansive fiscal policy will be possible as long as interest rates remain at their current low level. Attempts to estimate the natural interest rate – the one that stabilises the economy – have shown that it is falling systematically on a global scale. This is not a temporary trend linked to the pandemic or a result of the financial crisis a decade ago. Rather, it is a permanent phenomenon: the natural interest rate in developed economies fell from 2.5 per cent between 1998 and to 0.5 per cent in 2016.

The sustained decline in interest rates creates an opportunity to launch new public investments and improve the quality of existing ones. Academic research shows that, in the long term, the most productive state investments include those related to the development of children and youth; that is, investment in nurseries, kindergartens and public education. For children from wealthier families, the benefits of preschool education do not always exceed its costs. However, for children from less affluent families, the rate of return is in the double digits.

Healthcare is another area where the effectiveness of public investment is above-average. Spending on healthcare helps boost employees’ productivity, reduces the number of sick days and increases how many years citizens work. Properly financed preventive care, such as compulsory vaccination or programmes countering obesity among pupils, reduces the cost of treatment in the future.

Cuts in public spending are often wrongly viewed as a form of restrictive but necessary fiscal policy. Yet in the long run, this can lead to significant increases in social and economic costs that far outweigh the potential savings.

Less investment in human capital means worse development prospects

Failure to take into account investment in human capital in most statistics results in a misconception of the public sector, which is seen as inefficient and as hampering socio-economic development. However, while most investment in physical capital (machines, buildings and infrastructure) comes from the private sector, the vast majority of investments in human capital are financed by the public sector. In EU countries, investment in physical capital amounts to 20.5 per cent of GDP, with as much as 86 per cent coming from the private sector. Investment in human capital amounts to 11.2 per cent of GDP, with as much as 80 per cent coming from the public sector.

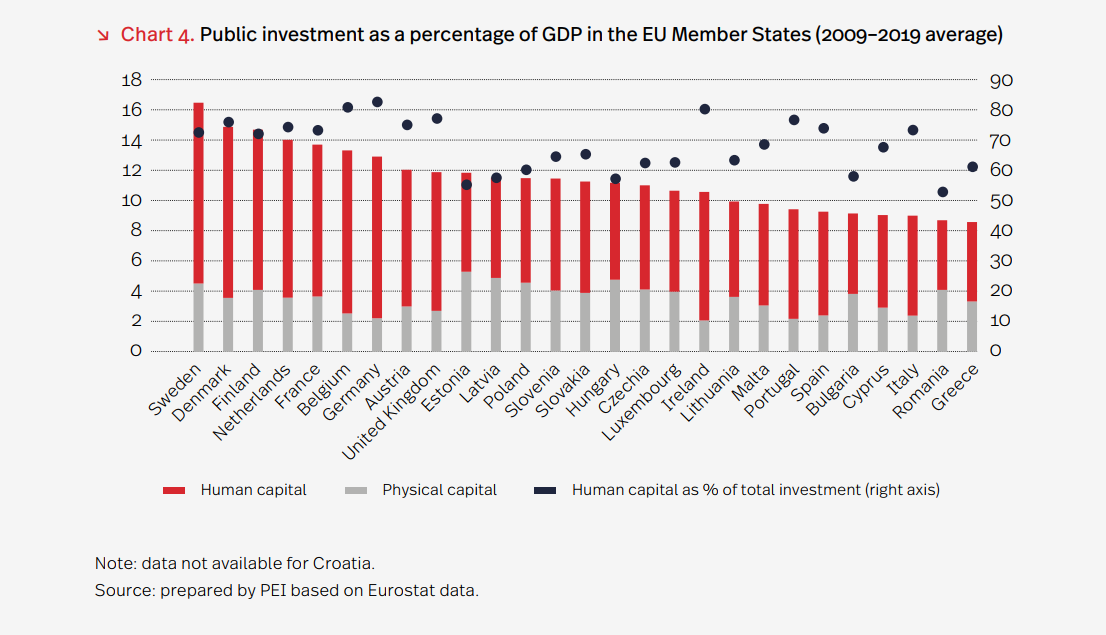

75 per cent of public investment in EU countries aims to develop human capital. This varies between countries, ranging from 50 per cent to 90 per cent. This large discrepancy is mainly due to the difference between the countries in Central and Eastern Europe and Southern Europe on the one hand and the remaining member states on the other. The former group invests 6.4 per cent of GDP in human capital on average. In the other member states, this is as much as 8.7 per cent of GDP. As a result, the former countries’ long-term development potential may be weakened. It is worth noting that the limiting of public investment in countries in Southern Europe was a consequence of the restrictive economic paradigm following the financial crisis of the late 2000s.

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research spans foreign trade, macroeconomics, energy and the digital economy, with strategic analyses on key areas of social and public life in Poland. The Institute provides analysis and expertise for the implementation of the Strategy for Responsible Development and helps popularise Polish economic and social research in the country and abroad.

Media contact:

Ewa Balicka-Sawiak

Press Spokesperson

T: 48 727 427 918

Kategoria: Macroeconomics / Press releases / Report / Reports 2021