Economic Weekly 40/2025, October 10, 2025

Published: 10/10/2025

Table of contents

The Value of IT Service Imports to Poland Is Increasing

4% year-on-year decline in Poland’s services trade surplus

17% year-on-year increase in imports of computer services to Poland

40% year-on-year drop in spending by Ukrainian citizens in the travel category

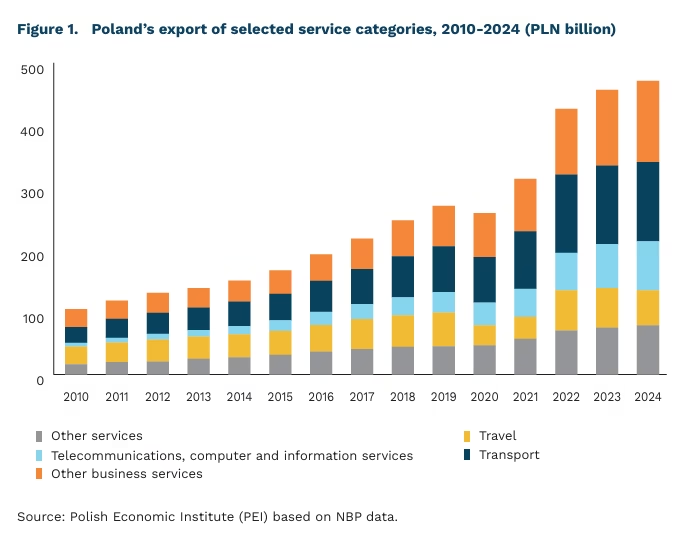

In 2024, Poland’s trade in services experienced a slight slowdown. The country’s service export value reached PLN 471 billion, increasing by 3% year-on-year, while service imports rose by 7%, totalling PLN 298 billion. This marked only the second year since 2010 (the previous being during the COVID-19 pandemic in 2020) when the trade surplus in services declined – by 4% year-on-year.

The rise in service imports is largely driven by a 17% year-on-year increase in computer service purchases, mainly from Ireland, Germany, and the Czech Republic. Services such as software implementation, IT hardware installation consulting, database services, and especially data processing, are now being purchased not only by large enterprises but also by SMEs. Demand for cloud computing services has also continued to grow. According to Eurostat, the share of Polish firms purchasing cloud services increased from 28.7% in 2021 to 55.7% in 2023.

The United States’ share in Poland’s service exports is also growing. In 2024, it reached 10%, up by around 2 percentage points compared to 2021, fuelled by a twofold increase in U.S. purchases of telecommunications, computer and information services. Other main service trade partners have remained stable. Over 62% of Polish services are exported to EU countries, with Germany maintaining its position as the top trade partner (22% of total exports), followed by the United States and the United Kingdom.

In 2024, the export value of transport services fell by 1% year-on-year, and for the first time since 2010, this category was no longer the largest in Poland’s service exports – surpassed by other business services. This shift reflects the economic downturn in Germany, declining price competitiveness due to rising labour costs, and a shortage of workers in Poland’s transport sector. Therefore key service categories remained relatively unchanged: other business services accounted for 28% of exports, and transport 27%. Meanwhile, telecom, computer and information services continued to gain importance, making up 17% of exports, with an 11% year-on-year increase.

There was a notable decline in the travel export category. The value fell by 11% yearon-year, primarily due to a 40% drop in spending by Ukrainian citizens. In 2022, these made up around 95% of services provided to Ukrainians in Poland, falling to 83% in 2024. This decline is likely linked to residency status acquisition or housing stabilisation among Ukrainians who arrived in Poland after 2022. In the year the invasion began, 19% of Ukrainian refugees relied on organised accommodation – in 2024 this dropped to 9%. More people are renting independently – from 52% in 2022 to 70% in 2024.

Katarzyna Sierocińska

Starting a Business Seen as Easy by Poles

83% share of Poles in 2024 who believed starting a business is easy, compared to 48% in Europe

21st Poland’s position out of 25 countries in the National Entrepreneurship Context Index (NECI)

6.6 score (out of 10) awarded to Poland in the ‘internal market dynamics’ subcategory

In 2024, 83% of Poles believed that starting a business is easy, according to the GEM Poland 2025 report by Polish Agency for Enterprise Development (PARP). This is 7 percentage points less than in the record year of 2019 and 24 points more than in 2020. The European average stood at 48%. Poland had the highest share among all European countries. Sweden followed with a 5-point difference, while the lowest shares were recorded in Italy (22%), Spain (27%) and Greece (30%). This perception of ease does not correlate with actual entrepreneurial intentions. In Poland, only 3.1% of individuals aged 18-64 who were not running a business declared plans to start one within the next three years, compared to 15% across Europe. This means that Poland’s indicator is nearly five times lower than the European average.

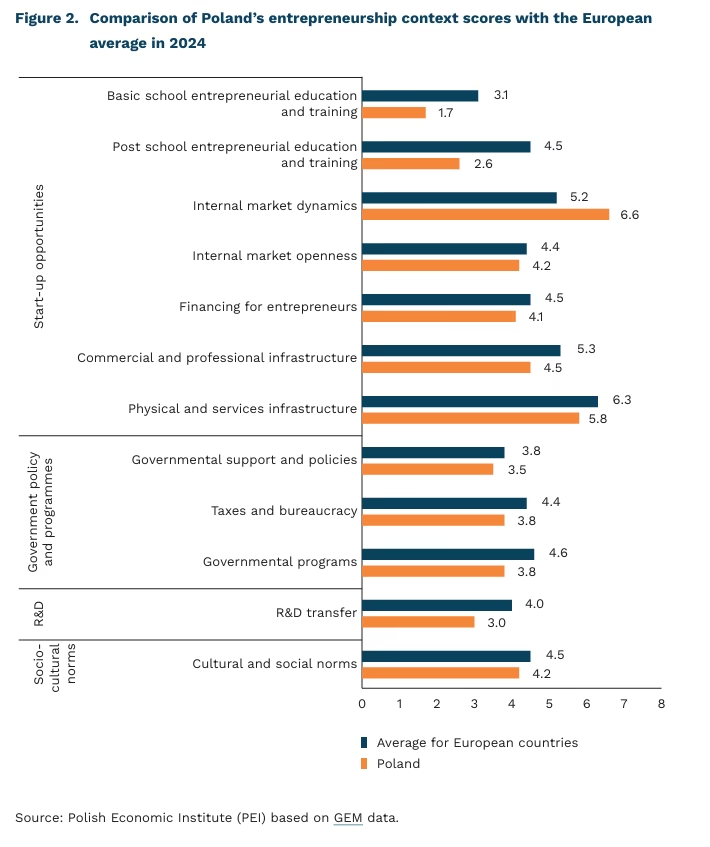

In the 2024 edition of the National Entrepreneurship Context Index (NECI)(1), Poland scored 4.0 out of 10 – slightly down from 4.2 in 2023, though still higher than in 2022 (3.8). Despite a high self-reported ease of doing business, Poland ranked only 21st out of 25 European countries. Lower scores were given to Croatia (3.9), Slovakia (3.7), Belarus (3.5) and Bosnia and Herzegovina (3.4). Lithuania ranked first, with 6.4 points, reflecting a more favourable institutional and cultural environment for entrepreneurship.

The NECI assessment consists of four categories: ‘entry opportunities’, ‘government policy and programmes’, ‘research and development’, and ‘socio-cultural norms’. In the ‘entry opportunities’ category, Poland scored below the European average in most areas. The lowest scores were recorded in basic school entrepreneurial education and training (1.7) and post school (2.6). The highest was in the ‘internal market dynamics’ subcategory with a score of 6.6, above the European average. In the ‘cultural and social norms’ category, Poland scored 4.2, slightly below the European average, and 3.5 in ‘R&D transfer’. In the ‘governmental support and policies’ category, Poland received its lowest mark for government policy (3.5), and a slightly better one for support programmes (3.8).

Poland is among the countries where the regulatory and institutional conditions for starting a business are not perceived as the most favourable, although this does not always translate into actual entrepreneurial activity. The high perceived ease of launching a business and relatively good access to infrastructure contrast with weak results in entrepreneurial education, science–business collaboration, and the effectiveness of public support. Overall, the entrepreneurship environment in Poland remains stable but average, pointing to the need for strengthening skills, innovation, and a culture that encourages risk-taking.

- National Entrepreneurship Context Index (NECI) – a composite index developed within the Global Entrepreneurship Monitor (GEM) study, used to assess the quality of a country’s entrepreneurship ecosystem based on the opinions of at least 36 national experts, across 13 framework conditions.

Aleksandra Wejt-Knyżewska

The Peak of Social Media Popularity May Be Behind Us

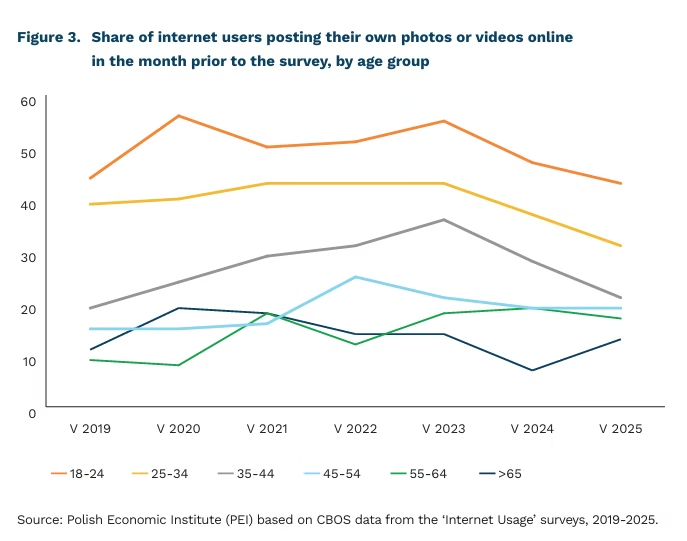

Data from Statistics Poland (GUS) show that 61% of people in Poland used social media in 2024 – 1.2 p.p. less than in the record year of 2023. While the drop is modest, it reflects a broader global trend. CBOS surveys show that only 23% of adult internet users in Poland now post their own photos or videos – down from 32% in 2023. The peak of social media popularity may well be behind us.

This shift is most pronounced among younger users. A good illustration of this is Facebook’s position: in 2015, 71% of teenagers in the United States used the platform, while last year the figure was just 32%. Such a dramatic change has been one of the reasons behind the search for new solutions and the promotion of alternative platforms: first, through Meta’s large-scale investments in the metaverse, and now through a growing focus on artificial intelligence. The latest example is a proposed new platform, platform designed to feature videos generated entirely by AI. OpenAI has announced a similar concept.

There is one social group where the trend is moving in the opposite direction – people aged 55 or 65 and over (depending on the study) are increasing their use of social media. In Poland, 31% of internet users aged 55-64 and 14% of those over 65 post on forums or social media platforms. In the younger of these age groups, this marks a clear rise from 19% in 2019. Among the older group, the posting rate before the pandemic stood at 18%, but the share of internet users in this cohort rose from 33.3% to 56.8% over that period, meaning the number of older adults active on social media in Poland has grown significantly. Similar trends have been observed in data from other countries. While current debates on the risks of social media tend to focus on the mental health of young people, in the future the negative impact on the mental health of older adults may become an equally important concern.

The declining engagement of users with so-called social media platforms, along with the decreasing quality of available content, has been described by sociologist Cory Doctorow as the ‘enshittification’ of social platforms(2). According to Doctorow, many platforms have followed a similar trajectory, starting as spaces for genuine human connection and personal sharing, then shifting towards algorithm-driven feeds that prioritise what is labelled as ‘interesting’ or ‘relevant’ but is in fact increasingly sponsored content, and f inally evolving into artificial environments filled with content generated by AI and bots. The gradual withdrawal of users from these platforms is a natural consequence of this process, as their presence yields diminishing personal value. In the longer term, this could lead to a reconfiguration of the main players in the digital market. Network effects may support the emergence of alternative platforms, but as long as profit remains the core driver, we may simply see a repeat of the same cycles Doctorow described. Achieving deeper change – one that would alleviate loneliness and restore direct human connection – is much harder to realise. It is difficult to expect market mechanisms alone to lead in that direction.

2. Polish translation following Jan Jęcz, ‘Cory Doctorow, Enshittification of TikTok’, https://jeczjan.substack.com/p/cory-doctorow-gownowacenie-tiktoka [accessed: 8 October 2025].

Ignacy Święcicki

Over Half of Transactions in the Euro Area Are Still Made in Cash

52% share of transactions in the euro area conducted in cash in 2024

1/3 proportion of Poles in 2023 who paid exclusively or mostly in cash

69% share of Poles who keep cash on hand ‘just in case’

Despite the growing popularity of digital payments, data from the European Central Bank (ECB) show that cash continues to play an important role in everyday transactions across Europe. In 2024, 52% of all transactions in the euro area were made in cash. In terms of value, the share was lower, at 39%.

Cash transactions still dominate in 14 out of the 20 euro area countries. In half of them, cash accounts for 45-55% of all payments. The highest share of cash use was observed in Malta (67%) and the lowest in the Netherlands (22%). Regionally, cash remains more prevalent in southern and eastern Europe, while people in western and northern Europe are more inclined to pay digitally.

ECB data on business operations indicate that between 2021 and 2024, the share of f irms in the euro area accepting cash fell from 96% to 88%, mainly due to lower consumer demand for cash payments. According to survey data from Narodowy Bank Polski (NBP, Poland’s central bank) from 2023, approximately one-third of Poles paid exclusively or predominantly in cash, while 69% reported keeping cash aside ‘just in case’.

According to survey data from Narodowy Bank Polski (NBP, Poland’s central bank) from 2023, approximately one-third of Poles paid exclusively or predominantly in cash, while 69% reported keeping cash aside ‘just in case’.

Among the main reasons for relying on cash, consumers surveyed by the ECB most frequently cited anonymity and privacy (41%), better awareness of their spending (35%), and the comfort of instant settlement without the need for authorisation (30%). Only 18% said cash was the safer option. In contrast, 94% of businesses cited security as a key advantage of cash, and 92% mentioned its reliability.

In a recent publication, the ECB highlighted the growing role of cash in times of crisis and issued a clear recommendation to European citizens, following the example of the Dutch, Finnish and Austrian governments, to keep at least EUR 70-100 on hand to cover essential expenses during the first 72 hours of an emergency.

Analysts have challenged the security-based arguments for cash, emphasising the role of cashless transactions in combating the shadow economy. In Poland, a regulation introduced in 2017 limited single cash payments to PLN 15,000. In 2024, this limit was reduced to PLN 8,000 for B2B payments, and a new ceiling of PLN 20,000 was introduced for consumer payments. Given the short time these restrictions have been in force, it is too early to reliably assess their effectiveness in curbing abuses. There is little doubt that such limits cannot fully prevent non-transparent transactions. However, to some extent, they contribute to fostering a culture of tax compliance in reportable transactions. At the same time, they may also further erode public trust in institutions.

Agnieszka Wincewicz-Price

Emissions from the Construction Sector Remain Stable

5.5% share of EU value added generated by the construction sector in 2024

6.7% share of Poland’s value added generated by the construction sector in 2024

1.4% share of EU construction sector CO₂ emissions attributable to Poland

In 2024, the construction sector accounted for 5.5% of total value added and 6.7% of employment in the European Union. These figures cover building construction, civil engineering (including transport and energy infrastructure), and specialised construction activities such as demolition, preparatory work, installation, and finishing. Sector activity remains slightly above COVID-era levels but is still relatively moderate. The EU-27’s average annual construction output index in 2024 was just 2.8 p.p. higher than in 2021 (Eurostat). Poland’s construction sector plays a greater role than the EU average, contributing 6.7% to national value added and 7.1% to employment. In 2024, the sector’s production index in Poland rose by 5.1 p.p. compared to 2021 (Eurostat).

Unlike the building sector as a whole, which globally accounts for over one-third of energy use and emissions, emissions from construction activities are more diffuse and harder to attribute to specific sources. In addition to direct emissions from construction sites, the sector also relies on high-emission materials such as cement, steel, and aluminium, whose carbon footprint is accounted for at the production stage (IPCC). The actual carbon footprint of a given project depends on which scopes of emissions are considered (Scope 1, 2 or 3 – GHG Protocol). These scopes determine whether only direct emissions – resulting from equipment use and on-site activity – are analysed, or also indirect emissions, such as those associated with electricity consumption and the production and transport of building materials.

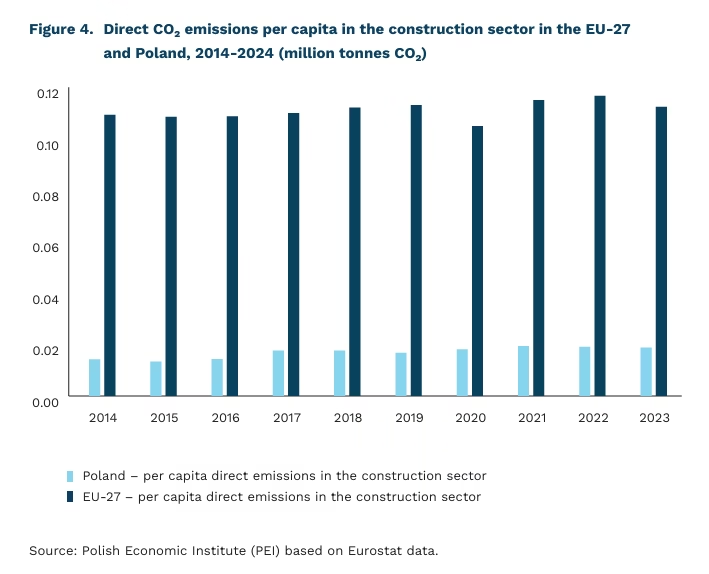

Between 2014 and 2023, annual emissions from the construction sector in the EU remained stable at around 50 million tonnes of CO₂. In Poland, they ranged from 0.5 to 0.7 million tonnes. Per capita, direct emissions from construction remain low, i.e. 0.11 tonnes of CO₂ per capita in the EU and 0.02 tonnes in Poland in 2023. This is due to Eurostat’s methodology, which includes only operational emissions from companies classified under NACE sector F, excluding emissions from material production and building operation.

In 2023, Poland’s construction sector accounted for just 1.4% of EU construction emissions and 0.3% of Poland’s total CO₂ emissions. This is disproportionately low compared to Poland’s 8% share of the EU population and 4.4% of EU GDP. There are two possible explanations for this: either Poland’s construction sector is relatively less emission-intensive per worker or per unit of value added compared to the EU average, or part of the emissions related to the production of construction materials is classified under other sectors – most likely energy-intensive industries such as steel or cement production.

Construction is not covered by the EU ETS and will not be directly subject to EU ETS 2, although it will feel its indirect effects. EU ETS 2, which includes road transport and buildings, will affect fuel prices and increase demand for buildings with a smaller environmental footprint. The impact of climate policy on the sector will also be seen in efforts to promote the circular economy, reduce waste, and encourage broader use of environmentally friendly building materials, such as bioconcrete (UN Environment Programme).

Krzysztof Krawiec

Despite the Absence of Disability or Caregiving Duties, a Large Group of Pre-Retirement-Age Women in Poland Remain Economically Inactive

69.6% share of women aged up to 64 who were economically active in Q2 2025

2.15 million number of working-age women economically inactive in Q1 2025

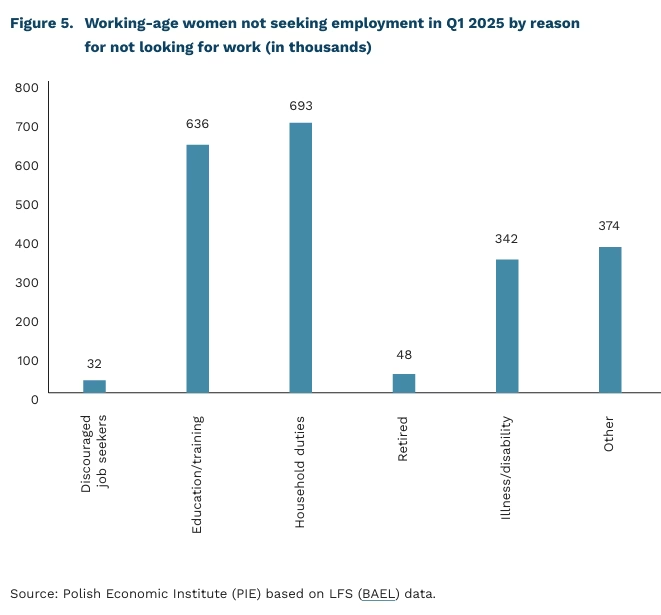

In Q1 2025, one million working-age women in Poland were economically inactive and not seeking employment for reasons other than retirement, disability, or household duties. According to LFS (BAEL) data, this accounted for over one-quarter of all economically inactive persons of working age. Compared to men, the number of economically inactive women (excluding those citing retirement, disability or caregiving as reasons) was higher by 280,000. In total, 2.15 million working-age women in Poland were economically inactive at the start of the year, of whom 2.13 million were not seeking work.

The OECD’s latest report highlights that women without childcare responsibilities for children under the age of six constitute one of the three largest groups among the economically inactive in Poland. This group excludes women receiving disability or retirement benefits. The remaining two groups consist of people with disabilities and pensioners who are economically inactive. In all three categories, Poland records lower labour market participation than the EU average.

As of mid-2025, Poland ranked 29th among the 38 OECD countries in terms of labour force participation of women aged up to 64. The participation rate stood at 69.6%, which is 1.5 percentage points lower than the EU average. In neighbouring countries such as the Czech Republic, Hungary, and Slovakia, female labour force participation in this age group exceeds 72%. However, it is important to note that these countries have higher statutory retirement ages, resulting in significantly higher participation among women aged 60-64. In Poland, only 26% of women in this age group are active.

According to OECD studies, the likelihood of economic inactivity is higher among women without tertiary education. Other key factors increasing the risk of labour market inactivity include raising small children and a lack of prior work experience. Among mothers of young children, those with a university degree were twice as likely to be active in the labour market as those without higher education.3 In addition to educational attainment and previous job experience, the report also emphasises the need to expand access to childcare services in Poland, which would help reduce inactivity in the early years following childbirth.

Jędrzej Lubasiński

Recurring US Budget Crisis Threatens Further Economic Losses

$15 billion weekly cost of the current US federal government shutdown, according to the White House

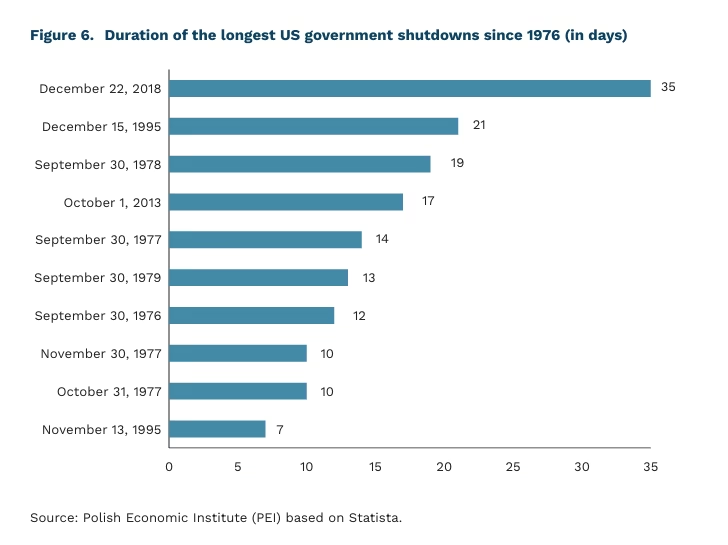

Once again, the United States is facing a federal government shutdown. The official closure began on 1 October, the first day of the 2026 fiscal year, after Congress failed to pass a temporary budget resolution drafted by the Republicans, which was intended to fund government operations until 21 November. This marks the 22nd government shutdown in US history. The longest lasted 35 days during the 2018-2019 standoff, also under President Donald Trump. The current budget crisis demonstrates that government shutdowns have ceased to be exceptional events and have instead become a recurring feature of partisan political conflict – one whose economic costs are increasingly palpable.

From a macroeconomic perspective, a government shutdown is more than just a political issue. According to White House estimates, the weekly cost of the current federal government shutdown could reach USD 15 billion. While some of these losses may be recovered once normal government operations resume, not all of the impacts can be reversed. During the funding gap, hundreds of thousands of federal employees are placed on mandatory furlough, while others work without pay. Government purchases, tenders, and contracts are suspended, and companies cooperating with the administration put investments and payments on hold. These effects spill over into the broader economy – lower consumption and delayed private investment weaken short-term domestic demand.

The shutdown also halts the publication of key macroeconomic data. In recent days, for example, no figures have been released for the trade balance or labour market, making it harder for the Federal Reserve, investors, and businesses to make informed decisions. As a result, the economy enters a period of reduced informational transparency, and markets lose the reference point that hard data typically provide. Even so, the ongoing government shutdown has not prevented major US stock indices from maintaining an upward trend. Yields on US Treasury bonds have risen only slightly, indicating that markets are pricing in limited fiscal risk. The calm situation on financial markets suggests that investors view the budget conflict as a temporary disruption rather than a systemic threat.

Piotr Kamiński