The value of FDI in developed countries increased by 134 percent in 2021

Published: 28/04/2023

The economic recovery in 2021 contributed to the consolidation of dependence on supplies from China and Russia by increasing imports from there. In 2018-2021, China's share in material consumption in the EU-27 grew by nearly 1%. At the same time, the process of moving production to other (cheaper or safer) countries, as well as bringing it home, has been visible in recent years. In 2021, FDI flows to developed countries increased significantly, compared to flows to developing countries. The total value of greenfield transactions grew by 15%, but fell by 50% in the case of China. FDI to developed countries rose by 134% in 2021 (y/y), according to the Polish Economic Institute’s report The new face of global trade. Are we dealing with reshoring?, which analyses the impact of the pandemic and the war in Ukraine on global production chains.

The EU is importing more raw materials from China and Russia

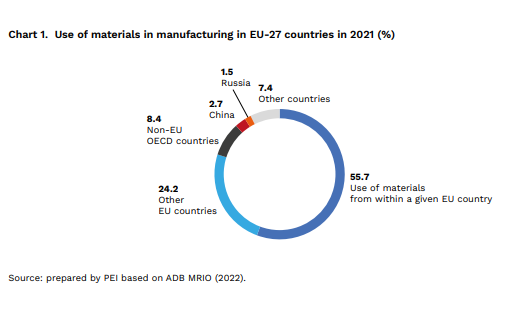

79.9% of the materials used by EU countries in industrial processing in 2021 came from the country itself or from other EU-27 member states. Non-EU OECD countries accounted for 8.4% of the materials used, and 11.7% came from outside the EU and OECD. Of these, 2.7% came from China and 1.5% from Russia.

Despite many declarations about the need to shorten supply chains and move production away from China, in 2018-2021, the country’s share in the consumption of materials in industrial processing in the EU-27 grew by 0.9 pp. Russia’s share increased by 0.4 pp. The share of materials from China and Russia has only decreased in a few EU and OECD countries.

“Studying import dependencies enables us to identify sectors and products where we should pay special attention to finding a variety of sources of supply. These are energy-intensive industries, health, digital and electronic products, and renewable sources of energy. According to the PEI’s research, 87% of imports of the most critical products come from non-OECD countries; this accounts for almost 3.7% of EU imports. China alone is responsible for around 25% of supplies of critical products, and Russia for 6%,” says Dominik Kopiński, a senior advisor in the global economy team.

Production is moving

The US-China trade war in 2018, the COVID-19 pandemic and Russia’s invasion of Ukraine in 2022 have led to profound shifts in the global economy. In 2019 and 2020, global production fell and the structure of manufacturing changed. In 2021, there was a post-pandemic recovery in the global economy. Global production grew significantly (with a decrease in the share of domestic input and an increase in the share of value added), as did the importance of imported materials, in particular from China.

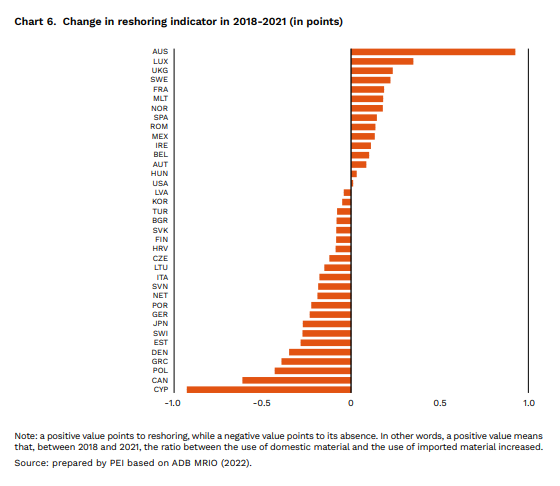

In 2018-2021, reshoring — the process of moving production that was previously relocated to another country back home — was observed in just a few EU and OECD countries: Luxembourg, Sweden, France, Spain and Ireland, Romania, Hungary and the US, but not Poland and Germany. Although offshoring — moving production to another country — is the reverse process, it can take place at the same time as reshoring if we consider the economy as a whole, although it will apply to other production activities.

“The offshoring rate is the ratio between the imported materials consumed and the value added generated. The list of countries where offshoring is taking place intensively includes Luxembourg, Cyprus, Estonia, Hungary, Slovakia, Poland, and some of the EU’s biggest economies, Germany and Italy. Despite numerous announcements about the need to move production in distant countries back or closer to home, offshoring is still being observed,” says Jan Strzelecki, deputy head of the global economy team.

New foreign enterprises are mainly being established in developing countries

In 2021, global FDI flows increased by 64% compared to the previous year and by 6% compared to 2019, before the pandemic (UNCTAD, 2022). There has been a relative increase in the size of FDI flows to developed countries, compared to developing countries. The former amounted to USD 746 billion, 134% more than in 2020, when the value of FDI was at a record low. This was linked to the increase in FDI transactions registered in the US, which more than doubled. In the EU, FDI flows fell significantly, from USD 210 billion to USD 138 billion. Still, overall, developed countries attracted 47% of total FDI, compared to 33% in 2020, a return the relative levels observed before the pandemic.

In terms of the global reorientation of FDI flows, the changes in greenfield projects are much more significant. In 2021, the value of greenfield projects announced rose by 15% globally, to USD 659 billion, all of it in highly developed countries (UNCTAD, 2022). In developing countries, the value has remained unchanged since 2020 (USD 259 billion). Developed countries lead over developing countries therefore rose from USD 57 billion in 2020 to USD 142 billion in 2021. For the past twenty years, the number of greenfield investments announced in developed countries has been higher than in developing countries.

***

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research primarily spans macroeconomics, energy and climate, the world economy, economic foresight, the digital economy and behavioural economics. The Institute provides reports, analyses and recommendations for key areas of the economy and social life in Poland, taking into account the international situation.

Media contact:

Ewa Balicka-Sawiak

Press Spokesperson

T: +48 727 427 918

E: ewa.balicka@pie.net.pl

Category: Analysis / Gospodarka światowa / Press releases / Report / Reports 2023