In 2018, the CIT gap was PLN 22 billion – Poland’s annual spending on maintaining the police force

Published: 08/07/2020

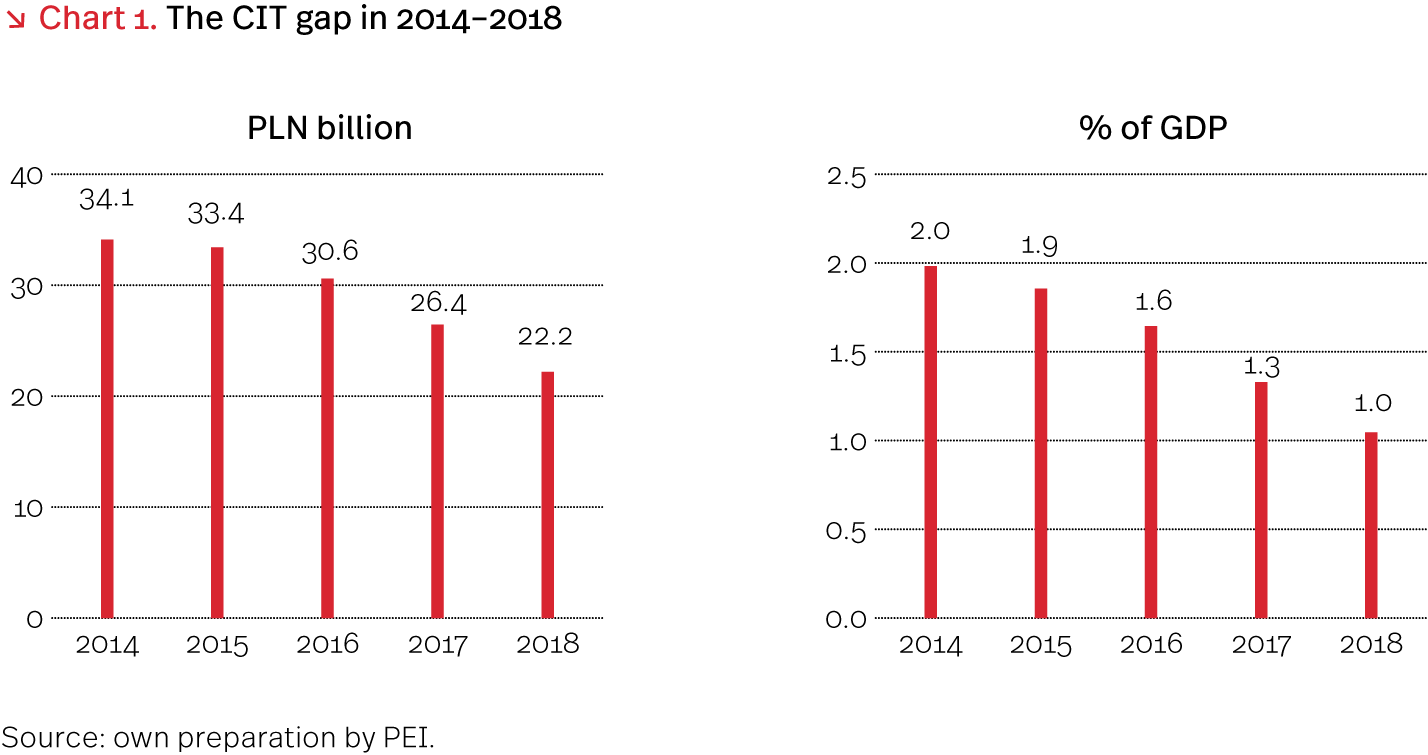

In 2018, the CIT gap was PLN 22 billion, 35 per cent less than in 2014. At the same time, CIT accounted for 5 per cent of State revenue in Poland, distinctly below the EU average of 7 per cent. A vital problem is the shifting of profits to tax havens – in 2018 alone transnational corporations artificially transferred from Poland profits of PLN 17 billion, which translated into CIT revenue foregone exceeding PLN 3 billion.

It is only possible to stop that process by taking firm action at the European Union level. We need more intra-EU solidarity with regard to taxes; otherwise, we can forget about accelerating the reduction of disparities between European regions – as argued by analysts of the Polish Economic Institute in the report entitled ‘The CIT gap in Poland in 2014–2018’.

‘The observation of data from recent years shows that CIT revenue increased much faster than GDP. In 2014–2019, CIT revenue went up from PLN 30 billion to PLN 51 billion, or by 72 per cent, whereas GDP grew by 32 per cent over the same period. The main reason was a fall in the CIT gap which slightly exceeded PLN 22 billion in 2018, against ca. PLN 35 billion in 2014. There were two contributory factors. Firstly, the period covered saw buoyant economic growth and prosperity, which reduced the willingness of firms to seek tax avoidance methods. Secondly, various tools introduced by the Ministry of Finance to hinder CIT avoidance by undertakings increased the CIT collection rate,’ says Jakub Sawulski, the head of the macroeconomics team of the Polish Economic Institute and the co-author of the report.

‘However, the existence of tax havens within the EU remains a major problem. If we want to think of the future of the European tax system as a vehicle for Europe’s sustainable development, the introduction of any new fiscal tools should be preceded by settling the situation with the already existing tools, primarily CIT,’ adds Sawulski.

How is the CIT gap created and why is it relatively large in Poland?

Poland lags behind Europe not only with regard to the role of CIT in public revenue, but also in the share of CIT revenue in GDP. The EU average is 2.9 per cent. In Poland, the respective proportion is as much as 40 per cent lower. A major problem is that as many as one-third of taxpayers liable to pay CIT show no income. In 2014–2018, the number of CIT taxpayers increased from 434,000 to 507,000, whereas the proportion of taxpayers reporting income dropped from 69 per cent to 66 per cent.

The causes of the CIT gap can be divided into two categories. One includes different legislation and legal interpretations between countries and unintentional errors or omissions, whether by the taxpayer or the tax authority. The other comprises intentional reductions in CIT due by using lawful optimisation tools or unlawful practices such as tax fraud.

The existence of the CIT gap is particularly harmful to Poland as it continues to struggle with capital deficiencies. On account of profit transfers outside Poland, the money is neither received by the budget nor present in domestic economic transactions. In 2018, the gap was 1 per cent, a considerable loss.

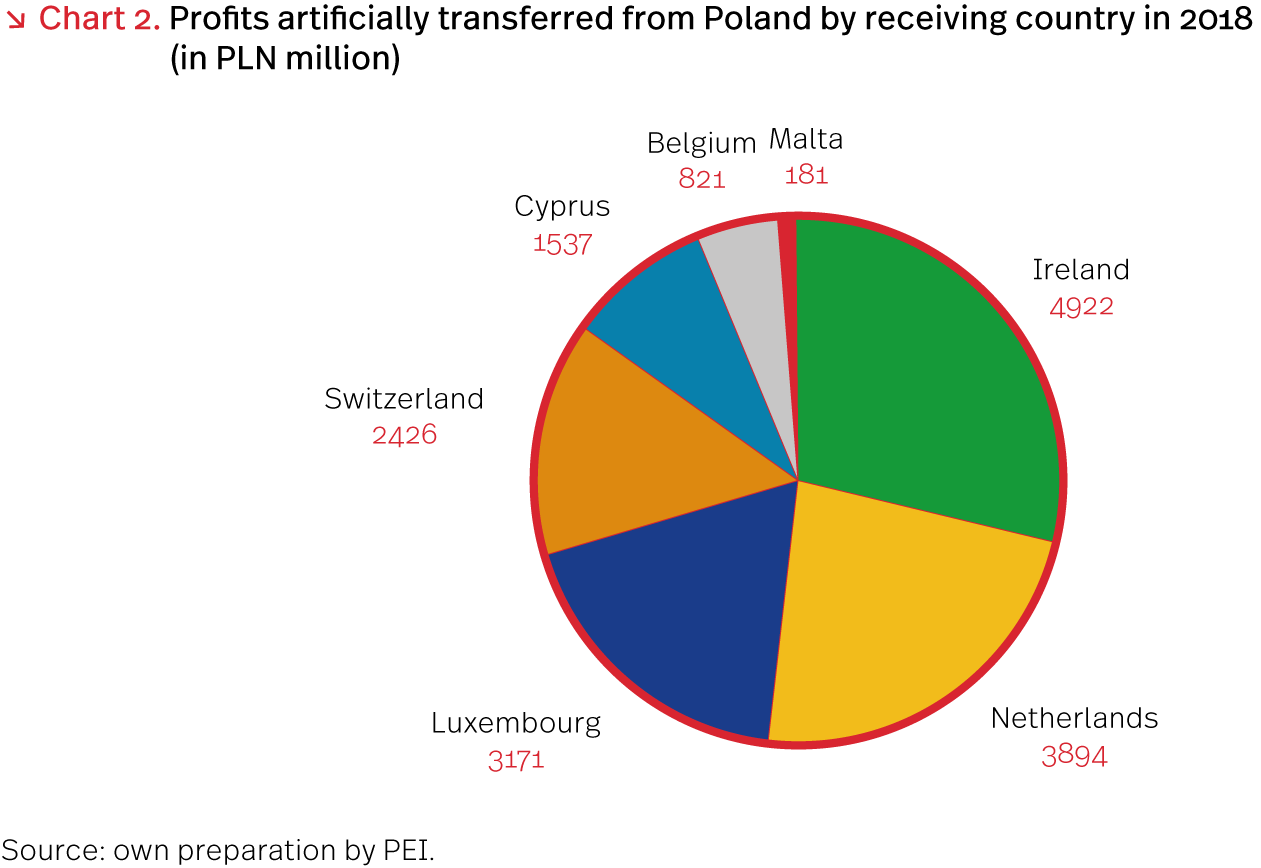

An important component of the gap is the so-called ‘foreign CIT gap’, or revenue foregone as a result of profit transfers to other countries by enterprises, mostly transnational corporations. In 2018, such transfers totalled PLN 17 billion; therefore, the resulting foreign CIT gap was PLN 3.2 billion and represented 15 per cent of the overall CIT gap.

75 per cent of the amount of PLN 17 billion was transferred to three countries: Ireland (PLN 5 billion), the Netherlands (PLN 4 billion) and Luxembourg (PLN 3 billion). In 2014–2018, the ‘foreign CIT gap’ was on the rise, being approximately 40 per cent higher in 2018 than in 2014. The situation in Poland reflected world trends as in 2015–2017 global profit transfers jumped from USD 616 billion to USD 741 billion, i.e. by 20 per cent.

The EU must reduce tax avoidance to cover its development-oriented expenditure

CIT avoidance by businesses is a phenomenon whose scale has increased across the world in recent years due to globalisation, the rising market power of the largest firms and the sophistication of tax regulations. As it is of a global nature, appropriate solutions must be supranational. Tax solidarity within the European Union is of key importance as the report demonstrates that the vast majority of corporate profits are transferred to EU Member States. Therefore, the PEI proposes the implementation of the following solutions:

- Creating the EU’s blacklist of tax havens;

- Giving the European Commission the power to impose sanctions on countries engaged in unfair tax competition;

- Introducing ‘compensatory taxation’, i.e. adopting a minimum rate of corporate income tax subject to no relief or exemption;

- Establishing an obligation for multinational enterprises to disclose information on their tax strategies and the standardisation of the collection of such data at the EU level;

- Incorporating tax solidarity and clear policy for fighting tax fraud and tax avoidance into the EU agenda, with a special focus on the situation of the Member States losing the most to tax avoidance and evasion.

Due to the COVID-19 pandemic and the resulting economic crisis, the need for increasing the EU’s financial resources has become exceptionally pressing and necessary to be resolved. The fiscal tools likely to cover the EU’s expenditure indispensable to return to a path of permanent economic growth and sustainable development include digital tax, capital gains tax, tax on access to the EU’s common market and financial transaction tax.

The Polish Economic Institute is a public economic think-tank dating back to 1928. Its research spans trade, macroeconomics, energy and the digital economy, with strategic analysis on key areas of social and public life in Poland. The Institute provides analysis and expertise for the implementation of the Strategy for Responsible Development and helps popularise Polish economic and social research in the country and abroad.

Media contact:

Agata Kołodziej

Head of the Communications Team

T: 727 427 918

Kategoria: Macroeconomics / Press releases / Report / Reports 2020