The Polish economy during the quarantine. The worst moment for companies was at the end of April

Published: 31/08/2020

At the start of April, 18% of companies surveyed did not have financial liquidity, and just 26% said that the financial resources available will enable them to operate for more than three months.

However, at the start of July, just 5% of companies lacked financial liquidity and as many as 60% had the financial means to operate for more than three months. Companies’ staffing plans calmed down, too. At the beginning of April, 28% of companies surveyed said they were reducing employment; at the start of July, it was just 6%. According to a report by the Polish Economic Institute, The Polish economy under lockdown. Poland compared to the rest of Europe, at the start of the lockdown, three-quarters of companies predicted that recovery from the pandemic would not take longer than a year. Today, nearly one-third assume that this state will go on for many years.

The report sums up research conducted by the Polish Economic Institute (PIE) with the Polish Development Fund (PFR) on Polish companies between the start of April and the start of July 2020. It shows the state of the Polish economy during the quarantine, but also how it changed over time: first, during the lockdown, and then as it was lifted.

“To sum up the opinions expressed by entrepreneurs during the six phases of the research, we constructed a synthetic Entrepreneur Sentiment Index that takes into account opinions on the value of sales, the number of new orders, a subjective assessment of financial liquidity, and planned changes in employment and the remuneration of employees. It shows a clear improvement in the situation: from -36.1 points at the start of April, it increased to +9.9 points at the start of July. Its growth was closely related to the unfreezing of the economy from mid-May, as well as the introduction of anti-crisis shields by the Polish government. Positive reactions were first observed among production companies; in mid-June, they were joined by commercial companies,” said Piotr Arak, director of the Polish Economic Institute.

The Polish economy compared to other EU countries

In March 2020, industrial production in all European Union countries declined by 10.8% compared to February. In April, it fell by 18.2% compared to the previous month. These were the sharpest-ever monthly decreases recorded by Eurostat, significantly larger than those linked to the financial crisis in late 2008 and early 2009.

In Poland, the fall in sold production of industry was well below the EU average in March (7.4%), but exceeded it in April (21.1%).

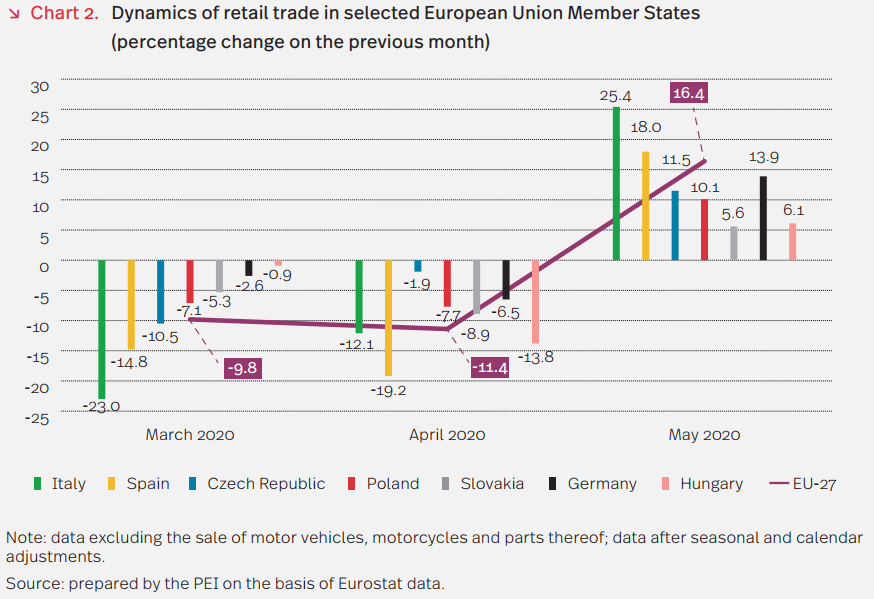

In the EU’s 27 member states, the lockdown caused retail sales to drop by 9.8% in March compared to the previous month, and by another 11.4% in April. Polish companies felt the consequences of the restrictions slightly less: the drop amounted to 7.1% in March and 7.7% in April.

The unfreezing of the economy around the start of May led to an increase in the value of retail sales; by 16.4% in the EU as a whole and by 10.1% in Poland. As a result, retail sales in the EU in May amounted to 93.0% of their value in February, before the pandemic; in Poland, this was 94.4%. Polish companies were therefore coping slightly better than other European ones.

“The studies conducted by PFR and PIE showed that the worst moment for Polish companies was at the end of April, when over two-thirds of companies surveyed reported a decrease in sales, and just 7% an increase. In May, the situation improved: 43% of companies reported a fall and 20% an increase. At the start of July, the percentage of companies reporting a fall declined to 36%. At the same time, during the whole period studied, large and medium-sized enterprises coped better with the crisis caused by the pandemic,” said Paula Kukołowicz, an analyst at PIE, who co-authored the report.

Changes on the labour market caused by the pandemic

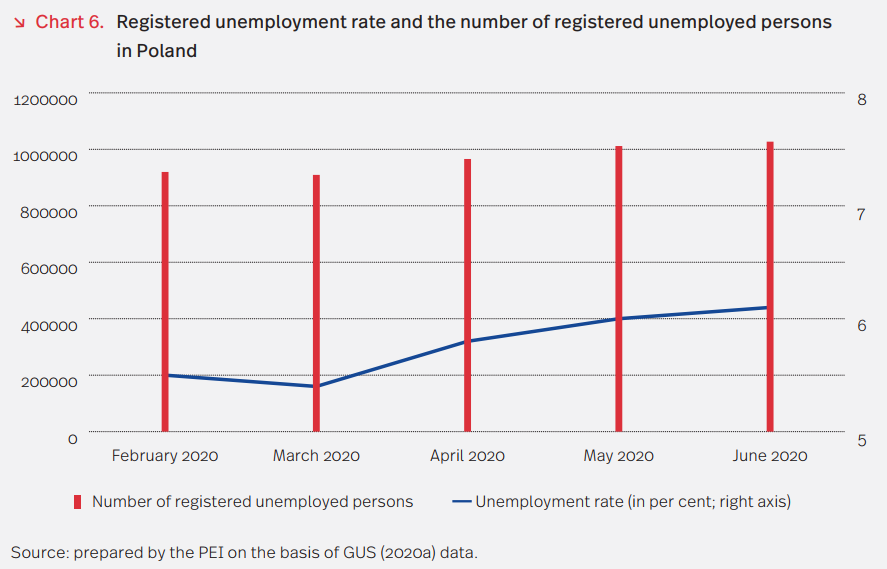

The coronavirus pandemic pushed up registered unemployment in Poland. In June 2020, it amounted to 6.1%, with 1.03 million unemployed people registered at employment centres, 150,000 more than during the same period in 2019. We observed the first signs of rising unemployment in April, when the number of registered unemployed people rose by 56,400 compared to March. It increased by 45,900 in May and by 14,800 in June.

At companies with over nine employees, real gross salaries decreased by 3.6% in April and by 2.8% in May compared to the previous month. “The lower remuneration observed in these months probably resulted from the ability, introduced as part of the first anti-crisis shield, to temporarily reduce employees’ salaries by 20%, which was accompanied by the temporary reduction of working hours. The data for June was surprising with its larger-than-expected increase in salaries in the enterprise sector, by 2.6% compared to the previous month and by 3.6% compared to June 2019,” said Katarzyna Dębkowska, head of PIE’s economic foresight team, who co-authored the report.

“In retrospect, it can be seen that entrepreneurs’ first reactions to the pandemic were marked by panic. At the start of April, 28% of companies surveyed planned to reduce employment, but by the middle of the month this percentage had already dropped to 14%, and 12% of companies actually reduced it in March and April. At the beginning of July, just 6% of companies surveyed were planning layoffs,” Katarzyna Dębkowska added.

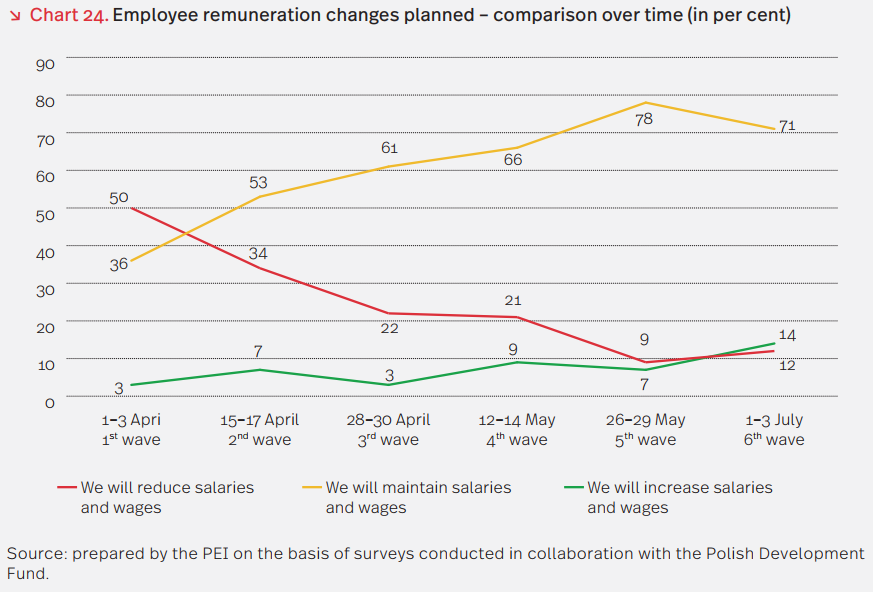

The situation was similar when it came to plans to reduce salaries: at the start of April, just 36% of companies surveyed planned to keep them at the same level, but by the end of May this had risen to 78%. At the same time, the percentage of companies planning to reduce salaries decreased systematically: from 50% at the start of April to 9% at the end of May. In July, it increased again slightly to 12%.

The European Commission’s spring forecast revised unemployment forecasts. It is expected to amount to 7.5% in Poland (compared to the 3.6% announced in the autumn) and to 9% in the EU as a whole (compared to 6.2%). However, according to Statistics Poland data, by June 2020 there had been a slight increase in unemployment in Poland, which suggests that the situation will not change rapidly in coming months and will not reach the level forecast by the Commission.

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research spans trade, macroeconomics, energy and the digital economy, with strategic analysis on key areas of social and public life in Poland. The Institute provides analysis and expertise for the implementation of the Strategy for Responsible Development and helps popularise Polish economic and social research in the country and abroad.

Media contact:

Agata Kołodziej

Head of the Communications Team

tel. 48 727 427 918

Kategoria: Economic Foresight / Press releases / Report / Reports 2020