Polski Instytut Ekonomiczny zaprezentował raport „Reducing the VAT gap: lessons from Poland”

Opublikowano: 19/02/2019

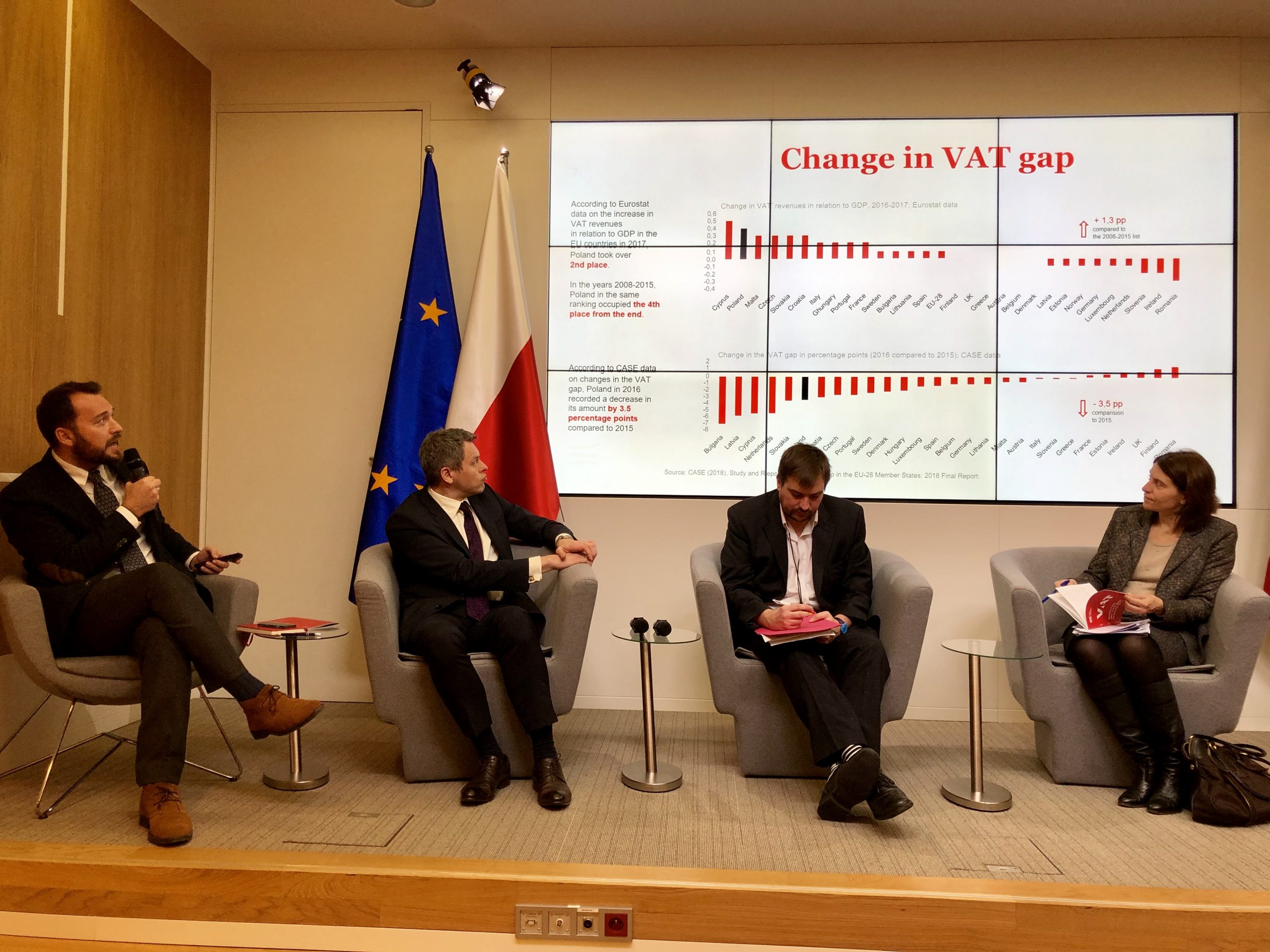

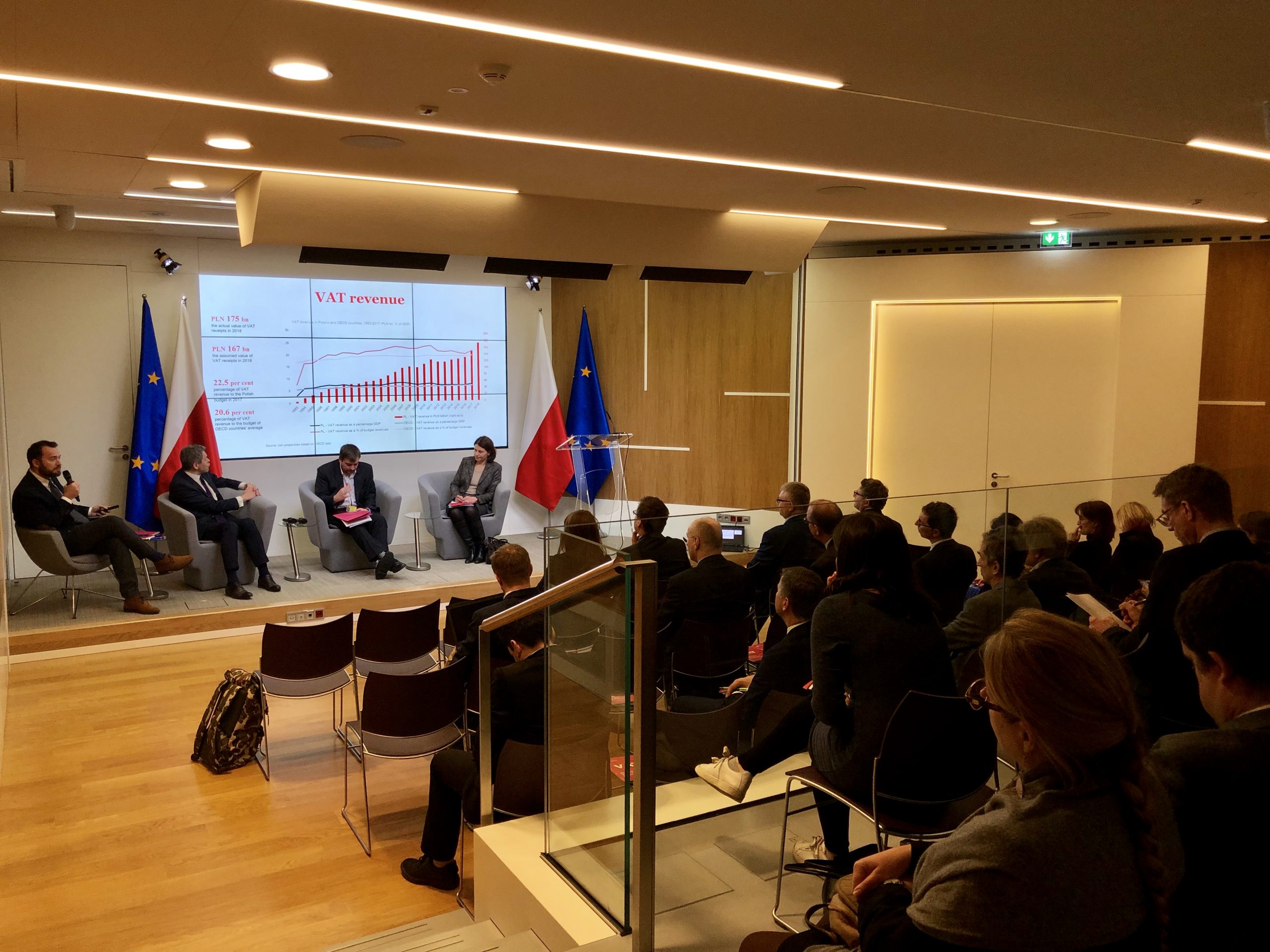

19 lutego 2019 roku odbyła się prezentacja raportu w Brukseli.

Polski Instytut Ekonomiczny przedstawił w Brukseli raport opisujący dobre praktyki w uszczelnianiu VAT w ramach Strategii na rzecz Odpowiedzialnego Rozwoju. Publikacja będzie służyła promocji rozwiązań zaimplementowanych w Polsce w tych krajach, które zmagają się z problemem ściągalności VAT.

W panelu dyskusyjnym wzięli udział

- Filip Świtała, podsekretarz stanu w Ministerstwie Finansów;

- Maria Teresa Fábregas, Komisja Europejska;

- Piotr Arak, dyrektor Polskiego Instytutu Ekonomicznego.

Dyskusję moderował Jim Brunsden (Financial Times).

Kategoria: